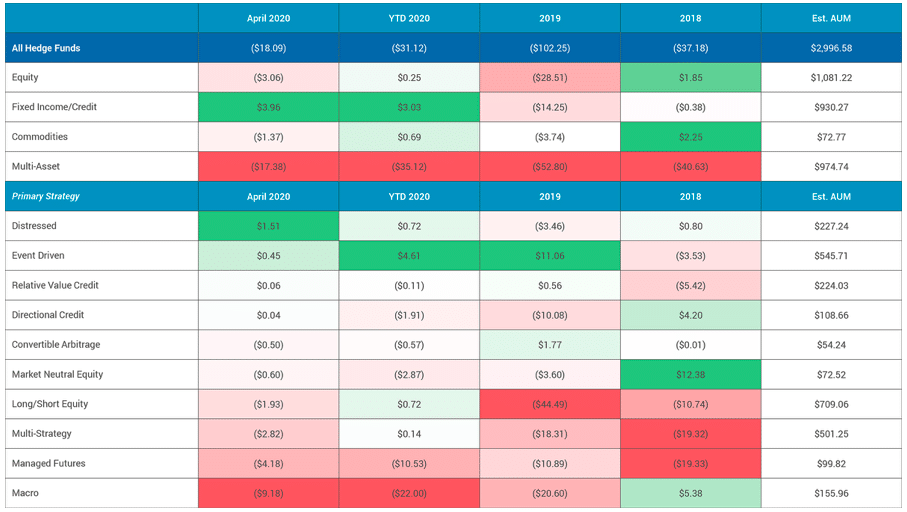

Stockholm (HedgeNordic) – After large losses in March pushed hedge fund industry assets below $3 trillion for the first time since 2014, investors redeemed an estimated $18 billion from hedge funds in April, according to eVestment. Following net redemptions of about $24 billion in March and $18 billion in April, net outflows in the hedge fund industry during the first four months of 2020 reached $31 billion.

According to eVestment, some large hedge fund vehicles experienced large redemptions in both March and April. In March, funds with more than $1 billion in assets under management experienced the largest outflows as a percentage of their total capital since the financial crisis. Last month, the percentage of funds that suffered net outflows of more than two percent of their assets declined significantly compared to March. However, the percentage of funds that lost more than five percent of assets due to redemptions did not decline meaningfully in April relative to March.

With an estimated $9.2 billion in net redemptions, macro managers experienced the largest net outflows as a group in April. The redemptions were not widespread across all macro managers, as about 57 percent of the group reported redemptions for last month. According to eVestment, the outflows from macro managers were driven by targeted redemptions at some large macro funds, partly in response to poor performance. All ten macro funds with the largest redemptions in April had negative performance for the first four months of 2020. In contrast, of the ten macro funds that received the largest allocations in April, four of them had positive performance for the year.

“There are some segments that appear to be well-positioned in investors’ eyes, notably products in the credit space with a focus on distressed opportunities,” says Peter Laurelli, eVestment’s Global Head of Research. “There were some meaningful inflows for some event-driven and credit strategies in April, particularly for some distressed managers,” he writes. As a group, funds that focus on distressed opportunities received net inflows of $1.5 billion in April, taking the year-to-date net flows in positive territory at $0.7 billion. Event-driven managers received an estimated $0.5 billion in net inflows in April and $4.6 billion in the first four months of 2020.

Photo by Bernard Hermant on Unsplash