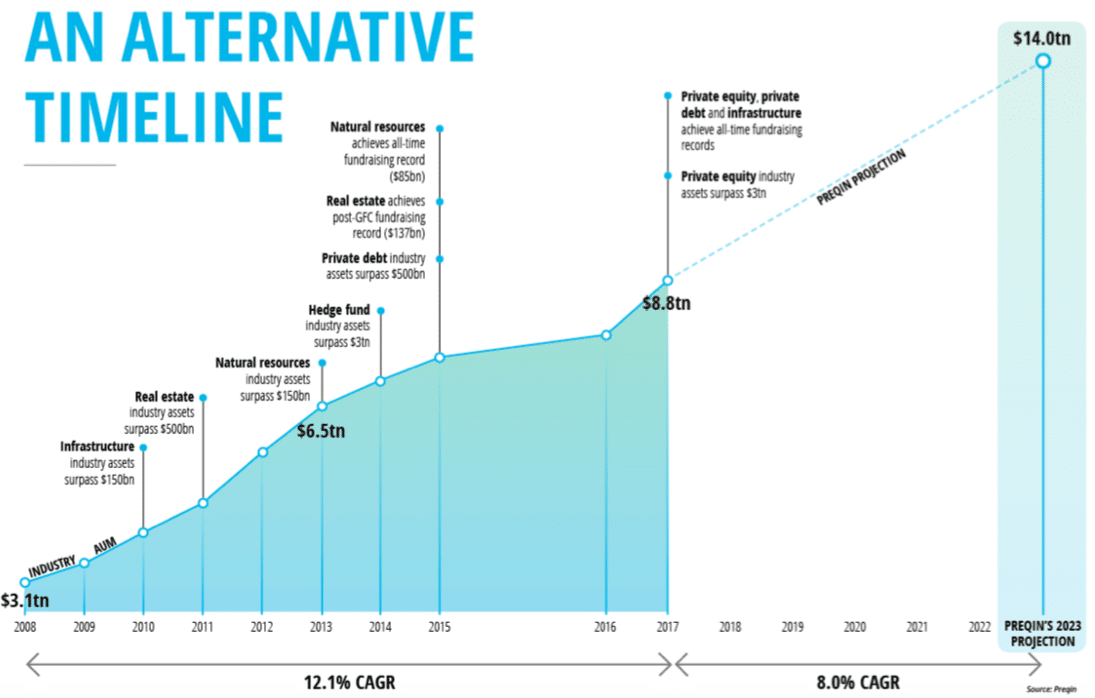

Stockholm (HedgeNordic) – The alternative assets industry, which includes hedge funds, private equity, real estate and infrastructure investments in a variety of vehicles, is predicted to reach $14 trillion in assets under management by 2023 from $8.8 trillion recorded at the end of last year. Data provider Preqin also predicts private equity funds will overtake hedge funds as the largest alternative asset class even though the hedge fund industry is anticipated to grow by 31 percent in five years.

In a report called “The Future of Alternatives: The Classes of 2023,” Preqin predicts that the hedge fund industry will oversee $4.7 trillion in assets under management in five years from $3.6 trillion as of the end of last year. The capital managed by private equity funds, meanwhile, is projected to grow 58 percent from $3.1 trillion to $4.9 trillion, allowing the group to become the largest alternative asset class. Private equity funds and hedge fund vehicles collectively accounted for three-fourths of the $8.8 trillion alternative assets industry at the end of last year.

“While industry participants are predicting this share to decrease over the next five years to 69 percent, as other alternative asset classes look set for faster growth, these industries are expected to contribute the majority (56 percent, $2.9tn) of the growth in dollar terms over the next five years,” the report writes.

Private debt and infrastructure are predicted to double their assets under management, reaching $1.4 trillion and $1.0 trillion, respectively. Real estate funds, meanwhile, are expected to grow 50 percent to $1.2 trillion. Natural resources funds are expected to reach the highest rate of growth (300 percent), yet, will remain the smallest asset class among alternatives with $800 billion in assets. Preqin’s estimates are based on average predictions from 420 fund managers and investors polled on each asset class.

“Fourteen trillion dollars may sound like an overly ambitious prediction for the alternative assets industry, but it is lower than the average growth rate we’ve seen in the past decade. There are several key factors that will drive this growth, including: the proven long-term performance of alternatives; the growing opportunities available in private debt; and the rise of emerging markets in which alternatives funds are already entrenched. If anything, we believe that $14tn is more likely to be too low than it is to be too high,” says Mark O’Hare, Preqin’s chief executive officer.

Picture © Gajus—shutterstock.com