Stockholm (HedgeNordic) – The strategy employed by Nordic Cross Credit Edge, the latest member of the family of hedge funds managed by Stockholm-based asset manager Nordic Cross Asset Management, is a new breed in the Nordic universe.

Portfolio manager Emil Nordström (pictured) and founding partner Joakim Stenberg took some time out of their schedules to explain to HedgeNordic the workings of their newest fund’s strategy and discuss market anomalies and inefficiencies the fund seeks to exploit.

Credit Edge’s Two-Pillar Strategy

Nordic Cross Credit Edge is an alternative fixed-income fund that aims to generate an annual net-of-fees return of more than six percent, serving as a higher-return alternative to traditional fixed-income funds. The fund gets exposure to high-yield credit markets using derivatives such as call options. As low realised volatility makes options relatively cheap, the capital left after paying option premiums is held in high-quality and liquid financial instruments that can be quickly converted into cash to invest in corporate bonds that sporadically trade at significant discounts to the initial par values. Such opportunities tend to arise during a liquidity squeeze in corporate bond markets triggered by investor uncertainty.

Anomaly – High-Yield Credit Offers Equity-Like Returns with Less Risk

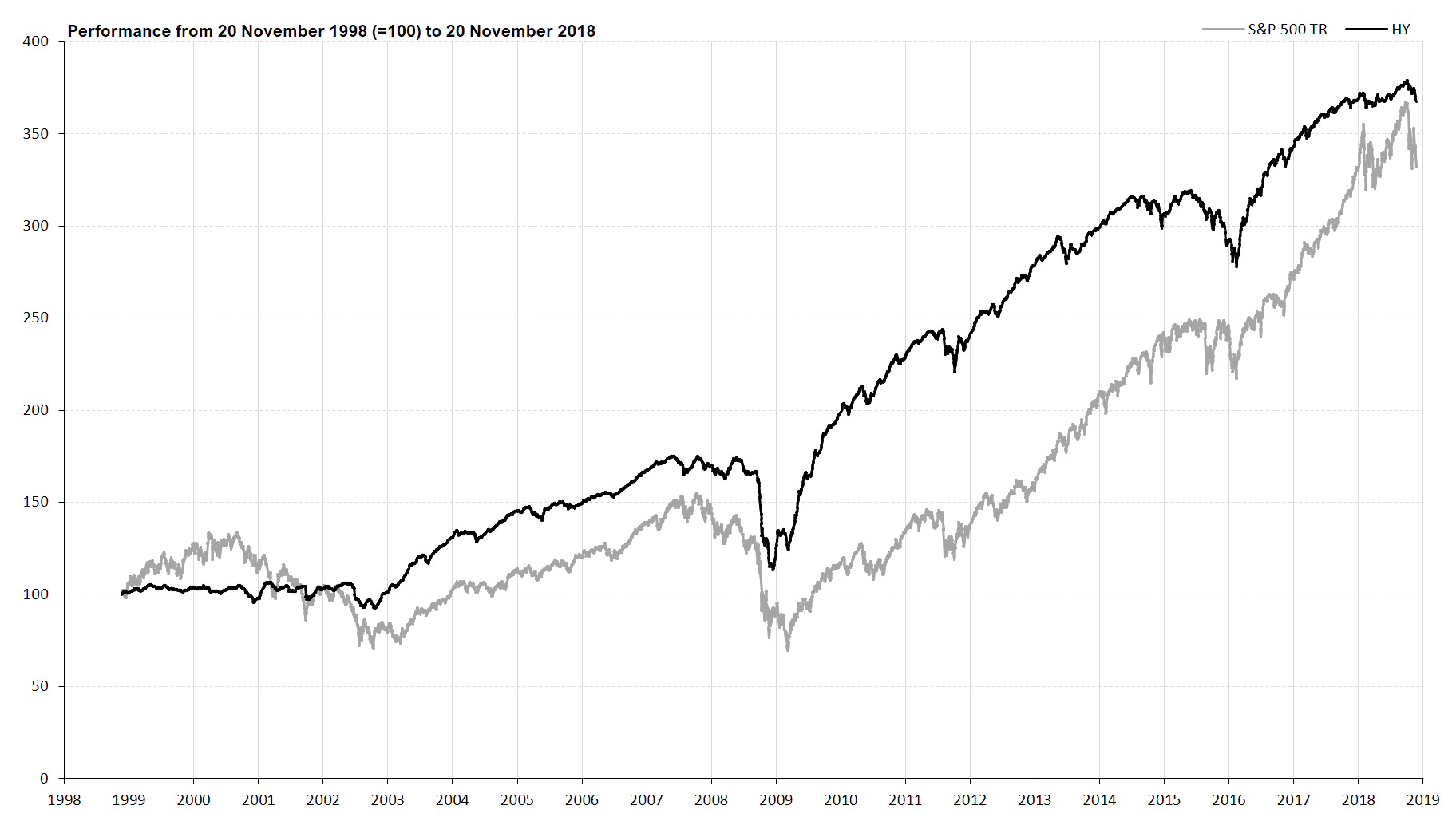

The first step in the new fund’s strategy involves buying call options offering exposure to European high-yield bond markets. The decision to get exposure to high-yield bonds was not made lightly, but was done to exploit the long- and well-known low-volatility anomaly in high-yield bonds. As Nordström says, “During the last twenty years, US high-yield bonds have performed in line with the S&P 500 but with less than a quarter of the volatility.”

