Stockholm (HedgeNordic) – In an interview with Swedish business journal Dagens Industri, Svante Bergström (pictured), founder and CEO of the 5,3 billion USD systematic hedge fund Lynx, says that the “worst is behind us” referring to the sharp trend reversal seen in February where Lynx lost about 14 percent and the last three years of lackluster performance for the fund.

Commenting on the move in February, Bergström says:

“In the beginning of February when the stock market declined sharply, the dollar reversed and commodities started to fall, the combined effect was that we lost the money we had made in January”.

Responding to a question on why the fund did not react quicker to the move, the Lynx founder was quoted as saying:

“The February move happened in just a few days, our average holding period is normally two months. We cannot turn positions in a couple of days. However, we did reduce positions quickly, cutting the exposure in half.”

Commenting on the last three years of non-existing absolute returns for the fund, Bergström says:

“It has been a very difficult environment for trend following funds overall. We have had a very strong stock market where we have made a lot of money but at the same time we have lost in commodities, interest rates and currencies.”

He stresses that the claim they make to perform well in times of financial market turmoils should be viewed in a longer term perspective.

“Investors are using Lynx as protection in longer term downturns in equity markets that are typically coupled with a lot of investor anxiety and that last for at least some months. Historically, we have delivered very strong returns in these periods.”

In terms of how investors have reacted to the recent downturn in the fund´s performance, Svante says that instiutional investors, who are using the fund for downside protection in a longer term bear market in stocks, have added to allocations following recent losses. Retail clients have made smaller redemptions.

Answering the question whether there is any reason to fear that Brummer, who owns 40 percent of Lynx, will cease to allocate to the fund due to the poor performance in recent years, just like they did with the Zenit fund in 2016, Bergström says:

“We feel confident in what we do and aim to continue for many years to come. I have had no indications that Brummer are having second thoughts.”

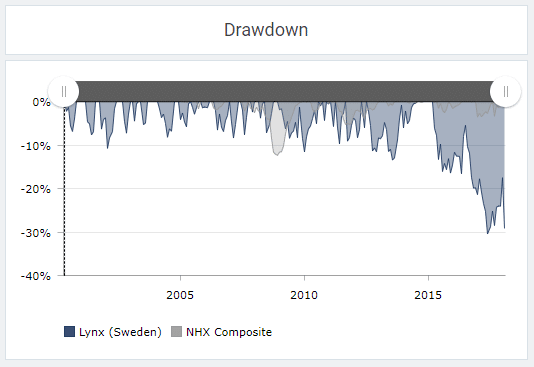

Chart. Lynx in deepest and longest drawdown since inception in 2000

Source: Hedgenordic