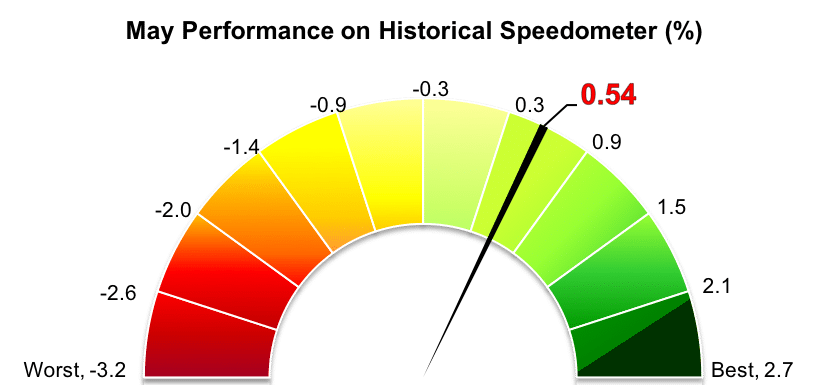

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds gained 0.5 percent in May (94 percent reported), collectively becoming last month’s second-best performing NHX sub-category trailing only equity-focused hedge funds. For the first five months of 2018, the NHX Multi-Strategy Index, the most diverse and inclusive NHX sub-category, gained 0.9 percent.

Not only did Nordic multi-strategy hedge funds continue their winning streak in May, but they also outperformed their international peers. The Eurekahedge Multi-Strategy Hedge Fund Index, an equally-weighted index tracking 266 global multi-strategy hedge funds, was down 0.3 percent in May (79 percent reported), taking the performance for the year into negative territory at 0.2 percent. The HFN Multi-Strategy Index, however, gained an estimated 0.1 percent last month. The Barclay Multi Strategy Index was up an estimated 0.5 percent in May, taking the year-to-date performance back into positive territory for the year at 0.1 percent. The estimated performance for May was calculated with reported data from 102 multi-strategy hedge funds.

Most multi-strategy funds in the Nordic Hedge Index posted gains for May, with 24 of the 35 members of the NHX Multi-Strategy Index delivering positive performance last month. Ress Life Investments, an alternative investment fund investing in the secondary market for U.S. life insurance policies, gained 5.6 percent in May benefiting from one policy paying out and the notice of pending payouts by two other policies. (Pictured Ress Life Founder, Jonas Martenson). The fund is up 5.9 percent in the first five months of the year.

Formuepleje Penta, which invests in equities and bonds based on the classical portfolio theory, climbed 4.2 percent in May. That’s on top of an increase of 3.8 percent in April, with the fund’s year-to-date performance reaching 5.6 percent. VISIO Allocator Fund, awarded the top prize in the “Best Nordic Multi Strategy Hedge Fund” category at this year’s Nordic Hedge Award ceremony, rose 3.9 percent in May, slimming the decline for the year to down 0.5 percent. Multi-strategy alternative fund Formuepleje Epikur gained 3.6 percent last month, taking the performance for the first five months of the year to 4.8 percent.

Evli Factor Premia, an alternative investment fund employing systematic market-neutral factor strategies, suffered a 5.7 percent loss in May, extending the loss for the year to 6.9 percent. Nordea Alpha 15 Fund, which employs various types of low-correlation investment strategies to provide dynamic exposure to multiple asset classes, was down 3.1 percent in May. The Nordea fund is down 2.2 percent in the first five months of the year.