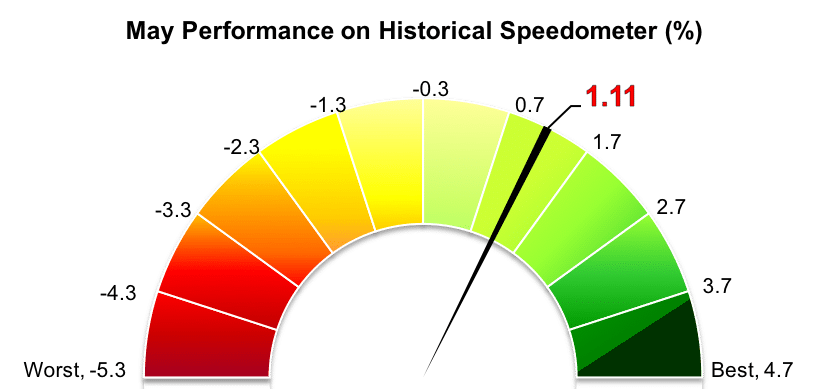

Stockholm (HedgeNordic) – Nordic equity hedge funds continued their strong performance last month, with the NHX Equities Index advancing 1.1 percent (90 percent reported). This NHX sub-category is up 1.3 percent in the first five months of 2018, thanks to two consecutive months of strong performance after a two-month period of underwhelming results for equity-focused funds.

Despite enjoying yet another month of strong performance, Nordic equity hedge funds underperformed both local and global equity markets last month. Global equity markets, as expressed by the FTSE World Index, rose a hefty 4.5 percent in Euro terms in May, mainly gaining in the first half of the month on the back of strong corporate and economic data. The second part of the month, however, was dominated by investor concerns over deteriorating political situations in both Italy and Spain, as well as Donald Trump’s decision to call off the summit with North Korea and threats of additional import tariffs. Eurozone equities fell 0.7 percent in May, while North American equities gained 7.3 percent in Euro terms. The VINX Benchmark Index, an indicator of the overall performance of equity markets in the Nordic region, produced a net total return of 2.0 percent in Euro terms.

The equity-focused members of the Nordic Hedge Index (NHX) performed in line with their international counterparts in May. For example, the Eurekahedge Long Short Equities Hedge Fund Index, an equally-weighted index of 1,027 equity hedge funds, gained 1.1 percent last month (69 percent reported), bringing the performance for the current year to 1.5 percent. The Barclay Equity Long/Short Index gained an estimated 1.1 percent, with the estimated performance calculated with reported data from 347 funds employing equity-oriented investing. The Barclay index is up 2.0 percent in the first five months of 2018.

A total of 32 hedge funds of the 51 equity-focused members of the NHX that reported performance figures for May delivered positive performance last month, with two vehicles returning more than 8 percent. The HCP Focus Fund (team pictured), a Helsinki-based fund following a value discipline of investing, advanced 8.7 percent in May, taking the year-to-date performance to 14.0 percent. Activist fund Accendo Capital, which struggled in the first quarter of the year, gained 8.4 percent last month, cutting year-to-date losses to 10.1 percent. The fund is recovering from its second-worst drawdown, with the second-largest peak-to-trough having reached 18.4 percent.

HCP Quant, which employs a quantitative investment strategy to find securities trading below their fair estimated values, and long/short equity fund Incentive Active Value were both up 7.4 percent last month (up 6.2 percent and 5.7 percent year-to-date). Healthcare-focused long-biased equity fund Rhenman Healthcare Equity L/S gained 6.3 percent in May, extending the year-to-date gains to 11.1 percent.

The other long/short fund managed by Rhenman & Partners Asset Management AB, Rhenman Global Opportunities L/S, was the worst performing member of the NHX Equities Index last month after losing 4.3 percent (down 5.8 percent year-to-date). DNB ECO Absolute Return and Sector Zen Fund were down 3.7 percent and 3.5 percent, respectively (up 3.5 percent and down 1.9 percent year-to-date).