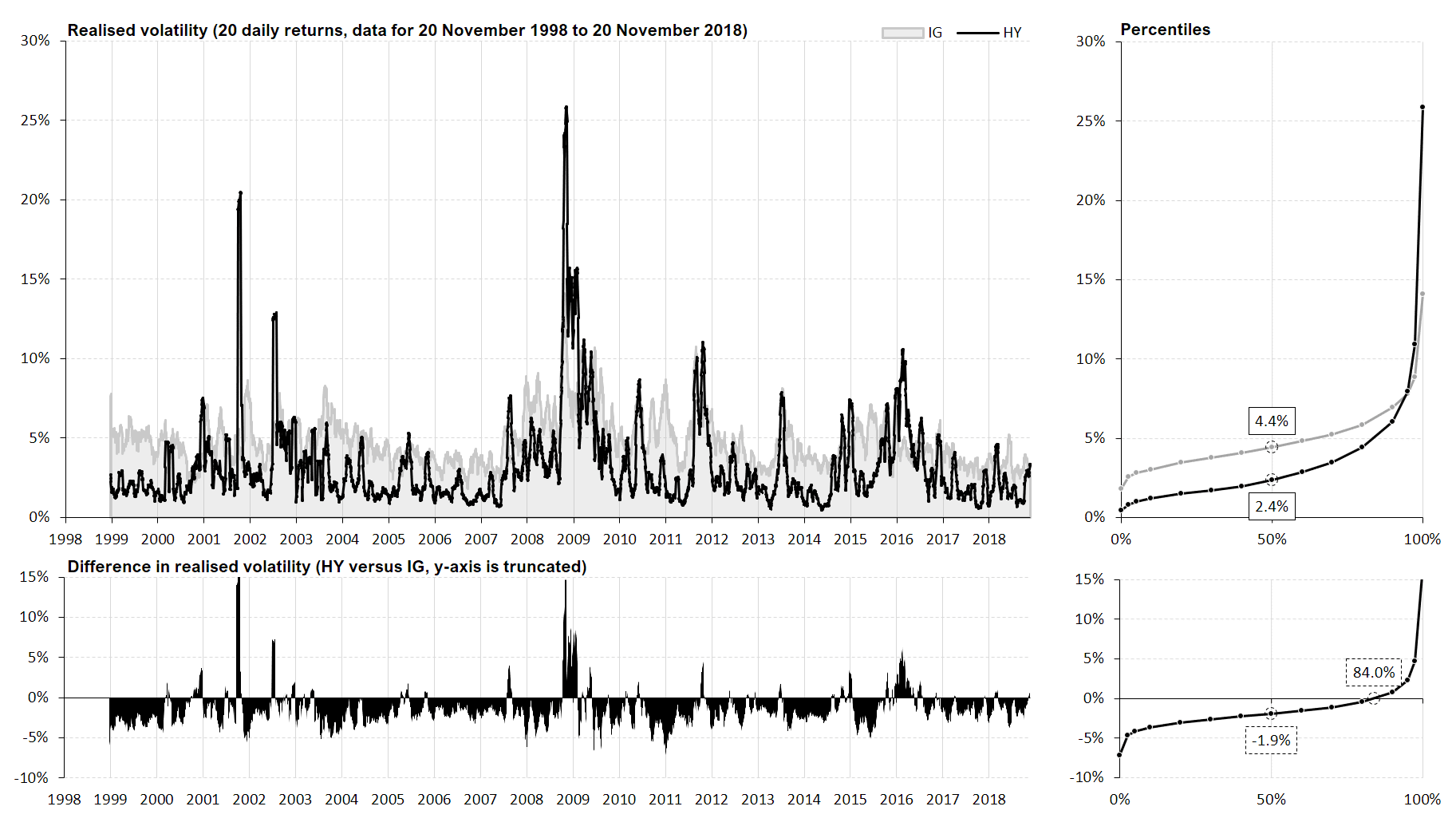

“More interestingly, however, high-yield bonds consistently exhibited lower realized volatility than investment-grade bonds during crisis-free environments” explains Nordström. The graphs below show the difference between the 20-day realized volatility of high-yield and investment-grade bonds during the last 20 years. This spread has been negative for more than 80 percent of the days. In addition, BB-rated bonds – positioned at the higher-end of the high-yield sector – demonstrated the lowest realized volatility during the last 14 years across the entire fixed-income spectrum.

Nordic Cross Credit Edge gets exposure to high-yield bonds markets by purchasing long-dated options. “Options represent a low-cost alternative of gaining directional market exposure to high-yield bond markets,” says Nordström. Theoretically, the maximum Credit Edge can lose in an extreme scenario is the premium paid on the option contracts, which is expected to be around 15 percent of net assets over time. In practice, however, the risk of a permanent loss of capital is much lower since the fund’s portfolio of options preserves value even in extreme events due to their time value. “Using call options, we can get high exposure with limited downside,” says Nordström. “Our goal with this part of the strategy is threefold: earn the high returns offered by high-yield bonds, get exposure to low volatility, and limit the risk of a significant loss of capital by using call options,” explains Nordström.

Inefficiency – Opportunistic Approach to Harvesting Liquidity-Driven Premium

Nordic Cross Credit Edge’s approach to getting exposure to high-yield bond markets requires little capital and leaves the portfolio management team with a massive cash hoard to allocate to other opportunities. Using their extensive experience of investing in Nordic corporate bond markets, portfolio managers Fredrik Tauson and Magnus Nilsson opportunistically deploy available capital to high-quality corporate bonds trading far below par as a result of a severe drying up of liquidity.

