Stockholm (HedgeNordic) – Most alternative risk premia strategies are seeking to pick up between one and seven risk premiums, using a 100% systematic and rules-based strategy. But the original concept of a risk premium is much broader than this. Risk premiums can be exploited by managers who are 100% systematic, 100% discretionary, or those, such as Copenhagen-based Moma Advisers, who are somewhere in between.

Moma CIO, Morten Mathiesen, “starts off using quantitative models to identify potential opportunities, but finds that some discretionary analysis is needed to forecast how demand and supply will change. Each trade has a profit forecast, based on the quantitative model, which typically constructs a portfolio of strategies with an expected annualised return between 7% and 12%”.

“By applying a systematic investment strategy with strict focus on downside risk, we have managed to build a 15-year track record with an annual average return of 13% with an annual volatility of 6.5% resulting in a 15-year Sharpe Ratio just below 2” he adds.

The recurring question posed by investors is whether Asgard’s returns are sustainable over the next 5, 10 or 15 years. “Supply and demand imbalances continue to create inefficiencies that can be exploited by earning a risk premium” argues Mathiesen.

Arbitrage versus risk premia

The opportunities are not arbitraged away, because they are not, strictly speaking, arbitrages in the first place: they are not risk-free trades. Financing must be secured and maintained in order to hold trades to maturity. In the interim, there is reinvestment and roll risk when various spreads are reset at fixings. “We must have an opinion about what the fixing rolls into,” says Mathiesen. Therefore, he feels that the term “risk premium” is more appropriate than “arbitrage” (although many of their trade types would, loosely speaking, be described as “fixed income arbitrage” by many managers and investors).

“Although the fund is not a typical risk premia fund, the Risk Premia name was incorporated due to the philosophy, that the portfolio managers are harvesting risk premiums in the various bond and interest rate markets, primarily in Scandinavia” explains Birger Durhuus, CEO of Moma Advisors.

Nordic mortgage bonds

At the simplest level, mortgage securities can offer higher yields, even after hedging the interest rate risk. This can be a compensation for prepayment risk, but mortgage bonds without prepayment risk also offer some extra yield. While part of the returns do come from this yield pickup on mortgages relative to government bonds – a risk premium – security selection is also important. Asgard’s returns have greatly outperformed a passive strategy of holding a generic hedged Scandinavian mortgage bond portfolio.

Returns have also beaten an index-based approach because the fund tactically varies the allocation to the sub-strategies, according to the opportunity set. On average, Nordic mortgages might have contributed around three-quarters of the strategies profits, but this fluctuates over time. Recently, in 2018, Asgard has increased exposure to mortgages after spreads had widened earlier in the year.

Yield curves

Elsewhere, pension funds and insurers forced to invest for liability-matching and solvency reasons, create a strong demand for long-dated European government bonds, which leads to quirks such as an inverted yield curve at the long end. “Those with deep pockets and long-term time horizons can profit from this,” says Mathiesen.

Cross-currency basis swaps

The same strategies may not work every year, so Mathiesen needs to be open-minded about opportunistically moving capital around to find attractive trades. The ECB’s asset purchases have reduced yields on Euro-denominated covered bonds to levels that price out Asgard, but this has created new opportunities by segmenting the Eurozone market from those using other currencies. “Corporates in Scandinavia can borrow more cheaply in Euros, which creates a one-way traffic demand for cross-currency basis swaps,” says Mathiesen. That, in turn, leads to attractive levels of “roll down” yield on the cross-currency basis swap curve as banks have scaled back or shut down their proprietary trading activities, there is less competition. “We do what the banks used to do” he adds.

Country spreads

Asgard also moves in and out of the CITA (Copenhagen Interbank Tomorrow/Next Average) versus EONIA (Euro Over Night Index Average) interest rate trade, to hedge the risk of Danish Krona appreciation. “At times of Euro risk aversion, the DKK is seen as a “shadow Deutschmark” and a safe haven, leading to appreciation pressure, which then forces the Danish Central Bank to lower interest rates to keep the DKK pegged to the Euro” explains Mathiesen.

Around 80% of trade types come under the above four categories. There are also other trades mainly designed to be portfolio hedges, such as the basis between three and six -month swaps, which can blow out in a crisis but can be seen as low-cost insurance insofar as it has a neutral carry. In addition, Asgard trades calendar spreads on the volatility curve of interest rates, which can generate positive roll down carry.

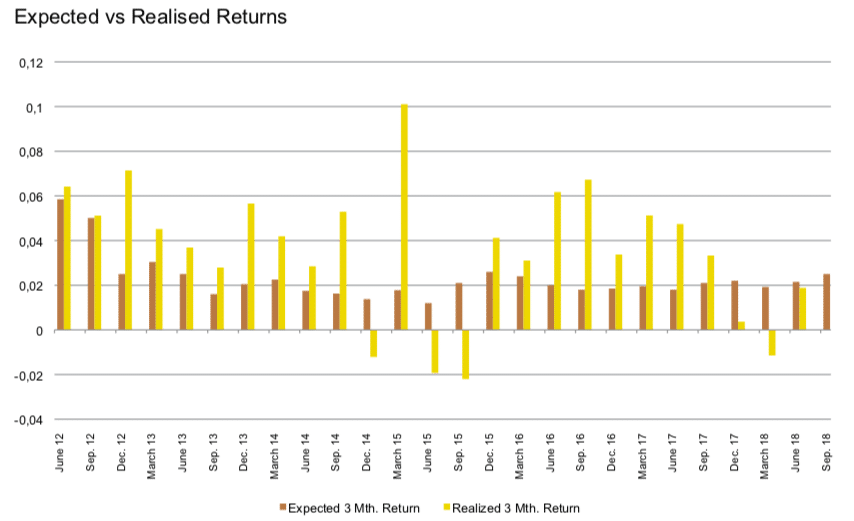

This year’s returns have so far been modest, but Mathiesen is optimistic that the long-term positive trend will continue in months and years ahead. “We have already seen a pick-up in return in the past 3 months, and our experience is, that in the case of a few slow quarters, expected and realized return increases in quarters ahead”. This somewhat mean-reverting pattern of returns is shown on the graph below.”The level of expected return is of course not as high as it was in 2009 when all risk premiums were stretched, but the current level is approximately equal to the average of the last 5 years. I still find that very attractive in today’s environment”.

The Irish-domiciled Asgard Fixed Income Risk Premia fund pursues the same strategy as the Cayman-domiciled Asgard Fixed Income Fund, which launched in 2003 and is closed for subscription. Moma Advisors, an authorised AIFM, launched an Irish ICAV, which is an AIF, to more easily access European investors.

In its first few months, the ICAV showed some “tracking error” versus the Cayman fund as it took some time to build up the book. Now performance is very similar, as the two portfolios have been aligned.

“We did run into a few unexpected challenges in the process taking the strategy onshore and under AIFMD regulation, such as changing the custodian and depositary, but these issues have been resolved, and we are now fully focused on delivering returns to the investors of the fund,” says Durhuus.

The Irish fund has so far raised EUR 270 million. Asgard estimate that capacity for the overall strategy, including both the Cayman and Irish funds, could be around EUR 800-1.000 million, but realistically acknowledge that they will not know what the optimal capacity is until assets reach that level. The Investment Manager is now having conversations with institutional investors worldwide.