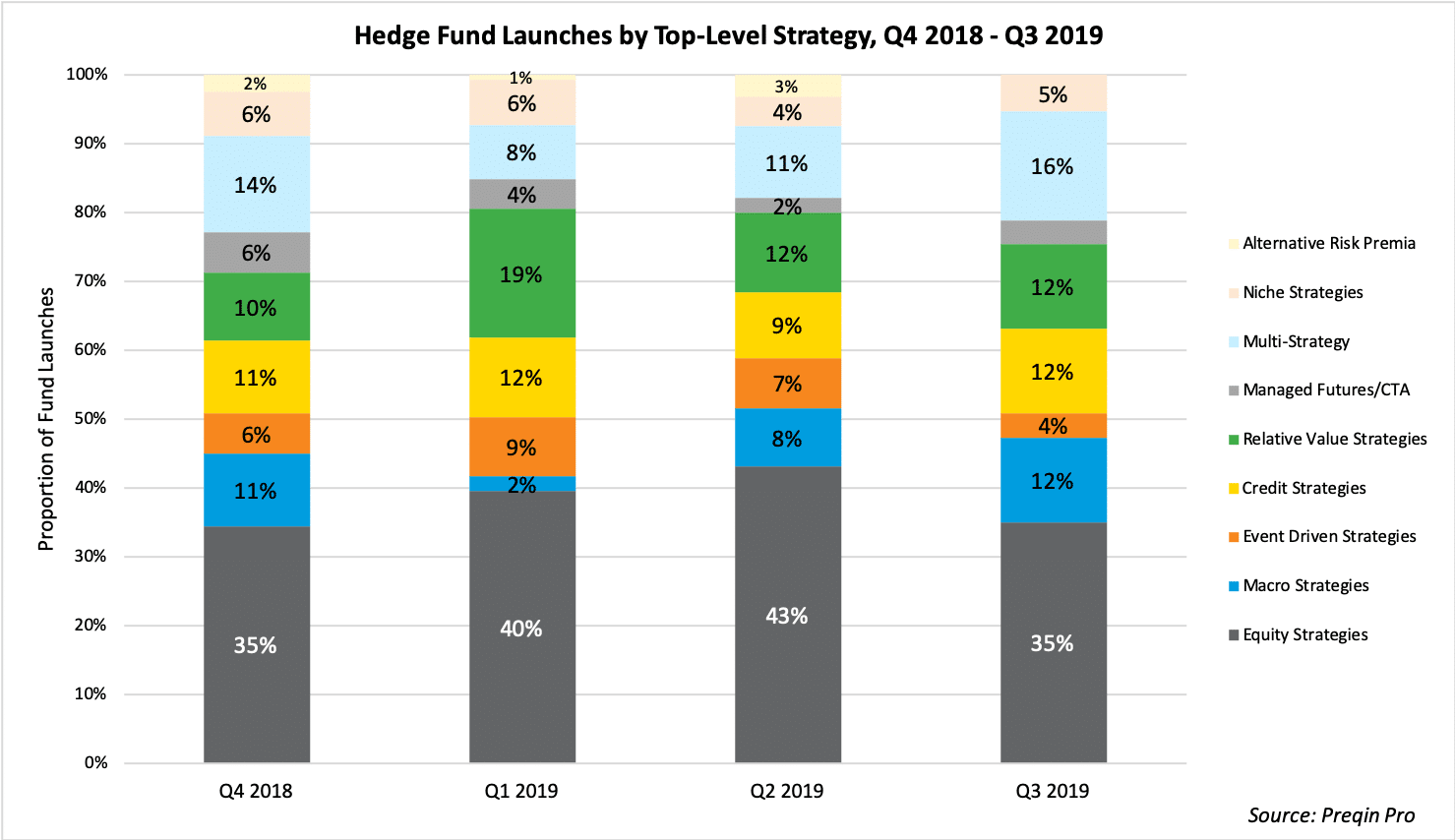

Stockholm (HedgeNordic) – The number of new hedge fund launches dropped to 67 in the third quarter from 121 in the previous quarter, as managers appear to have taken a more conservative approach in the volatile macroeconomic environment. According to Preqin’s latest quarterly update on the hedge fund industry, new funds launched in the third quarter appear to be focusing more on diversification.

In the three months that ended September, multi-strategy hedge funds accounted for a larger share of new launches than in the second quarter (16 percent of all launches in the third quarter versus 11 percent in the second quarter). Similarly, the proportion of macro-oriented funds also increased quarter-over-quarter, from eight percent of all launches in the second quarter to 12 percent in the third quarter.

