Stockholm (HedgeNordic) – As of January 2017, HedgeNordic has been calculating and publishing a new index, Nordic Hedge Index – Asset Growth Index (NHX-AGI), with an attempt at representatively measuring the asset growth or decline of the Nordic hedge fund industry. Ambitious as we are, we would have liked to answer simple yet obvious questions as: “how big is the Nordic hedge fund universe” or “what was the net inflow any given month in U.S. Dollars (or any other currency).” But right from the starting blocks, we ran into problems we have yet to overcome or find solutions to. The increased technical challenge of doing cross currency calculations going back several years (the AuM of the funds could be expressed in SEK, NOK, DKK, CHF, EUR, GBP, USD or any other currency) was a hurdle that could be taken with some effort. The main challenge we identified, however, was the dispersion among the AuM of the Nordic managers and funds.

The Nordic hedge fund universe consists of a few giants with funds in the billion-dollar range, while the vast majority probably sits in the 100 million to 300 million range. If the assets of a very large fund such as Brummer Multi-Strategy, whose AuM peaked at around 6.5 billion dollars, would decrease by 5% during a given period, the dollar-amount decrease may well offset much of the potential increase in assets enjoyed by other players within industry. While the numbers and results would be accurate, this would not be a fair representation of the industry as such, we feel. The solution we chose was to truly fall back on an indexed-based compounding methodology.

The assets under management (AuM) of each respective fund were converted to an index value of 100 at the start date of the index, set as December 31st 2009. The original index value for the NHX-AGI was calculated as the arithmetic mean of the index values of all constituents. Thus, the arithmetic mean of the index values of the funds constituting NHX-AGI equaled 100 at the start date. Each fund’s AuM, regardless of its size or any other factor, is equal weighted within the index. The calculation makes no distinction or discrimination with regard to the functional currencies or the size of AuM. A net appreciation of 1% of assets in a billion-dollar fund has the same effect on the index as a net increase of 1% of assets in a 50-million-NOK fund.

Selection of funds making up the NHX-AGI

The NHX-AGI constituents were selected on the discretion of HedgeNordic. The aim was to have a representative gauge to measure the asset growth/decline of the Nordic hedge fund industry as a whole. The first selection criterion was to shortlist the funds that had been consistently reporting AuM figures to HedgeNordic. From that pool, the aim was to create a representative basket taking into account: (1) trading Style (2) country (3) size of the fund at the start date. We aimed to stay neutral regarding selecting funds that had extraordinary appreciati on or decline in assets under management. The number of funds constituting the NHX-AGI should at least represent 10% of the universe making up the Nordic Hedge Index Composite, which is composed of155 funds.

Indeed, we would have preferred to have a wider base for the calculati on. However, as of December 31st 2016, there are only 49 funds acti ve and alive within the NHX-Composite Index that track back to 2010, of which only a porti on are disclosing AuM to the public, which signifi cantly narrows down our sample group.

Wrong Assumptions

We wrongly assumed that the index would flatten out after the first couple of years, which emerged as a problem with our methodology. Our line of thinking was that younger funds may enjoy a steeper assetgrowth curve in the fi rst three to fi ve years. Although sales teams’ opinions may diff er, the underlying assumpti on was that the challenge of adding 1% of assets a month in nominal Dollars to a fi ve billiondollar fund would typically be greater than increasing the assets of an emerging 50 million-dollar fund by one percentage point (again, in percentage of assets, disregarding ti cket sizes). We are still investigating the possibility of adding younger funds that meet certain criteria every year since the start date of the NHX-AGI to compensate for any such eff ects.

