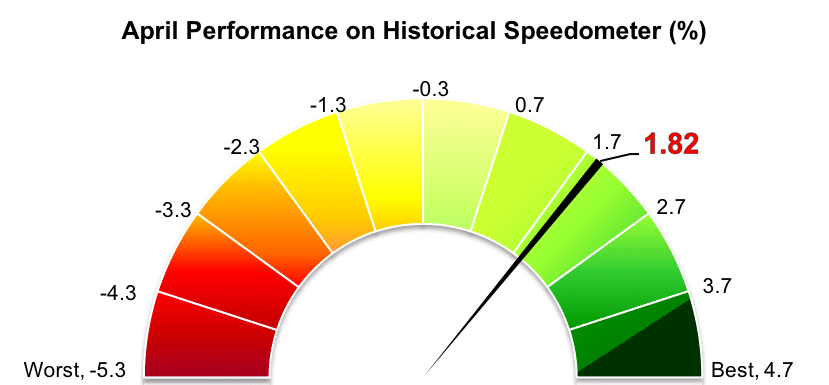

Stockholm (HedgeNordic) – Nordic equity hedge funds rebounded strongly in April from the steep losses incurred in February and March, recording their best month as a group since the summer of 2016. The NHX Equities Index gained 1.8 percent in April (93 percent reported), bringing the 2018 performance back into positive territory at 0.2 percent.

Despite the strong performance, Nordic equity-focused hedge funds trailed both local and global stock market indices in April. The VINX Benchmark Index, which serves as an indicator of the overall performance of equity markets in the Nordic region, delivered a net total return of 2.2 percent in Euro terms last month. Global equity markets, as measured by the FTSE World Index, rose 2.9 percent in Euro terms. Eurozone equities gained 5.2 percent last month and North American equities gained 2.3 percent in Euro terms. As investor concerns over issues with some technology stocks and the threat of a global trade war tempered by mid-April, first-quarter corporate earnings became the center of attention in the second half of the month. First-quarter earnings were generally ahead of expectations on both sides of the Atlantic.

Notwithstanding the underperformance relative to stock market indices, the equity-focused members of the Nordic Hedge Index (NHX) fared significantly better than their international peers last month. For instance, the Eurekahedge Long Short Equities Hedge Fund Index, an equal-weighted index of 1,030 constituent funds, advanced 0.5 percent in April, with 55 percent of constituent funds that reported April performance figures as of May 16. The Eurekahedge index is up 0.4 percent in the first four months of 2018. Meanwhile, The Barclay Equity Long/Short Index, a separate index that tracks the performance of hedge funds employing equity-oriented investing, gained 0.8 percent. Following the April performance, the Barclay index is up 1.0 percent in 2018.

