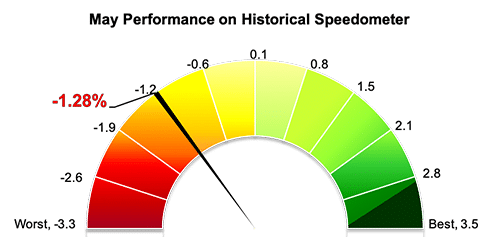

Stockholm (HedgeNordic) – Last month, Nordic equity hedge funds gave up some of this year’s gains as increased trade tensions sent equity markets sinking. Equity hedge funds, as expressed by the NHX Equities, were down 1.3 percent last month on average (89 percent reported), trimming the year-to-date gain to 3.7 percent.

Nordic hedge funds outperformed both local and global equity markets last month. Nordic equities, as expressed by the VINX All-share index, delivered a negative net return of 5.2 percent in Euro terms. The index includes all firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs. Global equities, as measured by the FTSE World Index, were down a similar 5.2 percent in Euro terms last month. Eurozone equities fell 5.5 percent, whereas North American equities declined 5.7 percent in Euro terms.

Nordic equity hedge funds as a group trailed their European counterparts last month but performed broadly in line with global long/short equity funds. The Eurekahedge Europe Long Short Equities Hedge Fund Index, which reflects the collective performance of 167 European equity hedge funds, was down an estimated 0.6 percent last month based on reported data from 39 percent of its index constituents. European long/short equity managers are up 3.7 percent in the first five months of 2019. The Eurekahedge Long Short Equities Hedge Fund Index, a broader index that includes 952 global funds, declined 1.4 percent in May, reducing the year-to-date performance to 5.6 percent.

One of every three equity-focused funds in the Nordic Hedge Index had positive returns in May. Last month’s best performing funds in the NHX Equities also registered their best monthly performance on record. Systematic market-neutral fund QQM Equity Hedge booked a gain of 7.6 percent, taking the fund’s performance for the year into positive territory at 7.2 percent. Fundamental equity long/short fund Bodenholm, meanwhile, gained 5.3 percent last month, its best month since launching in September of 2015. Bodenholm is up 5.0 percent in the first five months of 2019.

Stockholm-based long/short equity fund Gladiator Fond, which struggled in the first four months of 2019 due to Max Mitteregger’s bearish positioning in equities, advanced 5.2 percent in May and trimmed the fund’s year-to-date loss to 13 percent. Guide Avkastningsfond, Indecap’s long/short equity fund, was up 4.1 percent in May, whereas market-neutral fund Handelsbanken Global Selektiv Hedge gained 2.6 percent.

Photo by Markus Spiske on Unsplash