Stockholm (HedgeNordic) – Computer-driven, trend following hedge funds or CTAs recorded their worst month in 17 years in February, data from Barclayhedge and SocGen Prime Services suggest. The move is largely explained by losses caused from the sudden volatility spike that was seen on February 5 and that coincided with sharp trend reversals in many markets where CTAs had built significant exposures in the direction of the trend.

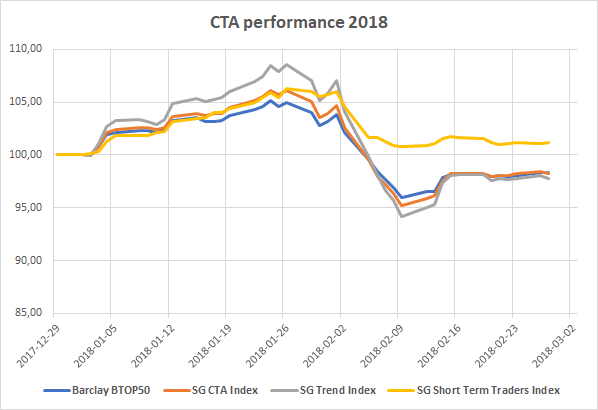

Looking at the different indices regularly used for industry comparisons, the market moves that followed on the day of the event and five days thereafter, were detrimental for CTAs (see chart below).

The gains that had been built up in January (see hedgenordic comment) were quickly erased and by the end of the month year-to-date numbers were firmly in negative territory, for the most part. The only exception was the SG Short Term Traders Index which include managers using shorter trading horizons, presumably they were quicker to adjust positions once the spike hit. By the end of February, short-term strategies remained positive on the year.

According to Financial Times, the loss for the SocGen CTA Index of about 5 percent on the month, masks even worse losses for some of the industry’s giants.

Man AHL’s $1.1bn Diversified fund lost almost 10 per cent in the month to February 16, while the London investment firm’s AHL Evolution and Alpha funds were down about 4-5 per cent over the same period. The flagship funds of GAM’s Cantab Capital, Systematica and Winton lost 9.5 per cent, 7.2 per cent and 4.6 per cent respectively between the start of the month and February 16, the Financial Times writes.

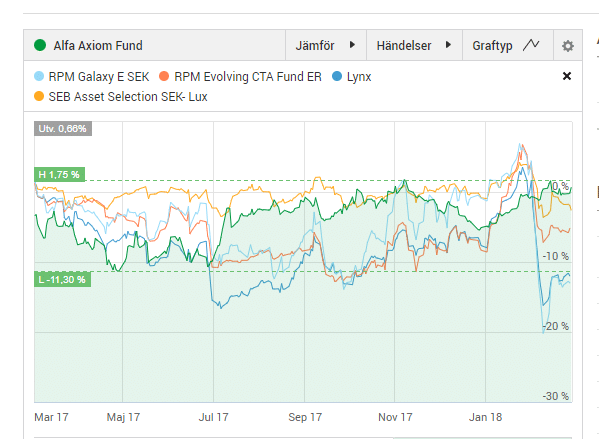

Reviewing estimates from CTAs in the Nordics reveals a similar picture. According to data from Avanza, the trend following giants Lynx and SEB Asset Selection were down about 12 percent and 6 percent respectively in February. For the year to date, that translates into a loss of 4.7 percent for Lynx and 1.8 percent for SEB AS.

The multi-manager funds from Stockholm-based CTA specialist RPM – RPM Evolving CTA Fund and RPM Galaxy – saw losses of about 9 percent and 16 percent respectively for the month. In the case of RPM Evolving, the fund remains positive on the year while Galaxy had lost around 12 percent.

The short-term trend follower Alfa Axiom had gained around 1 percent on the month (5.2 percent year-to-date) as of February 27 according to data from the manager, thereby significantly outperforming the CTA industry overall as well as the short term traders since the beginning of the year.

Below chart shows performance for the last 12 months for the main CTA funds offered to retail clients in Sweden through the Avanza platform, it does not take into account differences in volatility levels for the individual funds. Among the Nordic managers, only RPM’s Evolving CTA Fund and Alfa Axiom have managed to keep the gains generated in January thorughout February. Lynx and RPM Galaxy have had a rough time.

HedgeNordic is yet to receive final numbers for the managers underlying the NHX CTA index, but we believe the abovementioned monthly estimates to accurately reflect the development throughout February 2018. We will take the time to review the monthly performance rankings in our regular monthly review later this month.

Picture (c): MR.LIGHTMAN1975—shutterstock.com_352