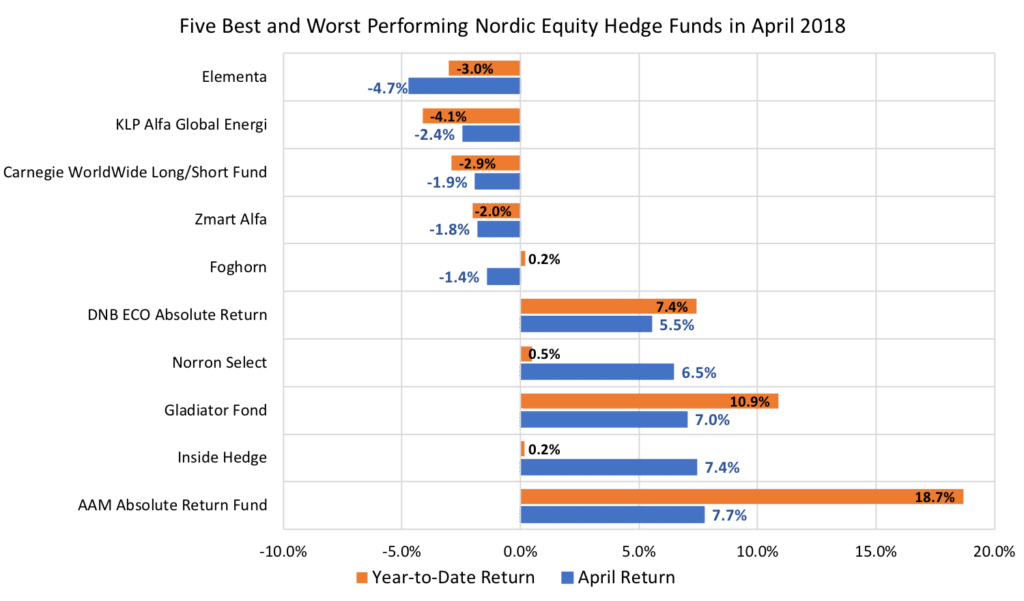

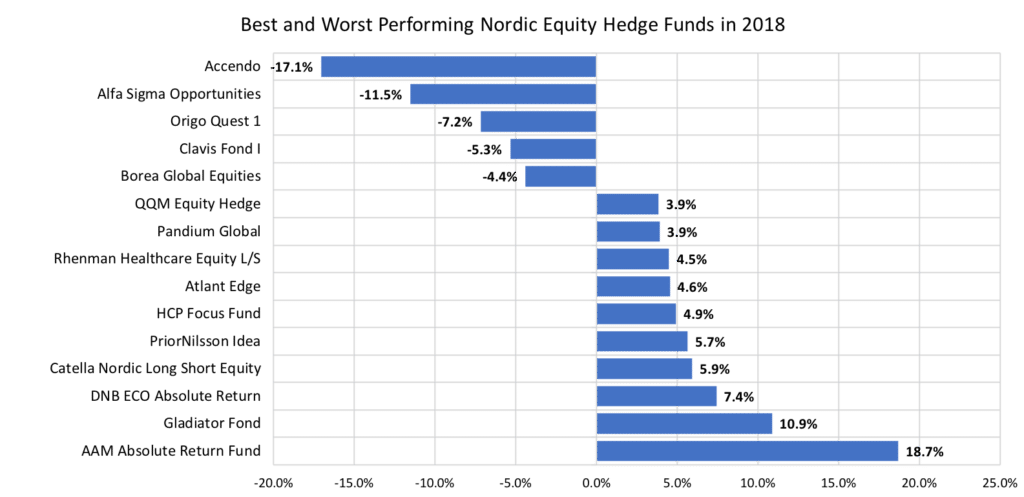

Nearly three-fourths of all constituents in the NHX Equites delivered positive performance last month, with three funds returning above 7 percent. AAM Absolute Return Fund, a specialized long/short equity fund investing in securities related to global energy and natural resources, gained 7.7 percent in April, extending the gains for 2018 to a splendid 18.7 percent. The fund’s performance in 2018 has partly been boosted by increasing oil prices, driven by production cuts by OPEC and Russia as well as geopolitical events. AAM Absolute Return Fund is the best-performing component of the NHX thus far in 2018.

Inside Hedge, run by Gothenburg based Erik Lidén (pictured) which invests in Swedish firms based on insider trading sentiment, and Gladiator Fond advanced 7.4 percent and 7.0 percent in April, respectively (up 0.2 percent and up 10.9 percent YTD). Norron Select gained 6.5 percent in April, performance partly attributable to a long derivatives position in Norwegian Air Shuttle (read more details). The fund is up 0.5 percent in 2018.

Moving on to April’s list of underperforming funds, niche long/short equity fund Elementa and market-neutral hedge fund KLP Alfa Global Energi were down 4.7 percent and 2.4 percent last month, correspondingly (down 3.0 percent and down 4.1 percent YTD). Carnegie WorldWide Long/Short Fund reported a loss of 1.9 percent for April, extending the 2018 losses to 2.9 percent.

Picture © Björn Andersson http://bjornsthlm.se