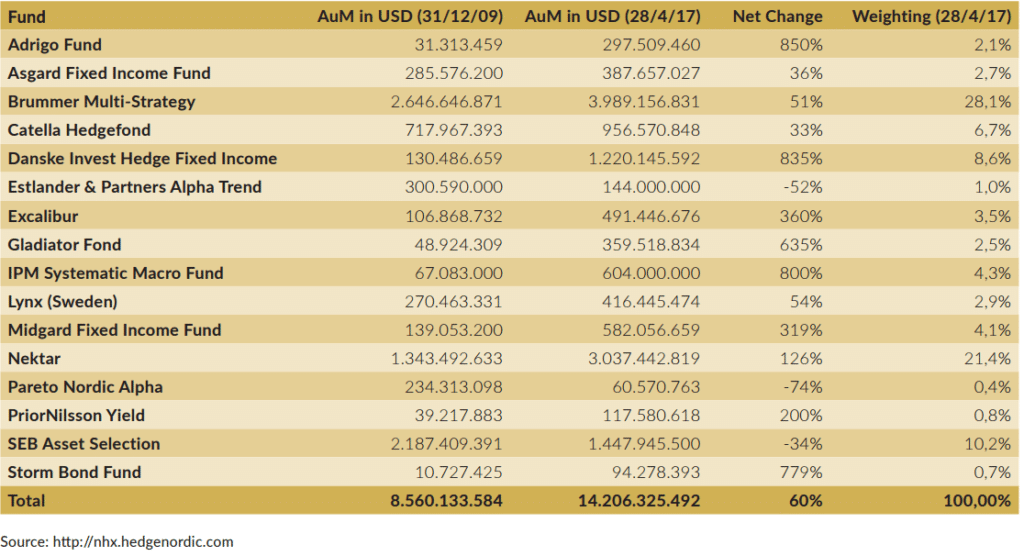

AUM DEVELOPMENT OF NHX-AGI COMPONENTS

If we were att empting to predict the growth in AuM of Nordic hedge funds in late December 2009, we would have likely expected the largest funds within the industry to realize a lower percentage increase in assets over the next six-year ti me span. This hypotheti cal predicti on would have however been wrong. For instance, the Dankse Invest Hedge Fixed Income Strategies fund, the fourth-largest consti tuent at start, with around $1.22 billion under management, enjoyed the second-highest* growth in assets in the period January 2010-April 2017. Leaving aside the Danske excepti on, our data shows that the smallest Nordic funds in terms of AuM enjoyed some of the highest rates of growth in assets over the period of six years and four months starti ng from January 2010. For example, Storm Bond Fund, a Nordic high-yield fund that had the lowest amount of AuM among the NHX-AGI components at the end of 2009, experienced the highest growth in assets in the period January 2010-May 2017**.

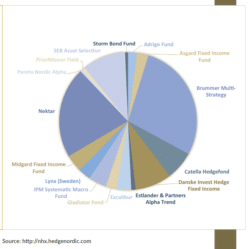

The table above sketches the compositi on and constituents of NHX-AGI. Putti ng things into perspecti  ve, the dollar-amount increase in the AuM of Brummer Multi -Strategy (BMS) – the largest fund in the Nordic hedge fund industry both as of the end of 2009 and as of the end of April 2017 – accounted for around 24% of the dollar-amount increase of the enti re NHX-AGI. This fi gure seems extremely high, especially considering that the change in the AuM of BMS was a mere 87% – a percentage increase that is signifi cantly lower than the triple- and quadruple-digit growth rates of the smaller funds. More importantly, BMS and Nektar, two players within the Brummer & Partners family of funds, accounted for nearly half of the increase in the dollar-amount of AuM of the NHX-AGI. Our att empts to create an index based on actual assets under management showed no meaningful results, with the table presented above presenting the hurdle of building such an index. Though all constituents in NHX-AGI are equal weighted for index calculation purposes, the pie chart to the right illustrates how an asset weighted compositi on of the same funds would look like.

ve, the dollar-amount increase in the AuM of Brummer Multi -Strategy (BMS) – the largest fund in the Nordic hedge fund industry both as of the end of 2009 and as of the end of April 2017 – accounted for around 24% of the dollar-amount increase of the enti re NHX-AGI. This fi gure seems extremely high, especially considering that the change in the AuM of BMS was a mere 87% – a percentage increase that is signifi cantly lower than the triple- and quadruple-digit growth rates of the smaller funds. More importantly, BMS and Nektar, two players within the Brummer & Partners family of funds, accounted for nearly half of the increase in the dollar-amount of AuM of the NHX-AGI. Our att empts to create an index based on actual assets under management showed no meaningful results, with the table presented above presenting the hurdle of building such an index. Though all constituents in NHX-AGI are equal weighted for index calculation purposes, the pie chart to the right illustrates how an asset weighted compositi on of the same funds would look like.

