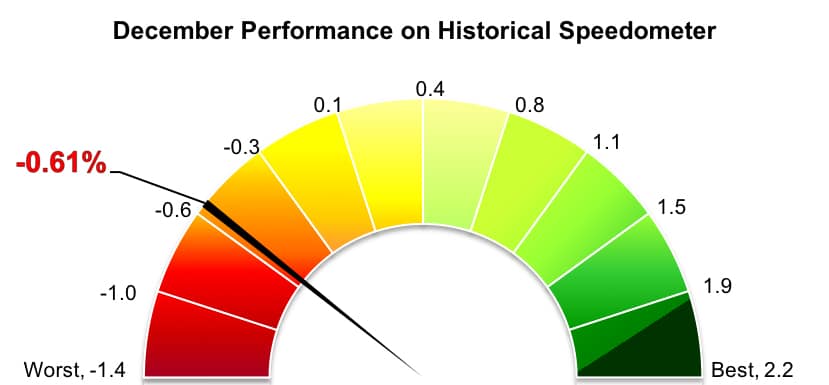

Stockholm (HedgeNordic) – The group of Nordic fixed-income hedge funds reported their third consecutive month of negative performance in December, erasing all of their gains for 2018. The NHX Fixed Income was down 0.6 percent last month (97 percent reported), and logged a negative 0.4 percent return for 2018. The year was the second-worst year on record for Nordic fixed-income hedge funds, yet, the group ended last year as the best-performing category in the NHX.

Nordic fixed-income hedge funds turned in virtually the same performance as their international counterparts in December. The Eurekahedge Fixed Income Hedge Fund Index, which reflects the collective performance of 323 global fixed-income hedge funds, was down 0.5 percent last month. The index was flat to marginally negative last year. The HFN Fixed Income Index (non-arbitrage), an index tracking the performance of fixed-income vehicles in eVestment’s database of hedge funds, fell 0.4 percent in December, cutting the year’s gains to 0.2 percent.

Around one in every four members of the NHX Fixed Income reported gains for December. Last month, two vehicles managed by Copenhagen-based Moma Advisors gained the most among the fixed-income hedge funds included in the NHX. Asgard Fixed Income Risk Premia, which specializes in carry and roll-down strategies and relative-value strategies, advanced 1.4 percent in December, reducing last year’s decline to 0.6 percent.

Moma’s flagship vehicle, Asgard Fixed Income Fund, was up 1.2 percent last month and gained 1.4 percent for the entire year. Fixed-income arbitrage fund CABA Hedge gained 1.0 percent in December, ending the year flat. Last year’s best-performing members of the NHX Fixed Income, Scandinavian Credit Fund I and HP Hedge, were also among December’s top five performers.

Picture © _Arrfoto—shutterstock