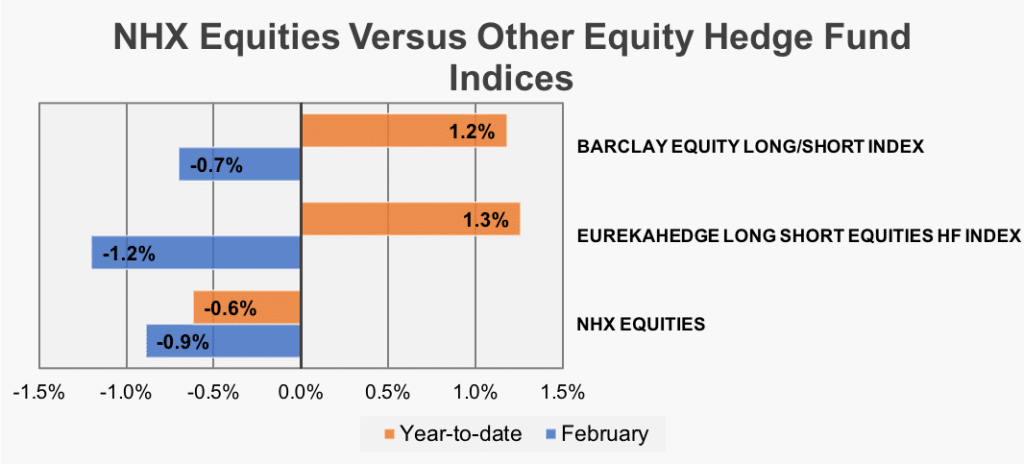

Stockholm (HedgeNordic) – Nordic equity hedge funds, as measured by the NHX Equities Index, fell an estimated 0.9 percent in February (91 percent reported), as stock markets around the world feared that central banks would accelerate the pace of interest rate hikes. The NHX Equities Index is down 0.6 percent in the first two months of 2018.

Nordic Equity Hedge Funds Against Local and International Indices

The equities-focused members of the NHX Composite outperformed both local and global stock market indices in February, with Nordic equity markets, as measured by the VINX, falling 1.2 percent in Euro terms. Global equity markets fell 2.0 percent in Euro terms and Eurozone equities fell a more severe 3.8 percent. North American equities, meanwhile, declined 3.6 percent in U.S. dollar terms and 1.8 percent in Euro terms. Equity markets around the world entered a period of turmoil in early February, reflecting investor fears about rising inflation and a resulting acceleration in the pace of interest rate hikes after the release of a better-than-anticipated U.S. jobs report.

Global equity-focused hedge funds did not fare much better than their Nordic peers in February, with the Eurekahedge Long Short Equities Hedge Fund Index falling 1.2 percent (43 percent reported as of March 13). The Barclay Equity Long/Short Index was down 0.7 percent, with a total of 240 funds having reported February figures.

