Stockholm (HedgeNordic) – Both in the Nordic and global hedge fund industry, closures were a key theme of 2018, especially in the final quarter of the year. In contrast to the global industry, however, new hedge fund launches in the Nordics filled up the ranks and empty seats.

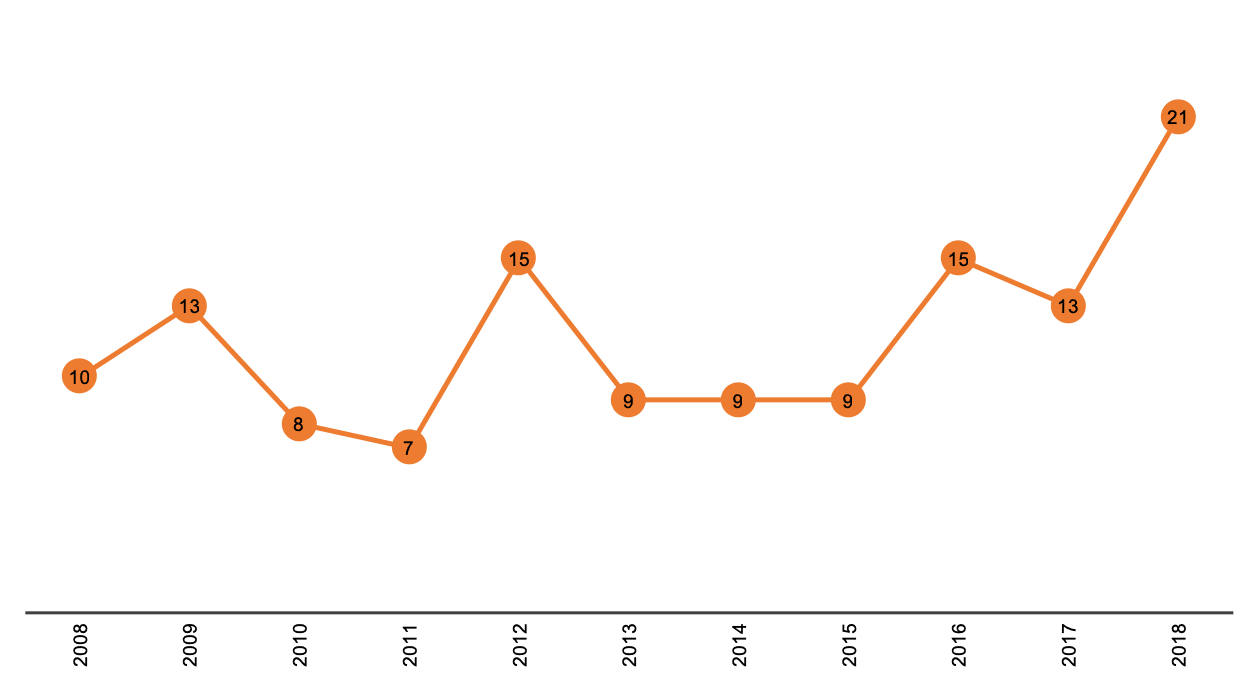

During the course of 2018, 15 constituents of the Nordic Hedge Index closed their doors or merged into other funds, resulting in delisting from the index. Despite the relatively high number of closures, new hedge fund launches outnumbered closures last year. Of the 172 current index constituents, 21 were launched in the previous year alone, the highest number of launches on record. Thirteen funds currently included in the NHX were launched in 2017, and an additional 15 were started in 2016.