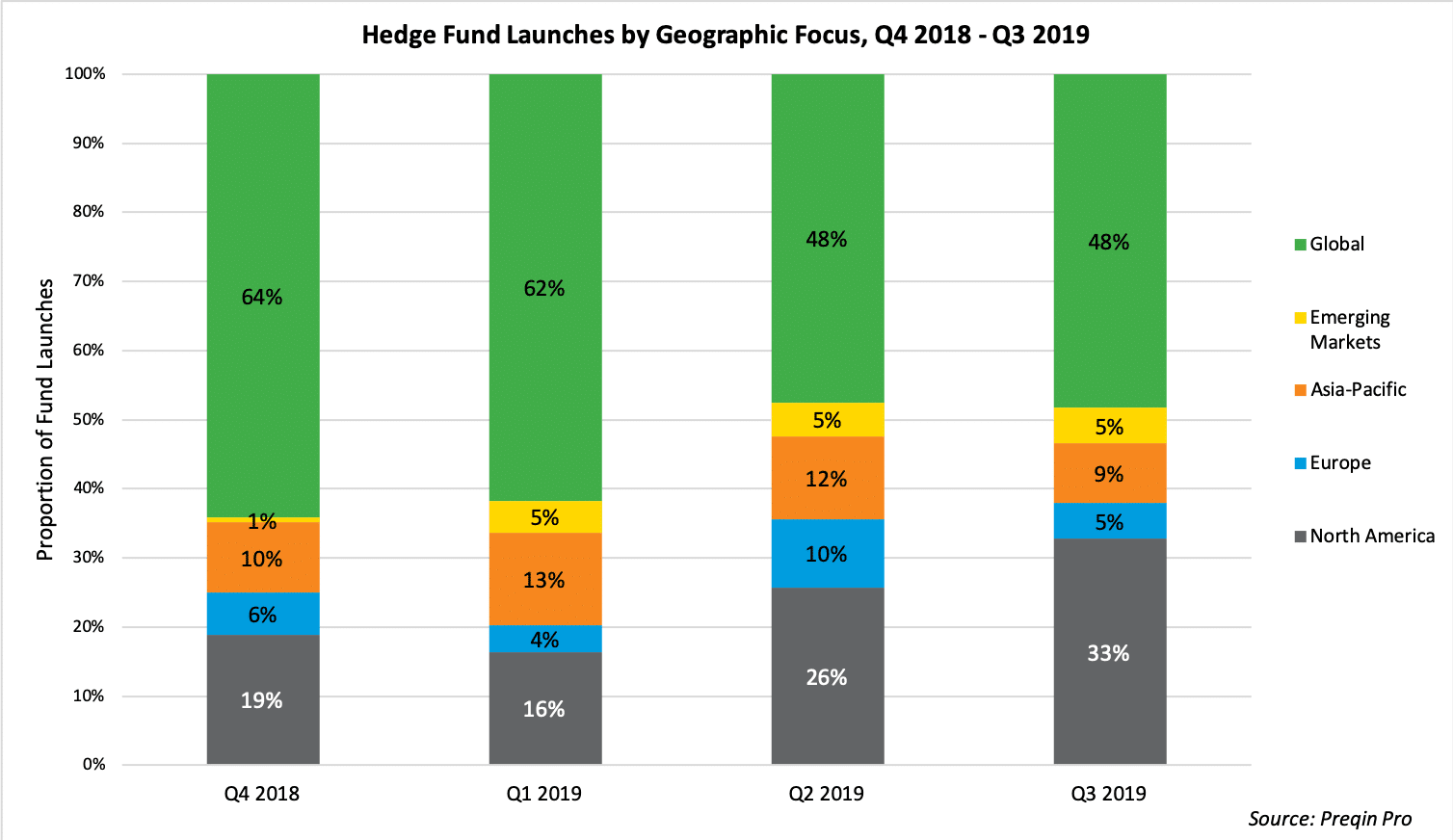

Around 33 percent of funds launched in the third quarter focus on North America, increasing for a second consecutive quarter from 16 percent in the first quarter to 26 percent in the second quarter and one-third in the third quarter. The share of global-focused and emerging markets-focused hedge fund launches remained at the second quarter’s level. In contrast, new launches focusing on Asia-Pacific and Europe declined by 25 percent and 50 percent respectively.

This year’s Q3 edition of the Preqin Quarterly Update: Hedge Funds can be found below:

Photo by Chris Liverani on Unsplash