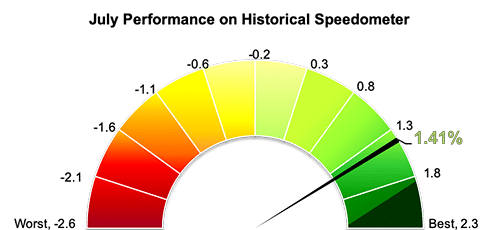

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds gained 1.4 percent in July (86 percent reported), cementing their position as this year’s best performing strategy group in the Nordic Hedge Index. The NHX Multi-Strategy, the most diverse and inclusive strategy category in the Nordic Hedge Index, is up 5.7 percent year-to-date through the end of July.

The NHX Multi-Strategy includes Nordic hedge funds that cannot be easily assigned to any of the other strategy categories in the Nordic Hedge Index: equities, fixed income, CTAs, or funds of funds. Most members of this group invest across a range of asset classes and strategies to achieve their objectives.

Nordic multi-strategy hedge funds outperformed their international peers last month. The Eurekahedge Multi-Strategy Index, which includes 268 constituents, was up 0.9 percent in July and 6.3 percent in the first seven months of 2019. The Barclay Multi-Strategy Index gained 0.6 percent last month, which brought its year-to-date performance to 4.2 percent.

Most members of the NHX Multi-Strategy posted gains for July. Pacific Precious, a multi-strategy fund focused on precious metals, was the best performing member of the group for a second consecutive month. In June, Pacific Precious achieved its best monthly performance on record with a gain of 7.2 percent. The fund is up 15.1 percent year-to-date through the end of July.

Evli Factor Premia, which employs global systematic market-neutral factor strategies across multiple asset classes, booked a 4.8 percent-gain last month. The fund was up 9.4 percent in the first seven months of 2019. SEB Diversified, a fund that targets absolute returns and invests in all major asset classes, returned 18.8 percent year-to-date through the end of July after gaining 4.1 percent in July alone. Investin Othania Etisk Formuevækst and Carve 2 were up 3.4 percent and 3.0 percent last month, respectively.

Photo by JESHOOTS.COM on Unsplash