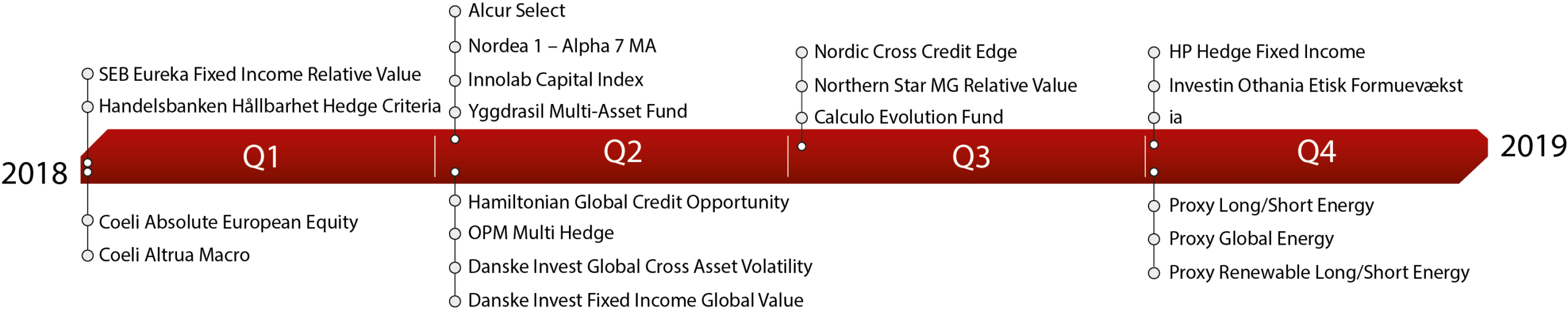

In 2018, the second quarter was the busiest in terms of new hedge fund launches, with eight existing members of the Nordic Hedge Index kicking off operations between April and June. The third quarter of the year, however, was the least busy quarter. Asset manager groups with the highest number of launches in 2018 include Coeli Asset Management, Danske Bank Asset Management, and Proxy P Management. Coeli Asset Management launched two hedge funds during the first quarter, Danske Bank’s asset management arm started two vehicles during the second quarter, whereas energy specialist Proxy P Management brought three long/short equity funds on the arena in the final quarter of the year.

Rookies: Country and Strategy Breakdown

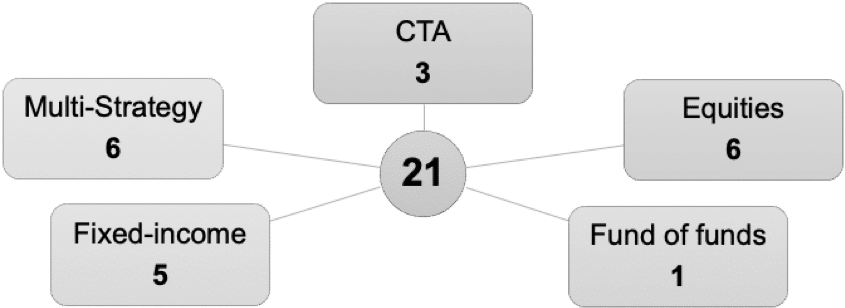

Of the 21 new launches on the Nordic hedge fund arena, six vehicles run equity-oriented strategies, with an additional six funds employing a multi-asset, multi-strategy approach. Five of the new launches focus their investing approach on fixed-income markets. Three new trend-following CTAs and one fund of hedge funds were launched throughout 2018.

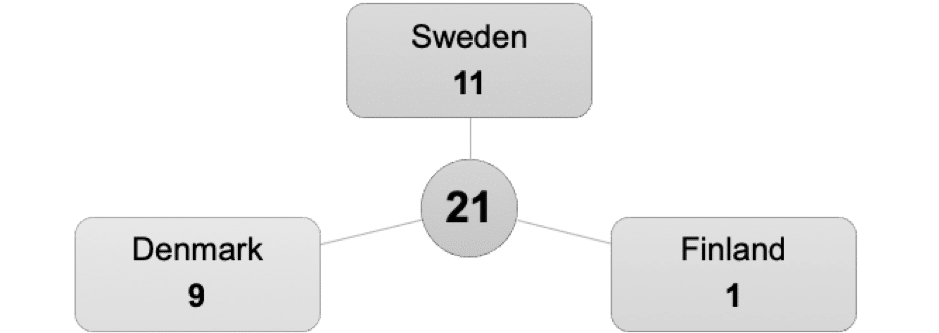

Historically, the Nordic Hedge Index has included a large number of Swedish hedge funds, currently accounting for around 60 percent of the index. Last year, 11 new Swedish hedge funds joined the Nordic hedge fund arena. A total of nine new Danish hedge funds kicked off operations last year, a fruitful year for the Danish industry. Only one Finnish hedge fund was started in 2018.

How Did Rookies Perform so Far?

