Stockholm (HedgeNordic) – Since 2006, Swedish Informed Portfolio Management – IPM has run an actively managed, risk factor investing strategy, applied to unleveraged, long-only equity portfolios. The strategy is based on the same investment philosophy as its flagship, systematic fundamental macro strategy that was launched in 2003. The value-oriented equity strategy aims to outperform a market cap-weighted benchmark through a full cycle. since inception, it has – despite the strong headwind for the risk factor value – kept pace with standard market cap-weighted equity benchmarks, while outperforming generic value investing approaches – such as the MSCI World Value index, which is composed of the cheapest half of the market, based on various valuation multiples (e.g. price to book value).

Compared to generic value-tilted indices, IPM uses a broader range of measures to define value, and a conceptually different approach: “we do not focus on what we call relative value, e.g. PE- or PB-ratio, but on absolute value, e.g. the absolute size of a company’s earnings or book value. We thus apply a fully price-indifferent approach” says Senior Investment Strategist, Daniel Leveau (pictured).

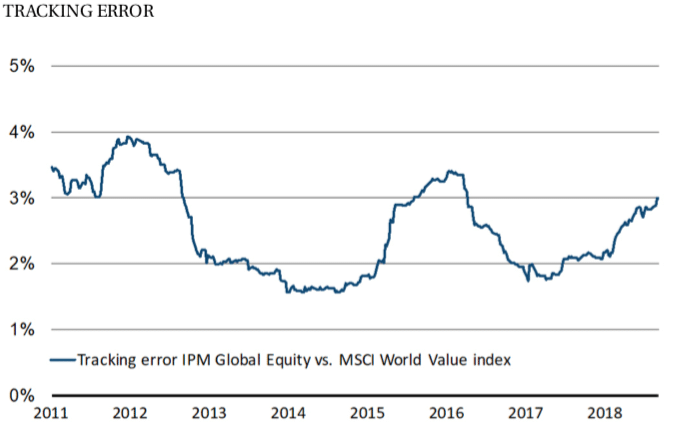

That said, the strategy does not deviate all too much from the generic value risk factor, as IPM expects value to generate a positive risk premium long-term, based on decades of performance history, and academic research. IPM’s tracking error versus MSCI Value has fluctuated between about 1.5% and 4% since 2011, as shown below.

Partly with the benefit of hindsight, Leveau finds explanations as to why value has been the “Cinderella” strategy for nearly a decade. The inflows into passive, index investing, are implicitly making big style bets on the risk factors growth and momentum, resulting in an increasing, fundamentally-agnostic demand for such stocks. Low, zero and negative interest rates also increase the valuation of more distant cash-flows of growth stocks, while the hunger for yield inflates the valuation of those that simply pay high dividends. Meanwhile, mega-cap technology growth stocks that currently enjoy a compelling narrative about the digitalization of many business models have generated strong growth in profits, but their valuation multiples have expanded at an even faster pace.

Value has also underperformed due to “value traps”, such as retailers that have gone bankrupt after losing market share to internet platforms such as Amazon, or Italian banks that traded at a fraction of their book value because investors accurately judged that many loans were bad debts, destined to be written off.

While Leveau believes there is no fool-proof way to avoid “value traps”, IPM’s value bet – typically around 50% of factor exposure – is tempered by exposure to the risk factors momentum, quality and small cap. The first two of these are partly designed to sidestep some value traps.

Value tends to be inversely correlated to momentum, and paying attention to negative price action can be wise where the share price turns out to be a good signal of headwinds. Quality measures, such as debt coverage ratio and accruals, can also help to avoid superficially cheap companies that are over-leveraged and maybe expensive on an enterprise value basis, or that struggle to convert reported profits into tangible cash-flows. The quality factors used by IPM have similar characteristics to the ‘G’ for Governance in ESG. Additionally, “the strategy is diversified across a very large number of stocks in order to minimize cluster risk to any specific stock,” says Leveau.

Compared to a market-cap-weighted strategy, IPM on average slightly over-weights small cap stocks but is nowhere near any capacity constraint. Around $3.3 billion of IPMs’ $8.6 billion assets under management are in the equity strategy, which remains open to investment, in UCITS funds and separately managed accounts.

