Stockholm (HedgeNordic) – Nordic CTAs continued to struggle during the second quarter 2017 as the NHX CTA Index lost another 4.1% during the period, bringing the year-to-date loss to -5.8%. This was largely in line with global industry benchmark as the SG CTA Index and the Barclay BTOP50 Index posted losses of 3.5% and 3.1% respectively.

The managed futures industry has been under pressure as of late and according to a recent Bloomberg article quantitative trend following strategies are on track for their worst performance in 30 years by some measures. Sector overcrowding, the suppression of notable price moves in either direction due to enduring central bank stimulus, and, relatedly, lows in cross-asset volatility, are mentioned as possible explanation to the recent weak performance.

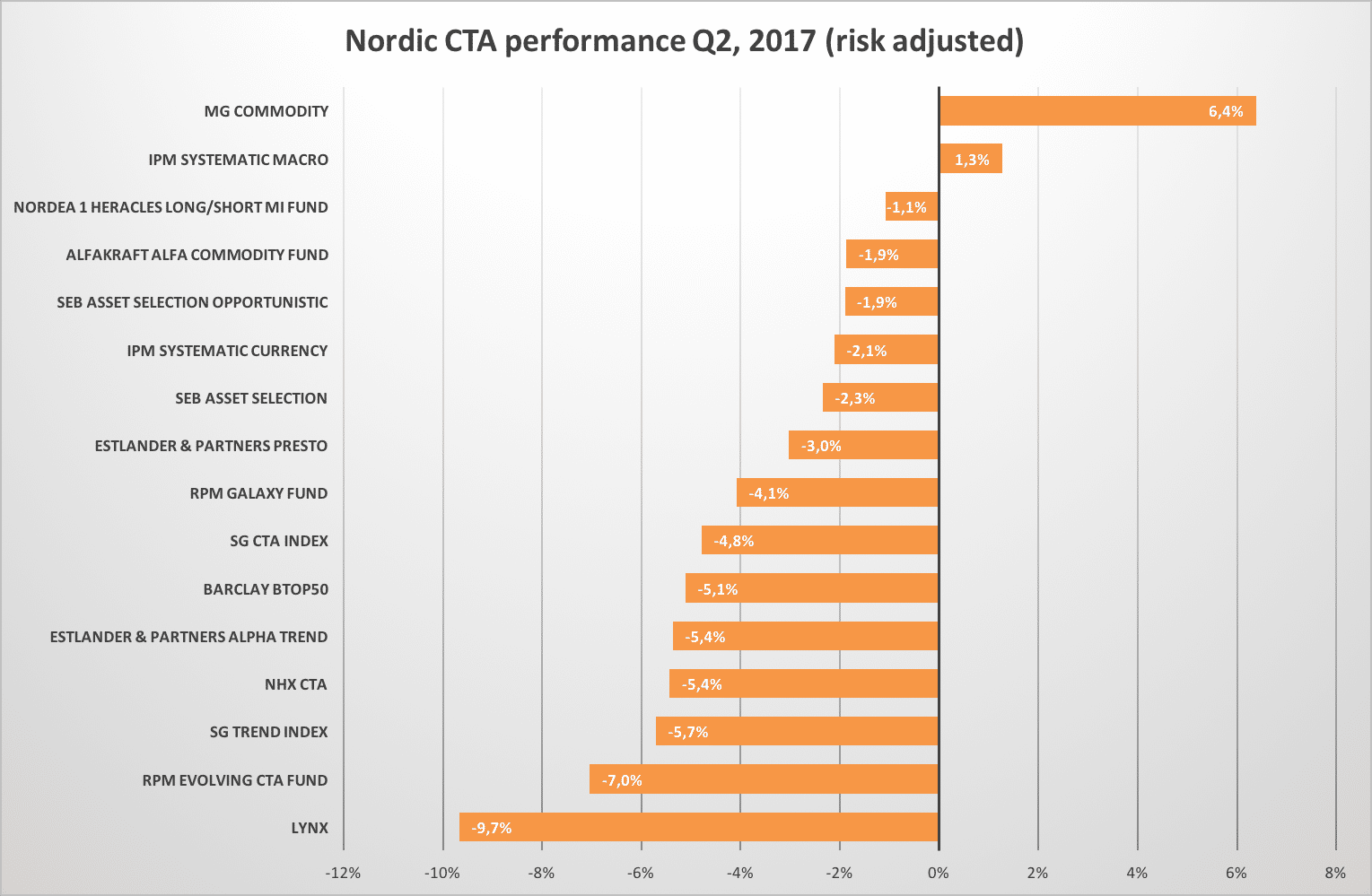

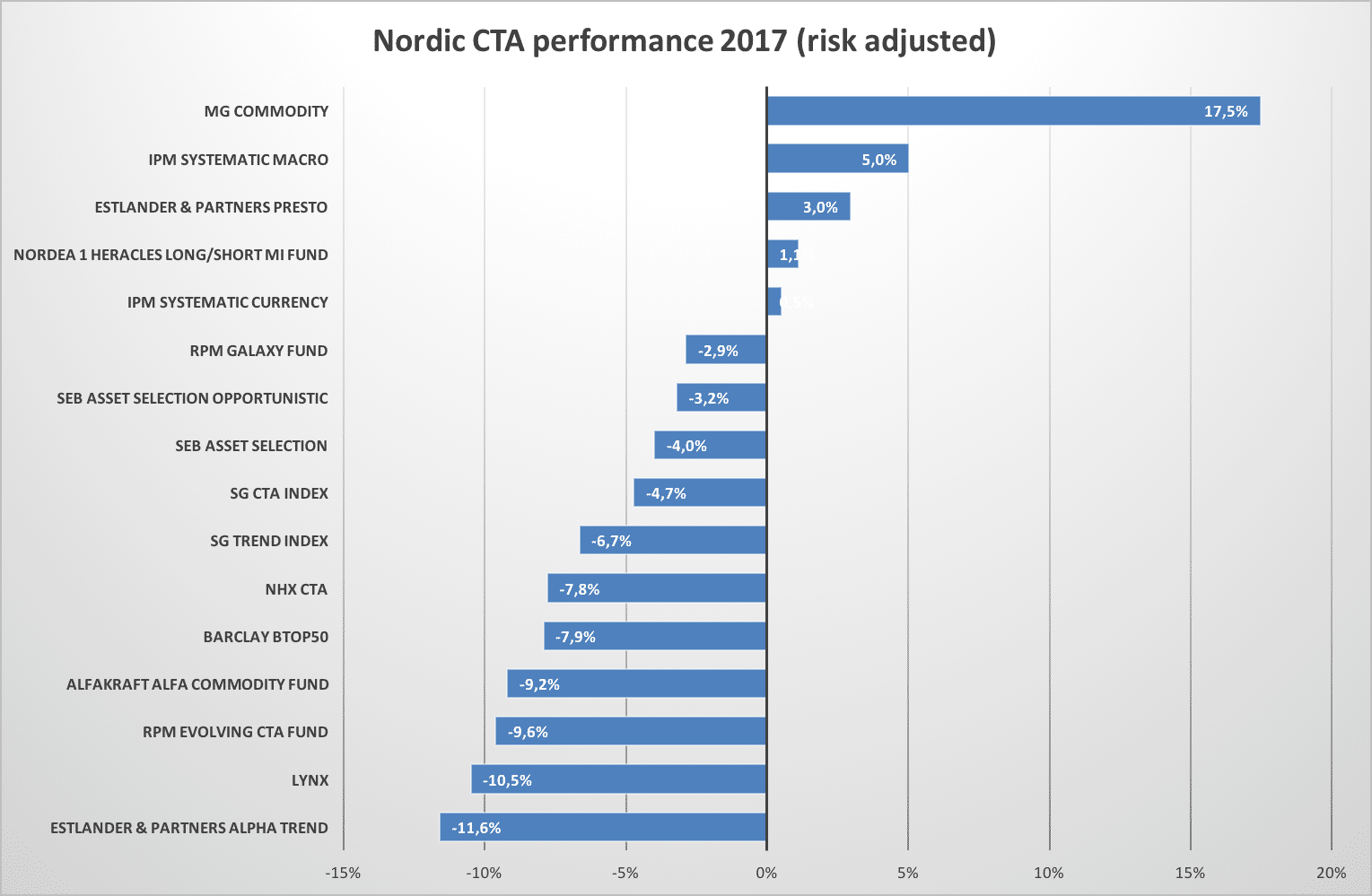

As for the Nordic managers active in the CTA space, there was quite a significant return dispersion among the different strategies during the second quarter. Overall, performance was weakest for the ones relying on trend following strategies while fundamental and sector specialist strategies fared better.

The worst performing fund was Swedish industry giant Lynx who lost 12.2% during the period to bring year-to-date performance to -13.2% (see separate HedgeNordic article here). The funds from Swedish CTA multi-manager provider RPM also had a rough time with the RPM Evolving CTA Fund and the RPM Galaxy Fund dropping 8.9% and 7.3% respectively. On a positive note, Swedish IPM’s Systematic Macro Fund and Finnish MG Commodity Fund managed to end the quarter in positive territory.

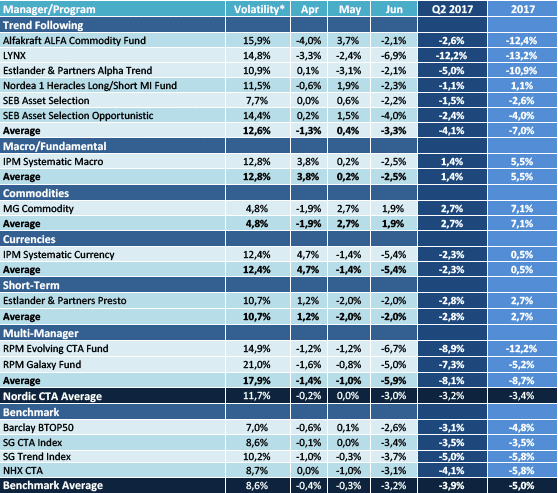

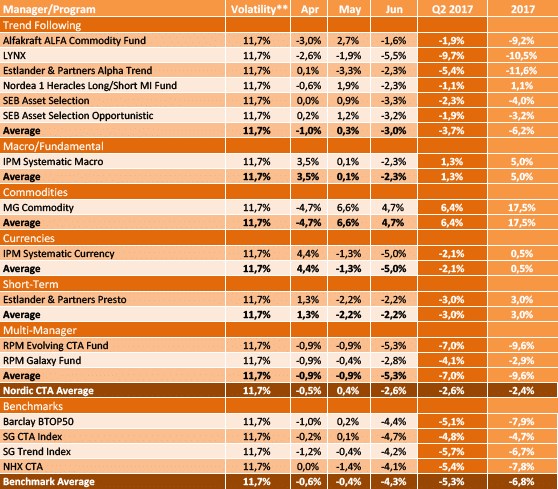

The returns for Nordic CTAs during the second quarter and for the full year are summarized in table 1 below, table 2 reveals the same numbers but has had all funds adjusted to a similar annualized volatility of 11.7%, which is the average number for Nordic CTA managers. Rankings for the quarter and the full year are displayed in chart 1 and 2 (both risk-adjusted to make the comparison viable).

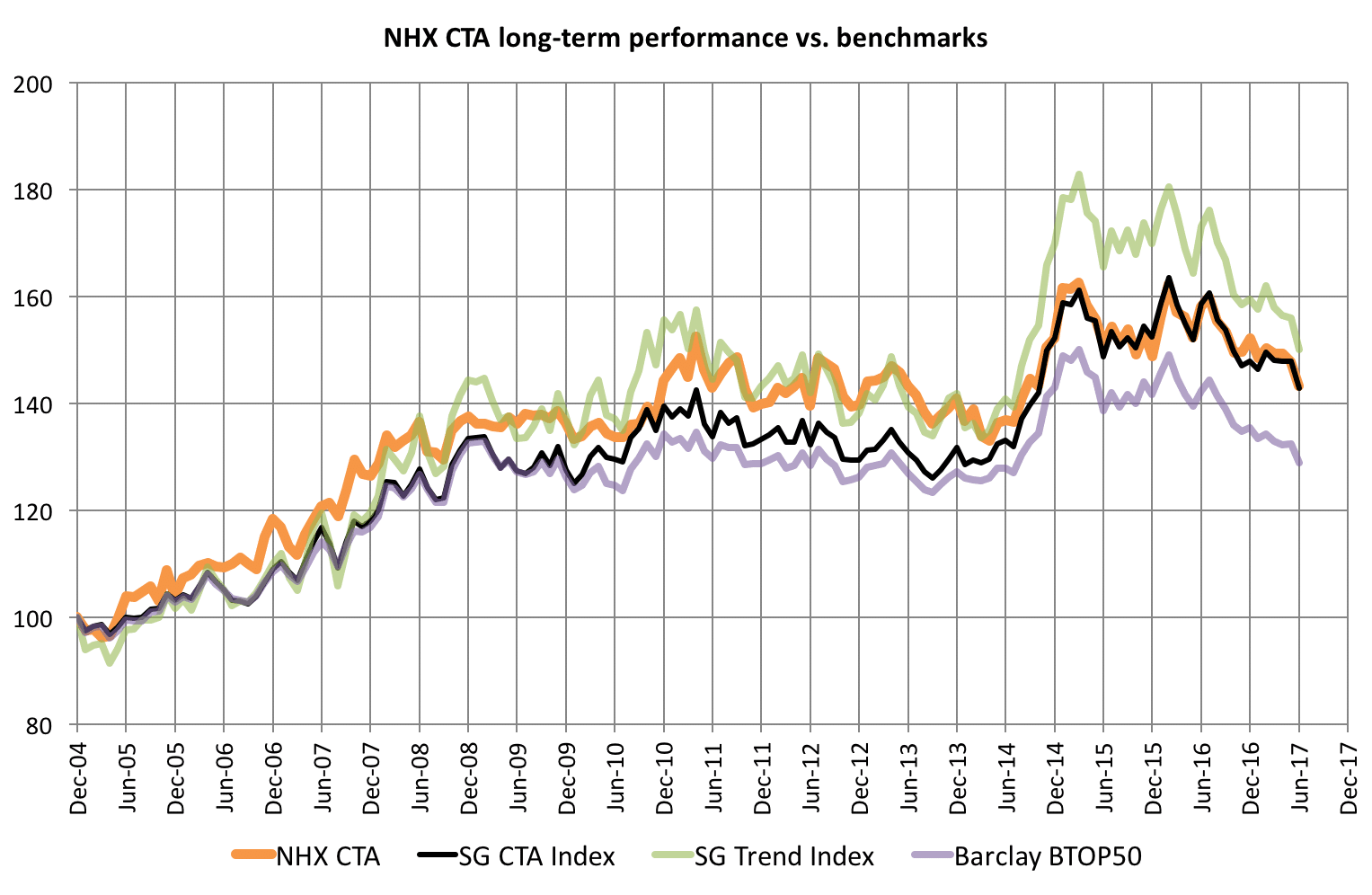

Looking at the longer term perspective, Nordic CTAs remain in line with global industry benchmarks since its inception in January 2005 (see chart 3 below).

Table 1. Performance overview Nordic CTAs Q2, 2017

Table 2. Performance overview Nordic CTAs Q2, 2017 (risk-adjusted)

Chart 1. Performance rank, Nordic CTAs Q2, 2017 (risk adjusted)

Chart 2. Performance rank, Nordic CTAs 2017 (risk adjusted)

Chart 3. Nordic CTAs – long-term performance against benchmarks

Picture (c): Vintage-Tone-shutterstock