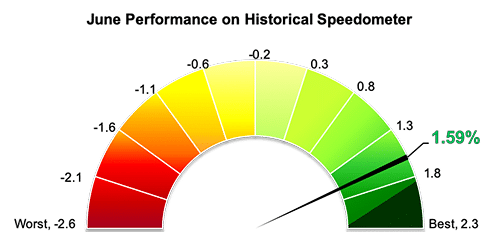

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds enjoyed their best first-half performance in over a decade after gaining 4.5 percent in the first six months of 2019. The NHX Multi-Strategy, the most diverse and inclusive strategy category in the Nordic Hedge Index, was up 1.6 percent in June (81 percent reported).

The NHX Multi-Strategy includes Nordic hedge funds that cannot be easily assigned to any of the remaining four strategy categories in the Nordic Hedge Index: equities, fixed income, CTAs, or funds of funds. Most members of this group invest across a range of asset classes and strategies to achieve their objectives.

Nordic multi-strategy hedge funds performed broadly in line with their international peers both in June and year-to-date. The Eurekahedge Multi-Strategy Index, which includes 265 multi-strategy funds, gained 2.0 percent in June, bringing the group’s performance for the first half of 2019 to 5.5 percent. The Barclay Multi-Strategy Index, meanwhile, was up 1.4 percent last month based on reported data from 38 funds. The Barclay index advanced 3.7 percent in the first half of 2019.

Three in every four members of the NHX Multi-Strategy, currently the best-performing strategy category in the Nordic Hedge Index this year, posted gains for June. Pacific Precious, a multi-strategy fund focused on precious metals, achieved its best monthly performance on record after gaining 7.2 percent in June. Both equity markets and traditional safe havens such as gold performed well in June, a rare occurrence in financial markets. The fund was up 9.5 percent in the first half of 2019.

Othania Invest, which uses a systematic model to allocate capital either into equity or bond exchange-traded funds depending on the degree of risk in equity markets for the month ahead, advanced 6.5 percent in June. The June performance took the fund’s return for the year further into positive territory at 7.7 percent.

Pacific Multi Asset, a multi-asset, multi-strategy fund under the umbrella of Pacific Fonder, also enjoyed its best monthly performance on record last month. The fund gained 5.6 percent in June and 7.7 percent in the first six months of 2019. SEB Diversified and Formuepleje Penta gained 5.5 percent and 5.2 percent last month, respectively.

Photo by Maarten van den Heuvel on Unsplash