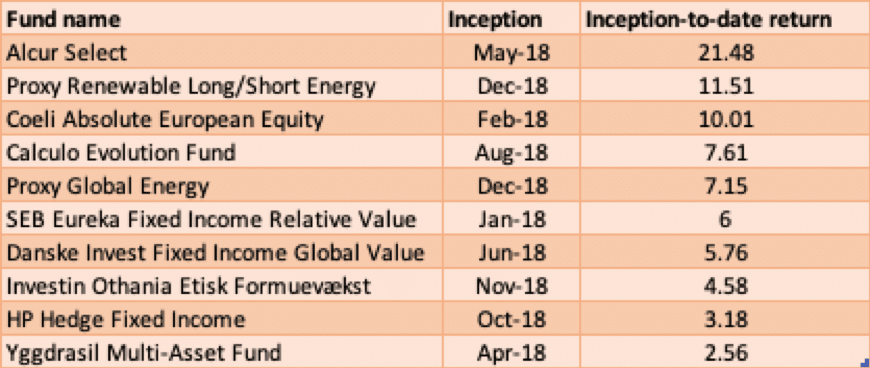

Despite facing turbulent market conditions in the final quarter, more than half of the 21 hedge funds launched throughout 2018 made money for investors since inception through the end of February. Small-cap-focused long/short equity fund Alcur Select, launched in May of last year, earned a net-of-fees cumulative return of 21.5 percent through the end of February. Two other equity-focused vehicles, Proxy Renewable Long/Short Energy and Coeli Absolute European Equity, were next in the performance leaderboard.

Systematic trend-following commodity fund Calculo Evolution Fund, one of a handful of trend-followers to perform well last year, earned a cumulative return of 7.6 percent thus far. Proxy Global Energy, one of the two long-biased long/short equity energy funds managed by Proxy P Management, completes the top-five leaderboard with a cumulative return of 7.2 percent. SEB Eureka Fixed Income Relative Value Fund and Danske Invest Fixed Income Global Value, two Danish fixed-income vehicles, closely followed suit with cumulative gains of 6 percent and 5.8 percent, respectively.

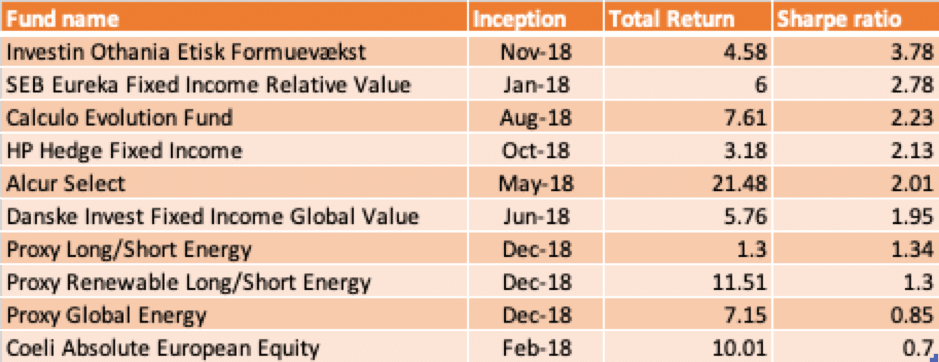

Looking at Sharpe ratios, a measure of risk-adjusted returns, Investin Othania Etisk Formuevækst fared best among rookies with a Sharpe ratio of 3.8. The fund uses a systematic model to allocate all managed capital either into sustainable equity or bond exchange-traded funds every month. SEB Eureka Fixed Income Relative Value, a diversified relative-value fixed-income hedge fund, exhibits a Sharpe ratio of 2.8 since launching in January of last year. Calculo Evolution Fund and HP Hedge Fixed Income are following suit with Sharpe ratios of 2.2 and 2.1, correspondingly.

How Big are Last Year’s Rookies?

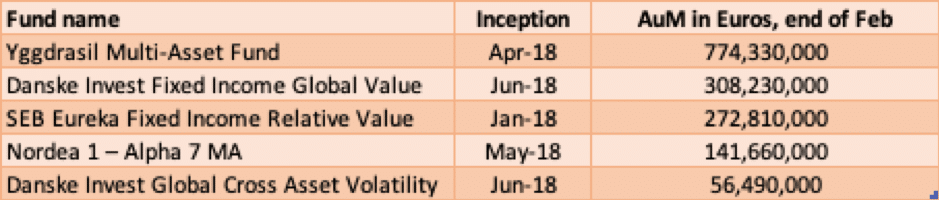

Some of last year’s rookie hedge funds attracted sizeable amounts of capital by the end of February this year. Yggdrasil Multi-Asset Fund, a multi-asset fund seeking opportunistic risk premia in liquid products and mature financial markets, managed a staggering €774.3 million at the end of February. Danske Invest Fixed Income Global Value oversees €308.2 million in assets under management, whereas SEB Eureka Fixed Income Relative Value manages €272.8 million.

The nine of the 21 rookies with reported assets under management in our database collectively manage €1.57 billion as of the end of February. The record number of hedge fund launches last year and the amounts of assets overseen by rookies represent an indication that the current environment for raising capital has not been extremely difficult for young and promising funds.

Picture © Lightspring—shutterstock