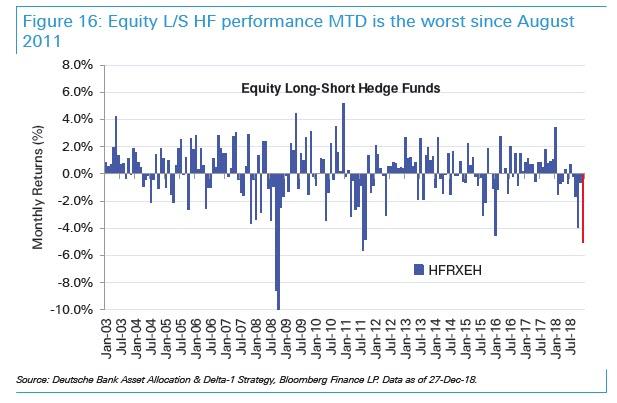

Stockholm (Hedgenordic) – Long/short quity hedge funds had its worst month since August 2011 in December according to data from Hedge Fund Research. The month-to-date loss for the HFRX Equity Hedge Index was 4,6 percent bringing year-to-date returns to -9.7 percent. For the overall hedge fund industry, 2018 was almost equally bad with the HFRX Global Hedge Fund Index ending the year with a loss of 7 percent, after suffering a 2.2 percent drop in December. That is the worst yearly performance since 2011 when the index lost 8,9 percent.

Among the most widely known hedge funds globally, not many managed to provide equity market protection during the month and high-profiled names such as Greenlight Capital, Cantab and Transtrend (through the Tulip trend fund which is a leveraged version of Transtrend´s flagship program) suffered heavy losses on the year, according to data from HSBC.

With regards to Nordic hedge funds, data is yet to be retrieved for the underlying funds constituting the Nordic Hedge Fund Index, however, already in November the index was on track for its worst performance since 2011 with a year-to-date loss of approximately 2 percent. This was on the back of the index suffering its worst monthly loss in ten years in October (see separate story here). Judging from the intra-month numbers presented in December, the month provided no relief for Nordic hedge fund managers.

We will return with a complete 2018 review for the NHX index as soon at it has been updated.

Photo by Zachary Young on Unsplash