As Nordström explains, “our exposure to high-yield credit through call options rewards us with the credit risk premium; the alpha is generated from the other side of the strategy – the opportunistic approach to buying discounted bonds.” The opportunistic approach involves buying high-quality but otherwise discounted bonds during times of liquidity squeezes caused by runs to quality. Joakim Stenberg gives the example of Deutsche Bank, when investor concerns over the bank’s capital levels at the beginning of 2016 led to a sell-off in other banks’ corporate bonds as well (due to a then-imminent sizeable penalty over the sale of toxic mortgage bonds before the financial crisis).

“When one company has serious problems, other companies also get problems. Investors redeem from credit, and the market disappears because it is so illiquid, particularly in the Nordics,” explains Stenberg. Due to the liquidity squeeze caused by investor concerns over Deutsche Bank’s balance sheet, junior bonds issued by SEB, for instance, were trading significantly below par. Fund managers with large piles of dry powder were presented with the opportunity to pick up SEB bonds at a significant discount and capture a liquidity-driven risk premium. The approach of getting exposure to high-yield credit via options, which leaves a vast cash hoard in the hands of Credit Edge’s fund managers, represents the fund’s main advantage over other vehicles that use an opportunistic approach to investing in corporate bond markets, Nordström and Stenberg reckon.

“The problem faced by pure opportunistic funds is that ten years may pass without any attractive opportunities caused by liquidity squeezes, and investors are left paying fees without getting a return”, Nordström explains. In addition, funds may face significant redemptions in times of turmoil, precisely when funds such as Credit Edge can load up on unjustifiably low-priced corporate bonds of solid companies. “You do not want to be fully-invested when these opportunities present themselves,” adds Stenberg. To sum up, Nordic Cross Credit Edge attempts to exploit an anomaly in the high-yield credit space and an inefficiency occurring periodically in the market of corporate bonds.