- DNB ECO – extension of successful long-only fund focused on renewable energy.

- Plenty of long and short opportunities in the renewable energy sector.

- 18 years of experience in the space – competitive advantage over peers.

Stockholm (HedgeNordic) – Renewable energy will go from strength to strength as governments all over the world are embracing the transition to a low-carbon energy society. DNB ECO Absolute Return, a market-neutral fund focused on renewable energy sectors, seeks to benefit from the shift towards low-carbon economies, as well as capitalize on short opportunities arising due to the hype and over-optimism around some companies in the young but rapidly evolving renewable energy industry.

Jon Sigurdsen (pictured), lead portfolio manager for renewable energy strategies at DNB Asset Management, explained the strategy behind DNB ECO Absolute Return, pointed out the sources of investments opportunities in the renewable energy space and touched upon the fund’s recent performance in an interview with HedgeNordic.

Opportunities in the Renewable Energy Space

DNB ECO Absolute Return is an extension of DNB’s older long-only fund focused on renewable energy. DNB Renewable Energy, managed by the same two-member portfolio management team consisting of Jon Sigurdsen and Christian Rom, has been enjoying a lengthy period of strong performance after gaining an average 13.9 percent per annum in the past five years. Both funds focus on companies operating in the renewable energy and resource efficiency sectors, which, Sigurdsen claims, offer plenty of long and short opportunities.

With 18 years of experience in the renewable sector, the team running DNB ECO outline a number of reasons for the high number investment of opportunities in the space. First, “sell-side research coverage is spotty and characterized by high turnover,” says Sigurdsen. Second, public companies in the renewable energy sector exhibit high stock price volatility, creating both long and short opportunities. Third, the sector is still at an early stage of development, which means market participants occasionally misunderstand business models. In addition to the above, noise and hype around companies operating in the sector also create attractive opportunities on some occasions.

The relatively younger age of the renewable energy space also creates one of the biggest challenges for DNB ECO Absolute Return: expensive short selling. While very liquid securities are easy to borrow and brokers typically charge short sellers small fees for lending out shares, non-liquid securities are normally “hard-to-borrow” and are associated with higher borrowing fees. For that reason, the team running DNB’s market-neutral fund initiates short positions in liquid securities only. “We know the cost of shorting each security at any point in time, and we only short when it’s cheap,” says Sigurdsen.

Despite the renewable energy sector offering plenty of opportunities, DNB ECO plans to gradually expand its investment universe to include companies in the waste management and sustainable water management sectors. “Investors have been asking for the broadening of our fund’s focus to include other environment-related sectors,” says Sigurdsen, but the shift will not impact the fund’s investment universe materially since renewable energy is already a major part of the broader environment-related industry.

Darwinian Approach to Stock Selection

DNB ECO Absolute Return is a market-neutral fund with stock market exposure varying between minus 20 percent and 20 percent. From an investment universe of approximately 2,000 stocks, the fund focuses on companies with market capitalizations in excess of $100 million and average daily traded volume of at least $1 million. The portfolio management team uses a form of Darwinian investing by selecting the best 80 to 130 ideas from the universe of more than 650 stocks the team actively covers.

The research process involves a non-numerical qualitative assessment of each company’s positioning within its respective industry using the five forces model developed by Michal Porter. The team running DNB ECO also sets target prices on all companies they cover based on a valuation approach that uses normalized values. Other characteristics such as long-term industry attractiveness, and company or industry fundamental development relative to expectations also play a role in the team’s fundamental research process.

Discussing the features distinguishing DNB ECO from peers employing a similar strategy, Sigurdsen says “given the huge amount of turnover among buy- and sell-side research analysts in the renewable energy sector, our 18 years of experience in the space represents a huge competitive advantage over our peers.” After all, one can hardly find portfolio management teams who can boast having so much experience in such a young sector. “Our global focus is another advantage compared to similar fund managers who focus on a specific region”, adds Sigurdsen.

DNB ECO’s Past Performance

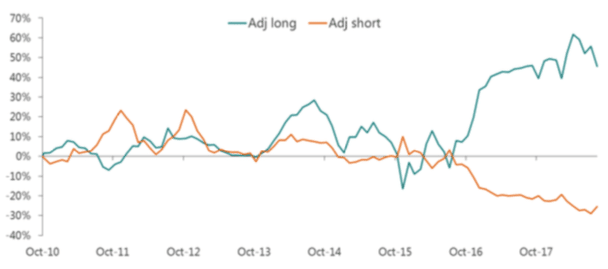

DNB ECO Absolute Return is down 6.0 percent year-to-date through August, after returning 6.3 percent last year and 18.9 percent in 2016. Despite delivering a compounded annual return of 5.3 percent in the past 36 months, the fund’s basket of short positions has been a significant detractor to performance starting from the second half of 2016. As shown in the graph below, the alpha generation from long positions has been much better compared to the alpha generated from short positions. Discussing the underperformance of short positions, Jon Sigurdsen says the fund’s short book has been mainly comprised of expensive stocks, which became even more expensive as equity markets continued to rally. However, “our short positions may start to pay off if interest rates go up,” says Sigurdsen.