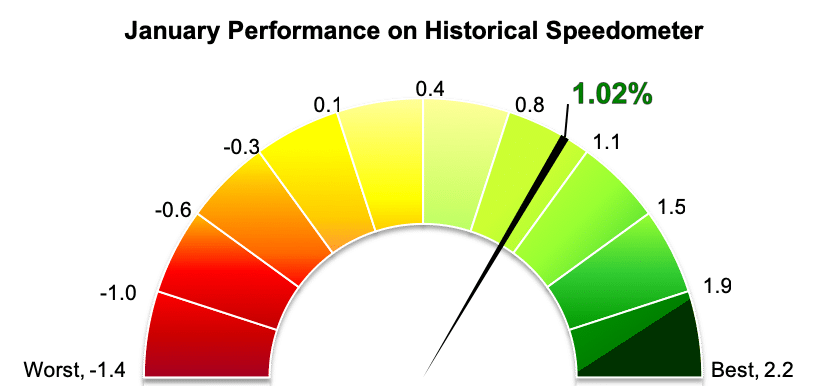

Stockholm (HedgeNordic) – After three consecutive months of losses, Nordic fixed-income hedge funds experienced one of the best months in nearly two years last month. The NHX Fixed Income gained one percent (84 percent reported) in January.

International fixed-income hedge funds, as expressed by the Eurekahedge Fixed Income Hedge Fund Index, enjoyed their best month in the past seven years. The Eurekahedge index, which reflects the collective performance of 312 global fixed-income hedge funds, advanced two percent in January. The index was flat last year, whereas the NHX Fixed Income declined 0.4 percent during the year.

Almost the entire universe of Nordic fixed-income hedge funds posted gains in January, but there was one fund that stood out from the crowd. Nykredit EVIRA Hedge Fund, a fund that maintains a concentrated portfolio of lower-rated European corporate bonds of strong companies with improving credit quality, recovered some of the losses incurred during 2018 after gaining 7.4 percent in January. Nykredit EVIRA, which lost 16.7 percent last year, rose 8.6 percent year-to-date through February 5.

Three fixed-income hedge funds managed by Danske Bank Asset Management and one vehicle managed by Nordic Cross Asset Management, namely Nordic Cross Credit Edge, completed last month’s list of top performers in the fixed-income category. Danske Invest Fixed Income Relative Value and Danske Invest Fixed Income Global Value gained 2.2 percent and 1.8 percent last month, correspondingly.

Picture © mark-higgins—shutterstock