Stockholm (HedgeNordic) – What promised to be a hectic period of violent swings and turbulences post Brexit, at least for the Nordic Hedge Index (NHX) appears to have been a non event. The NHX Composite with 76% of all NAVs reported, lies dead in the water for June, unchanged to end of May numbers at an index level of 175.47. This would be the first time since the index has been calculated starting in January 2005, we report a net change of 0.00%.

The swings of course become more evident breaking down to the subindices, where CTAs gained most indicating NHX-CTA up by 3.8% in June (93% conviction) and Fixed Income Strategies gained by 0.3% (71% conviction). NHX-Equities in June was down by 0.8%, Fund of Hedge Funds gave up 0.1% und multi strategy approaches lost 0.8%.

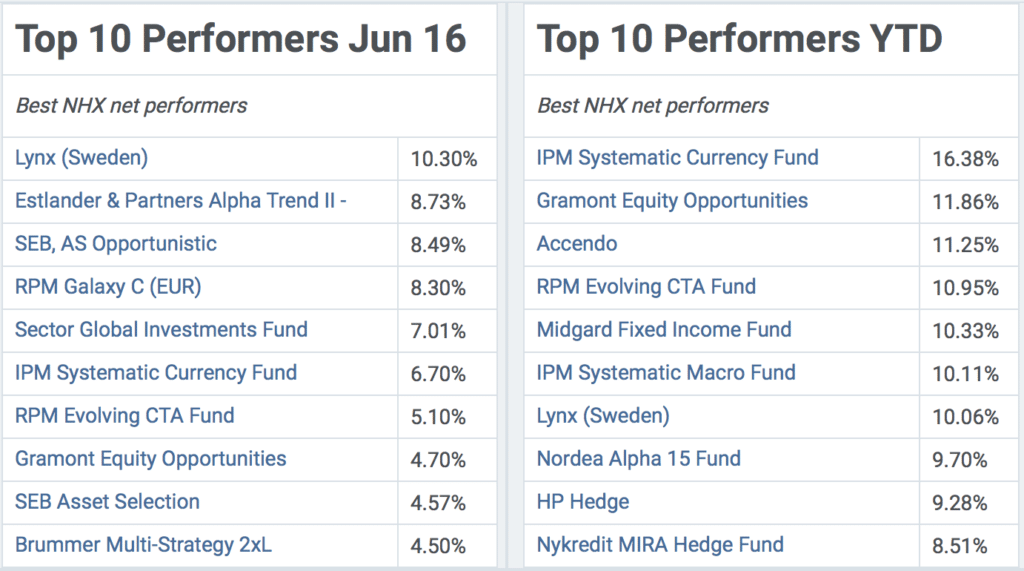

Out of the reported, Lynx, appreciating by over 10% on the month was the strongest fund while VISIO Allocator, down by 5.1% lost out the most.

Year to date, IPM Systematic Currency Fund (+16.4%), Gramont Equity Opportunities (+11.9%), and Accendo (+11.3%) are the strongest movers to the up-side.