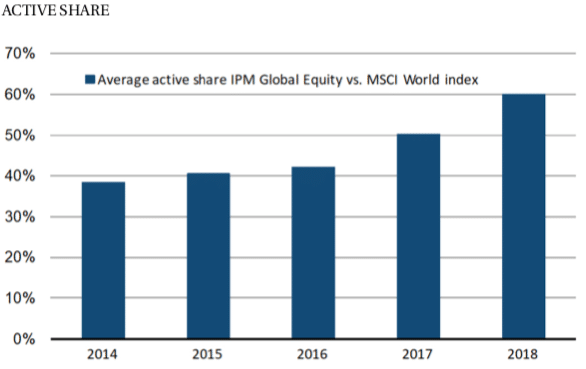

The size of IPM’s bets versus market cap-weighted indices will vary according to the perceived opportunity set. Despite the recently increased valuation and performance dispersion between value and growth stocks, tracking error versus MSCI World has not made new highs, as the strategy is highly diversified on a single stock level. IPM’s active share has increased markedly however, as shown below.

In other words, IPM has been steadily reducing its position overlap with the MSCI World Index, as shown below. This is partly driven by a bigger “value” style bet. “Our active share has increased as a function of in particular stretched valuations of the US stock market and technology companies,” says Leveau.

IPM is of the opinion that value is undervalued relative to growth, but the bifurcation between the two styles is not at the extreme seen at the peak of the TMT bubble in 1999 and nor is value as attractively priced in absolute terms as it was then. Still, Leveau reckons that value stocks, today trading at a slight discount to fair value, could prove to be more resilient than they were in 2008.

ESG and risk factors

IPM has been a signatory of the UN PRI since 2010.

“IPM’s comprehensive ESG analysis approaches ESG from four angles, which in combination actually only have marginal implications for risk factor exposures,” says Leveau.

IPM’s “factor integration” approach uses various financial metrics as a proxy for governance. As aforementioned, overweighting companies with good governance, and underweighting those with weak governance, has some overlap with the quality factor. This is intended – and is justified on performance grounds. Based on IPM’s research, the governance factor is expected to add between 0.25%-0.50% to annual returns (depending on region), and reduce drawdowns, without increasing volatility, relative to MSCI indices.

IPM’s “norms-based screening” can also be described as “negative screening” or exclusion, and avoids investing in companies that do not meet the UN Global Compact criteria or weapons-related conventions, e.g. companies deemed to violate the spirit or letter of the Non- Proliferation Treaty. Viewed in isolation, these exclusions could result in unintended risk factor exposures. But IPM’s “best in class” substitution, a form of “positive screening”, helps to counterbalance unintended sector, region or country biases arising from the screening. Companies with similar characteristics to those excluded are over-weighted. “As a consequence of this approach, IPM’s ESG policy does not materially change either the absolute or relative portfolio risk” explains Leveau.

IPM also has a transparent policy on engagement and proxy voting. IPM engages with companies both bilaterally and in conjunction with other investors; consultant GES International has been retained to assist with engagement since 2006. IPM is an active owner and discloses both its historical voting record and its future voting intentions to investors. ISS is retained for advice on proxy voting.

Why Value?

So, IPM’s degree of value exposure does fluctuate, and has been increasing for the past five years, but it is always expected to remain the dominant risk factor of its equity strategy.

Longer term, IPM has confidence in the value factor due to academic research, led by Fama and French, demonstrating how value investing exploits the bipolar tendencies of financial markets, which result in stocks becoming overvalued when investors are manic with everyone chasing the same, big fat carrot, and undervalued when they are depressive. “Rebalancing portfolios out of recent outperformers and into underperformers profits from subsequent mean reversion, in what Treynor dubbed the “noise-in-price,” says Leveau.

Career risk is one explanation for stocks becoming oversold. “Many managers tend to dispose of stocks that have performed sub-par and are exposed to negative media coverage for the simple reason that they do not want to have to explain these holdings to their investors,” says Leveau. In contrast, a culture of independent thinking results in IPM focusing on optimizing long-term investment results.