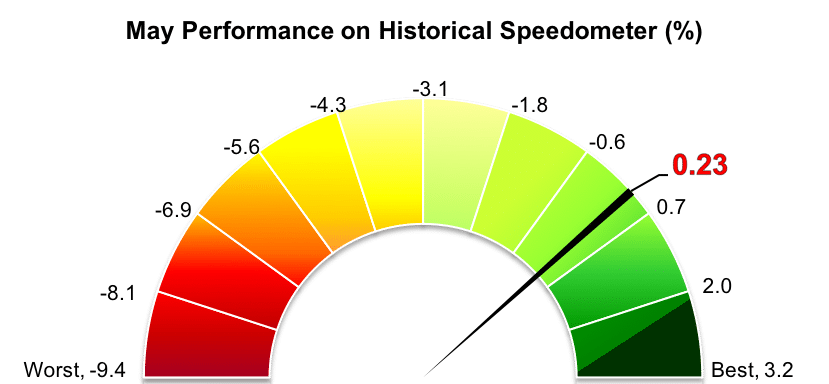

Stockholm (HedgeNordic) – The average net-of-fees return for Nordic fixed-income hedge funds for May measured 0.2 percent (92 percent reported). The NHX Fixed Income Index, up 0.7 percent in the first five months of 2018, posted gains in 23 out of the past 24 months.

Whereas Nordic fixed-income hedge funds continued their winning streak last month, their international counterparts posted losses as a group. The Eurekahedge Fixed Income Hedge Fund Index, an equally-weighted index composed of 343 fixed-income hedge funds, fell 0.4 percent in May (78 percent reported), cutting year-to-date gains to 0.4 percent. The HFN Fixed Income Index (non-arbitrage), however, was flat last month, maintaining the gains for the year at 1.0 percent.

Approximately half of 26 members of the NHX Fixed Income Index posted positive returns for May, with Formuepleje Fokus clinching the title of the strongest performer in the fixed-income group within the Nordic Hedge Index. The fund that predominantly invests in Danish mortgage bonds returned 1.0 percent last month, taking the performance for 2018 into positive territory at 0.6 percent.

Borea European Credit gained 0.9 percent in May, delivering gains for the 27th consecutive month. The fixed-income hedge fund managed by Borea Asset Management is up 3.3 percent year-to-date, after having gained 15.7 percent in 2017 and 10.9 percent in the prior year. KLP Alfa Global Rente also climbed 0.8 percent last month, which brought the year-to-date performance to 2.4 percent. Scandinavian Credit Fund I, Nykredit MIRA, and SEB Eureka Fixed Income Relative Value returned 0.6 percent in May.

Nykredit EVIRA, a hedge fund investing in European corporate bonds, suffered the worst monthly performance since its inception in September 2017, recording a monthly loss of 5.2 percent. Nykredit EVIRA is down 7.3 percent in the first five months of the year. Midgard Fixed Income Fund, a Europe-focused hedge fund investing in a range of fixed-income securities issued in EU countries, Switzerland and Norway, retreated 2.1 percent last month, cutting year-to-date gains to 0.8 percent. Global macro fixed-income fund Nordkinn Fixed Income Macro Fund was down 0.9 percent in May, taking the 2018 performance into negative territory at down 0.1 percent.

Picture © isak55_shutterstock