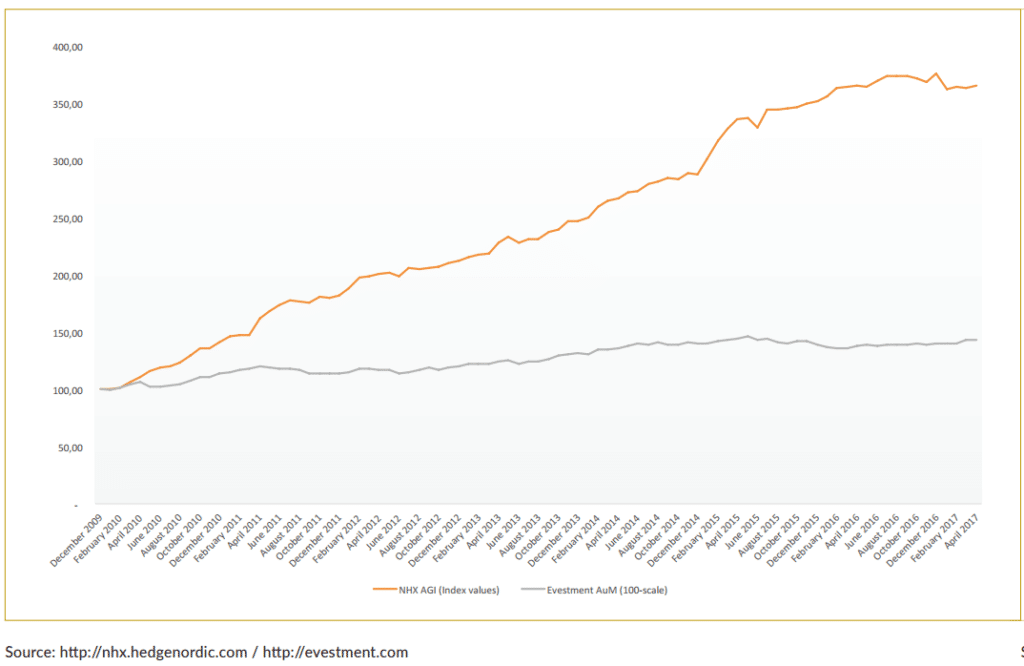

DEVELOPMENT OF THE NHX-AGI VERSUS GLOBAL HF ASSET FLOWS

Before drawing any conclusions from the data encompassed in NHX-AGI, one should bear in mind that the index does not reveal explicitly whether the dollar-volume of AuM of the Nordic hedge fund industry increases or declines. Instead, the NHX-AGI serves as a proxy representati on of AuM growth for the Nordic hedge fund universe. Hence, the index shows how the AuM of both small and large hedge funds develop on a monthly basis. Although it may be a stretch to to fi nd a meaningful benchmark for the NHX-AGI to illiustrate a comparison between the newborn Nordic index and external data, we att empted just that. In the chart to the left exhibiti ng the growth of assets for the global hedge fund industry the NHX-AGI shows to have been growing at a faster pace than the growth in hedge fund assets as provided by eVestment, a trend possibly explained by the relati vely young stage of growth of the Nordic hedge fund industry. Starting from mid-2016 up to this point in time, the NHX-AGI has experienced a noti ceable drop in values. Investor outf lows dominated the narrati ve surrounding the global hedge fund industry during 2016, and the Nordic hedge fund industry appears to be no exception. In additi on, there were individual funds, like Catella Hedge Fond, which had extraordinary reasons for a sharp decline in AuM. One should not ignore the possibility that the NHXAGI overesti mates the growth of assets for the Nordic hedge fund industry, as the index is computed using weighted-average percentage changes. For instance, the actual dollar-volume of assets under management of the 16 index components increased by roughly 66% in the period January 2010-April 2017, signifi cantly lower than the 265%-increase in the index value of the NHX-AGI. Nonetheless, the increase in the dollar-volume of AuM of the Nordic industry sti ll outpaced the 43% jump in the assets of the global hedge fund industry.

*Growth was measured using the functi onal currencies of the funds.

**The month-end AuM fi gure for May 2017 due to missing data for the month of April.

Picture: (c) wk1003mike—-shutterstock.com