Stockholm (HedgeNordic) – Since 2015, one of the categories celebrated at the Nordic Hedge Award is the most promising new launch among Nordic hedge funds. Funds considered for the “Nordic Hedge Fund Rookie of the Year” award have a track record of fewer than 15 months but have at least three monthly NAVs preceding the year-end net asset value (NAV) of the respective fund. Funds must be listed in the Nordic Hedge Index and meet the criteria required for such listing. There is no minimum or maximum requirement for assets under management.

For the “2019 Rookie of the Year”, the following funds are qualified:

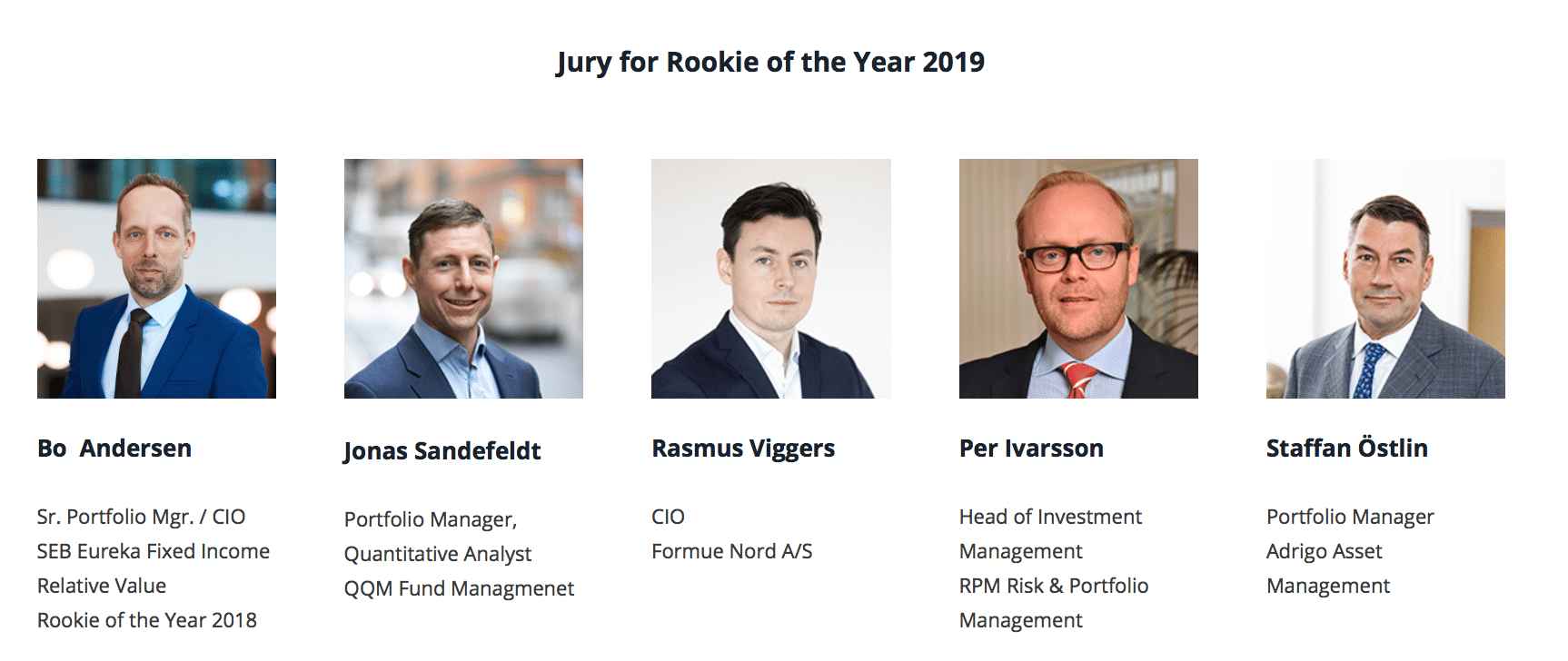

Unlike the other, regular categories where a quant model is used in combination with a jury board of representatives of asset owners and allocators, the “Nordic Hedge Fund Rookie of the Year” is determined by fellow fund managers, making this a prized peer award.

The jury for the “Nordic Hedge Fund Rookie of the Year” is put together of Bo Michael Andersen (SEB), the Rookie of the Year 2018, Jonas Sandefeldt (QQM), Rasmus Viggers (Formue Nord), Per Ivarsson (RPM) and Staffan Östlin (Adrigo Asset Management).

The winner will be announced on April 22, 2020, at the final event of the Nordic Hedge Award. To learn more about the “Nordic Hedge Fund Rookie of the Year” and previous winners, please click here: Rookie of the Year

Good luck to all contestants!

The Nordic Hedge Award is supported by these fine entities: