Stockholm (HedgeNordic) – The 2-and-20 fee structure was a norm in the hedge fund industry for decades, a fee arrangement introduced by Alfred Winslow Jones in 1949 when he launched what is considered the first hedge fund.

However, that seems a thing of the past, with now even major firms as Brevan Howard and Winton joining those managers capitulating to market pressure and lowering fees. There are three major forces driving fees down: the zero-interest-rate environment; the rise of synthetic/passive and thus lower-cost alternatives; but likely the most pressing, performance pressure.

The 2-and-20 Fee Structure: A Short History

Under the 2-and-20 fee structure, hedge funds charge investors a fixed fee of two percent of assets under management and 20% of profits above a predetermined benchmark. The 20% incentive fee is said to have been inspired by Phoenician merchants, who charged one-fifth of profits from successful journeys.

The question should be raised, however, as to the validity of the popular belief that this fee structure is primarily criticized for the incentive fee part. My sense is that most investors could accept higher incentive fees had hedge funds delivered market-beating returns on a consistent basis. It is, rather, the fixed component part, the management fee charged regardless of success that has come under fire. The underlying feeling is that managers may be more concerned about increasing the amount of AUM that trickles down to more dollars in management fees, rather than taking greater responsibility for performance.

2-and-20: Just Not the Nordic Standard

Recent statistics and studies show that hedge fund managers cannot command the 2-and-20 fee structure fee structure any longer. Hedge fund data provider Preqin recently found that managers are responding to capital redemptions and allocation changes with modifications to fee structures. HedgeNordic´s statistics on fees for the Nordic hedge fund industry reflect just that. The much-criticized fee structure is not much of a standard anymore, particularly in the Nordic hedge fund industry.

With an average management fee of 1.18% and average performance fee of 16.23%, the fee structure for the Nordic hedge fund industry seems quite attractive relative to fees charged globally. Preqin reported that the average hedge fund launched in 2016 charges a management fee of 1.51% and a performance fee of 19.48%. The mutual interest of Nordic fund managers and investors seems well aligned, thanks to the seemingly low management fee and the much-appreciated high-water mark. The fee structure used by most Nordic hedge funds ensures that fund managers make money only if their investors make money.

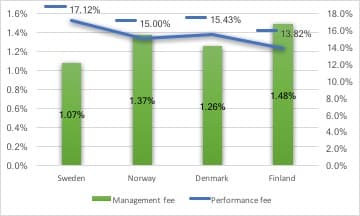

Fees Across Nordic countries

Let’s take a look at how fees differ across the Nordic countries and across strategies. Swedish hedge fund managers charge the lowest fee structure, with an average management fee of 1.07%, and an average incentive fee of 17.12%. Meanwhile, the Finnish hedge fund industry charges the highest management fee and the lowest performance fee throughout the Nordics. One should avoid jumping to the conclusion, however, that Swedish hedge funds are more attractive to invest in. The different structure of each country’s hedge fund industry within the relatively low sample group greatly influences average fees.

For instance, an industry with a great abundance of fund of funds would normally sport a lower-than-average fee structure, as some of these vehicles charge very low management fees and no performance fees at all. This is especially true of the funds of funds and multi-strategy funds investing in their own underlying hedge funds, as these seek to avoid double-charging investors.

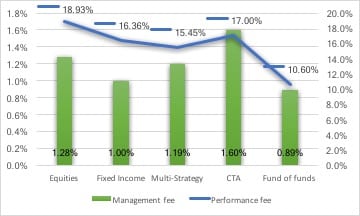

Fees Across Strategies

Data compiled by HedgeNordic shows that funds of funds charge less than other vehicles, with an average management fee of 0.89% and performance fee of 10.60%. However, investors in funds of funds carry the burden of fees charged by the underlying hedge funds.

The average equity-focused hedge fund charges the highest performance fee among the five NHX sub-categories shown in the graph, as well as the second-highest management fee. The average CTA charges a performance fee of 17.00% and the highest management fee of 1.60%.

Hedge fund fees however are just one part of the cost equation. The real discussion should be about value for money rather than headline fees. The easiest way to pause, or even stop, the downward fee spiral is for hedge funds to perform and show uncorrelated, consistent and reliable returns.