Best and Worst Performing Nordic Equity Hedge Funds

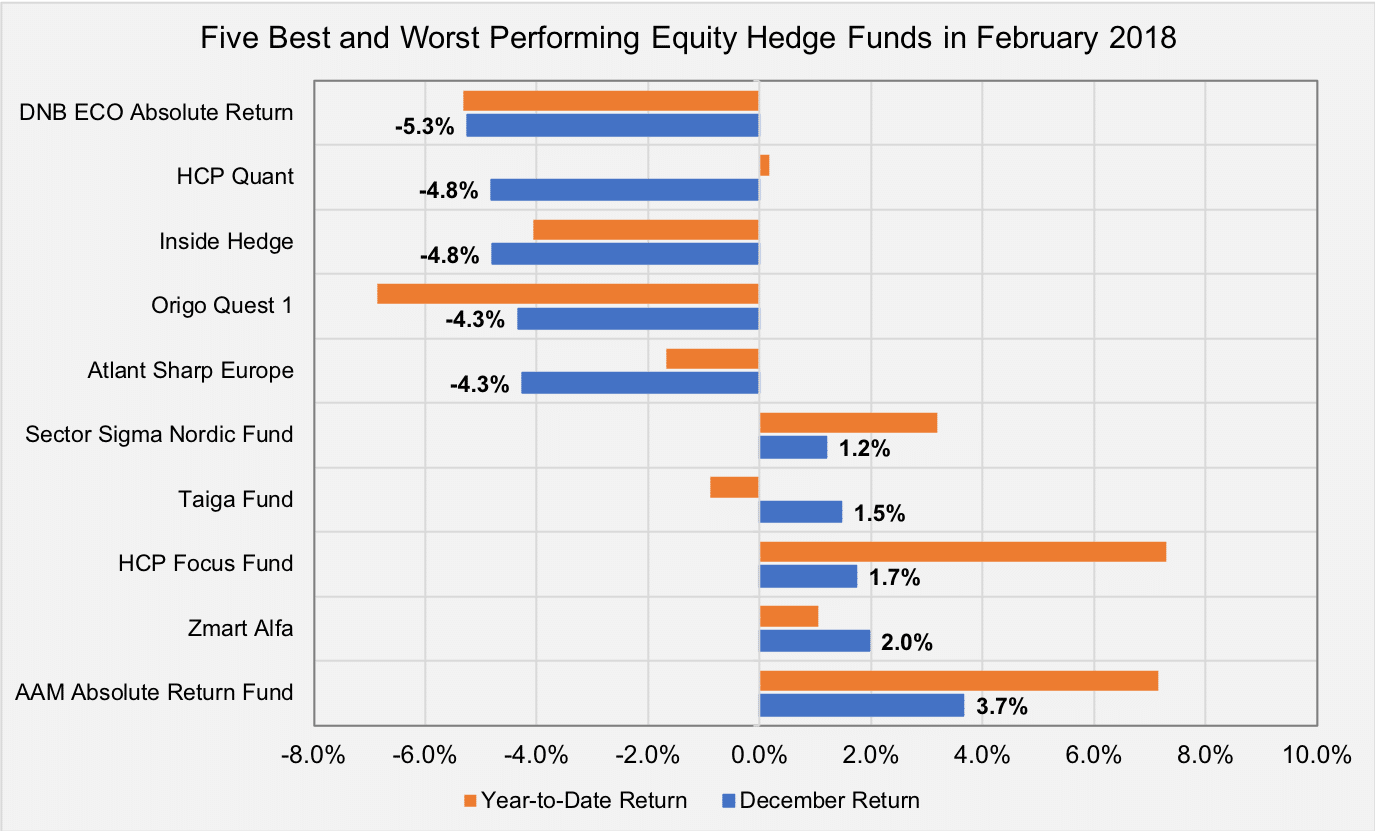

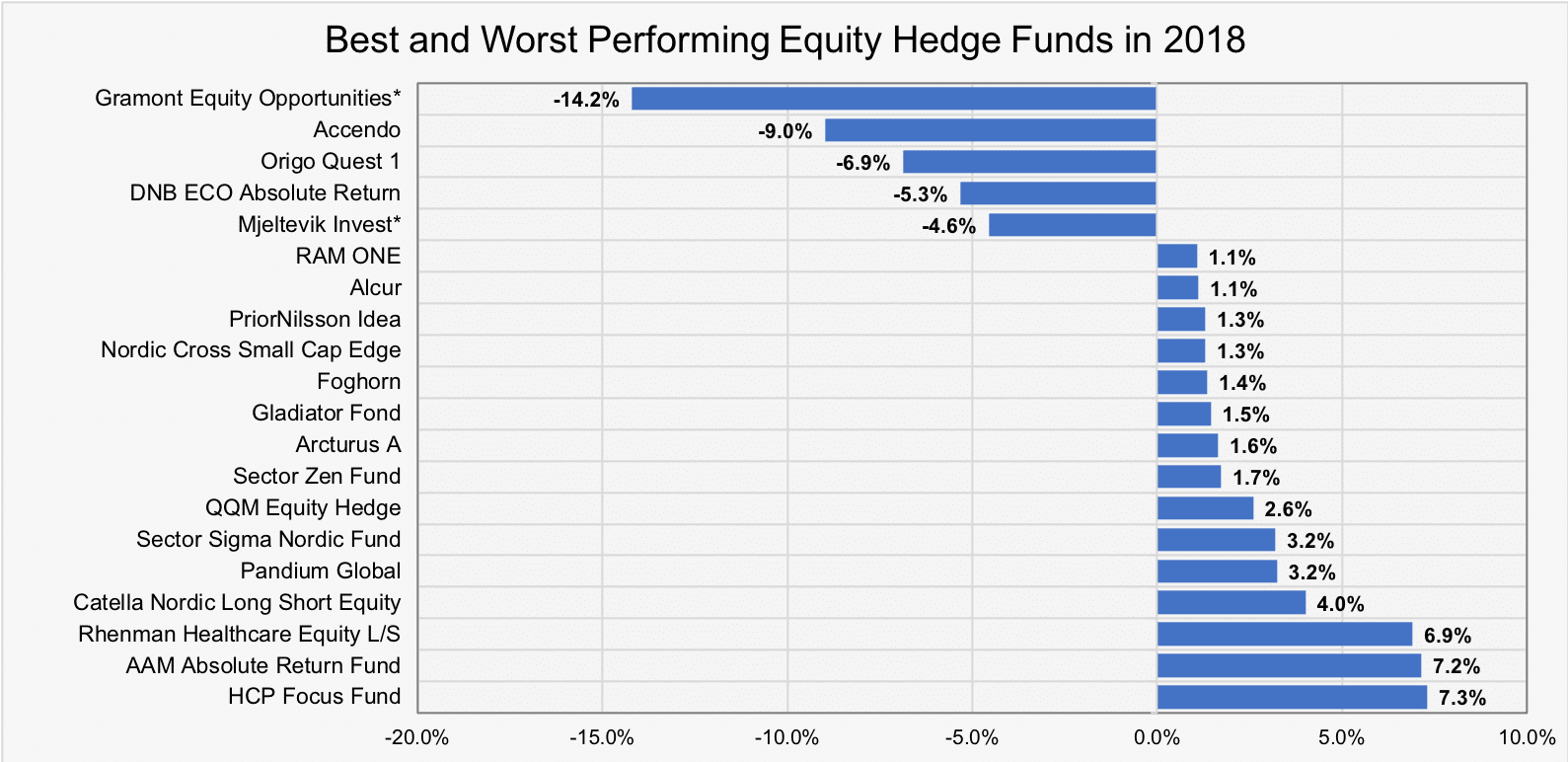

Approximately 40 percent of all NHX Equities members ended February in the green. AAM Absolute Return Fund, a specialised long/short hedge fund investing in equity securities of global energy and natural resources companies, comes out on top. The Oslo-based fund returned 3.7 percent last month, bringing the year-to-date performance to 7.2 percent.

Equities-focused market-neutral hedge fund Zmart Alfa and value-oriented HCP Focus Fund gained 2.0 percent and 1.7 percent (up 1.1 percent and 7.3 percent YTD), respectively. Taiga Fund, a long-biased value-oriented fund, advanced 1.5 percent in February, recouping some of the losses incurred in January (down 0.9 percent YTD).

The list of equity hedge funds hit hard by skyrocketing stock market volatility was large and included a variety of sub-strategies. After having enjoyed two relatively strong years of performance (up 6.3 percent in 2017 and 18.9 percent in 2016), DNB ECO Absolute Return is not enjoying a great start to 2018. The market-neutral fund focusing on renewable energy companies was down 5.3 percent in February (down 5.3 percent YTD). HCP Quant, Inside Hedge, Origo Quest 1, Atlant Sharp Europe, and Accendo Capital all recorded losses of more than 4 percent last month.

*Performance figures for February not reported.

*Performance figures for February not reported.

Picture © Minerva-Studio – Shutterstock.com