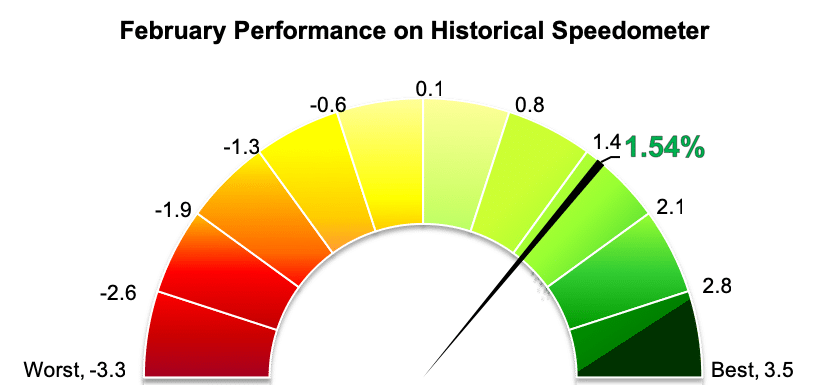

Stockholm (HedgeNordic) – Nordic equity hedge funds continued their strong start to the year into February. The equity-oriented members of the Nordic Hedge Index (NHX) gained 1.5 percent on average (89 percent reported) last month, with the group advancing 4.6 percent year-to-date through the end of February.

Nordic equity hedge funds lagged Nordic and international stock market indices in February. This comes as no surprise given their low net exposure to equity markets, as some equity-focused members of the NHX run market-neutral strategies and others even maintain negative net market exposure this year.

Last month, Nordic equities as expressed by the VINX All-share index earned a net return of 3.3 percent in Euro terms. This index includes all firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs. Global equity markets, as measured by the FTSE World Index, advanced 3.5 percent in Euro terms, after gaining around seven percent during the first month of the year. Eurozone equities gained 3.9 percent last month, while North American equities were up 4.1 percent in Euro terms.

Nordic equity-oriented hedge fund broadly outperformed their European and global peers last month. The Eurekahedge Europe Long Short Equities Hedge Fund Index, reflecting the average performance of 174 index constituents, was up only 0.2 percent last month. Eurekahedge Long Short Equities Hedge Fund Index, a broader index that includes 983 global long/short equity funds, advanced 1.1 percent. The 107 funds from the Barclay Equity Long/Short Index that reported February return figures were down 0.5 percent on average last month.

Three in every four members of the NHX Equities recorded positive returns for February, with small-cap-focused long/short equity fund Alcur Select topping the table. The Stockholm-based vehicle managed by Wilhelm Gruvberg and his team gained 8.6 percent last month, taking this year’s performance to 15.9 percent.

HCP Focus Fund, a Helsinki-based fund that maintains a concentrated portfolio of high-quality companies trading at attractive prices, advanced 7.7 percent last month. The fund managed by Ernst Grönblom is up 25.4 percent year-to-date, securing the title of the best performing member of the Nordic Hedge Index in 2019.

Value-oriented vehicle Taiga Fund was up 5.5 percent in February, extending year-to-date gains to 10.2 percent. Rhenman Global Opportunities L/S and Proxy Renewable Long/Short Energy were up 5.5 percent and 5.4 percent, respectively.

Picture © Jirsak—shutterstock