By UBS AM: Exchange Traded Funds (ETFs) offer several benefits to end investors such as transparency, cost efficiency, intraday liquidity and diversification. For fixed income ETFs, there is an additional advantage, particularly beneficial to smaller investors, which is easy access to a market that trades over-the-counter rather than on-exchange. Simply said, fixed income ETFs have equity-like ease of trading which simplifies the way investors build multi-asset geographically diversified portfolios, but also helps to manage income streams, preserve capital and diversify sources of return.

How big is the fixed income market?

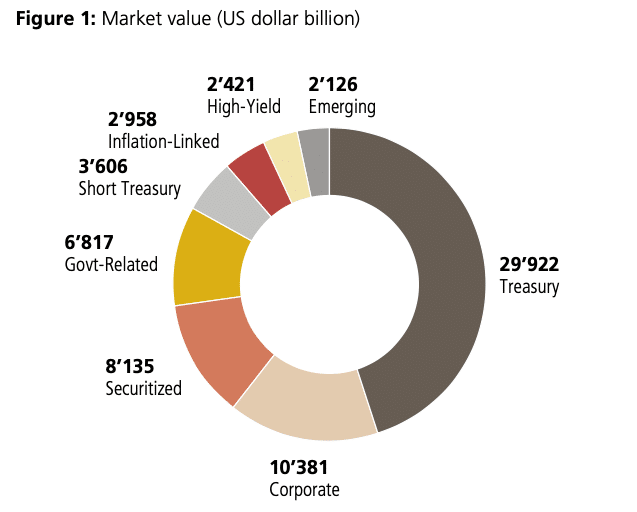

The indexed fixed income market is now valued at approximately USD 65 trillion which is nearly USD 20 trillion more than the global indexed equity market now valued at about USD 45 trillion.¹ The largest fixed income segment (Figure 1) are Treasuries (government issued) securities, a roughly USD 30 trillion market, followed by investment grade corporates (> USD 10 trillion). It is important to highlight however, that the global fixed income market is simply proxied by a benchmark that goes through certain eligibility criteria based on security type. The non-indexed fixed income market is left with sizeable segments, e.g. in certain municipal bond sectors, loans or parts of ABS being excluded. For example, according to the SIFMA report, the overall US based bond market is valued at USD 43 trillion², whereas the indexed part captures approximately USD 23 trillion, clearly telling just how sizeable the non-indexed segment is. This generally implies that the fixed income market is considerably larger than the equity market.

What share of this do ETFs have?

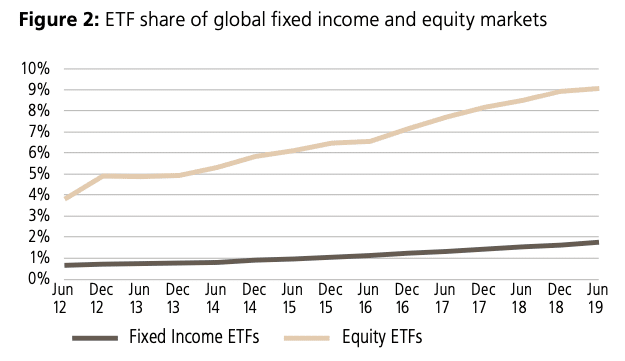

Global ETF assets are now at about USD 5.6 trillion, with more than 7500 ETFs across asset classes. The equity ETFs segment is by far the largest with USD 4.2 trillion, followed by fixed income ETFs with slightly in excess of USD 1 trillion. Relating ETFs to overall markets (Figure 2) it is apparent that fixed income ETFs still make up a disproportionately low proportion of overall fixed income assets. Specifically, assets invested in fixed income ETFs represent roughly 1.8% of the total indexed fixed income market, or put differently, not even two dollars in a hundred go into an ETF wrapper when implementing fixed income investments. In contrast, equity ETFs represent about 9.1% of the global equity indexed market, with the difference between the two asset classes actually widening in recent years. Both nevertheless enjoy persistent positive growth rates. The question is which fixed income segments are underrepresented and why.

Which segments are the most underrepresented?

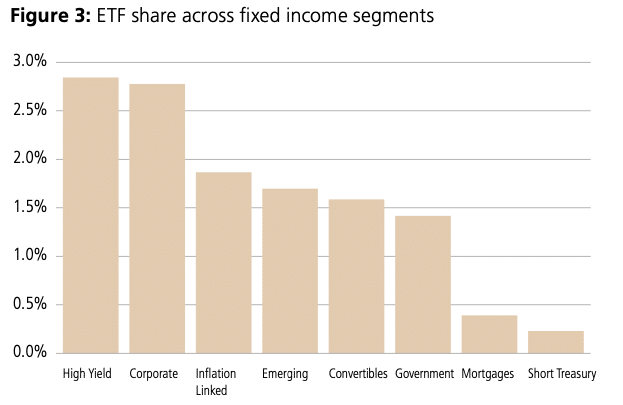

High yield bonds and investment grade corporate segments have the highest share (Figure 3), exceeding 2.5%. Emerging market bond ETFs (including both hard and local currency) have a share of about 1.7%. The government (including Treasury) sector has a share of c. 1.5%, whilst securitized bonds (including MBS) and short dated Treasuries (securities with a time to maturity less than 12 months), both have shares well below 0.5%. This may lead to the thesis that fixed income ETFs serve mostly yield enhancing investments done through tactical adjustments, whilst liquidity and “safe-haven” bond investments are done outside of an ETF wrapper. Moreover, the government bond sector is now experiencing a high percentage of negative yielding debt, thus has less of an appeal for investors. At the time of writing, approximately 35% of global Treasuries are negatively yielding. This might change when investment risk appetite shifts.

What is next?

In the near future, the fixed income ETF offering will be considerably more refined and granular, following developments and evolution in the equity ETFs market. Overall then, a move away from broad-based indices/segments into more tailored indices and strategies. This also includes the integration of Environmental, Social and Corporate Governance (ESG) criteria but also moving towards specific risk premia. UBS Asset Management is a pioneer in this area having launched ETFs that provide exposure to sustainable corporates, bonds issued by Supranational Development Banks, and even emerging market local currency debt enhanced with currency factors such as momentum and carry. All these latest developments allow investors to access fixed income exposures that are increasingly targeted by industry, sustainability profile, quality or a number of other factors and characteristics, providing an even greater flexibility to manage portfolios and reach a variety of objectives.

¹Source: MSCI. Data as of July 2019.

² Source: Securities Industry and Financial Markets Association (SIFMA); www.sifma.org

This article featured in HedgeNordic’s Special Report on “Alternative Fixed Income.”

Picture: (c) By J.Shunsuke—shutterstock.com