Stockholm (HedgeNordic) – David Saunders, Managing Director and founder of K2 advisors, one of the worlds largest fund of hedge funds overseeing in excess of ten billion Dollars in assets, visited Stockholm on September 28 to discuss the myths of liquid alternatives during a lunch presentation.

Saunders (pictured) believes, alternative mutual funds, so called “liquid alternatives,” offer a compelling historical risk/return profile which have the potential to help reduce anxiety-inducing volatility and to provide a return stream that exhibits low correlations to traditional asset classes.

The rapid growth in availability in liquid alternatives has resulted in increased attention and scrutiny of this class of investment vehicles. Some market analysts have cited concerns over liquid alternatives, suggesting their structure may result in compromised return potential, lower manager quality and limitations on trading strategies. These criticisms may in some cases be overstated, according to Saunders.

One of the obvious benefits of liquid alternatives in comparison to many traditional hedge funds- as the name suggests, is daily liquidity. However, this benefit has sometimes generated criticism as well arguing that the daily NAV structure may compromise return potential. This concept is often called the “illiquidity premium,” which refers to the perceived advantage that a traditional, less liquid hedge fund has in its ability to lock up capital for longer, and consequently invest in longer-duration assets that may have an enhanced return profile.

“Our empirical examination of the actual performance and composition of liquid alternative funds and their traditional hedge fund counterparts illustrates the illiquidity premium may be overstated, and in fact very little is lost in terms of investment performance on the part of liquid alternatives”, Saunders explains

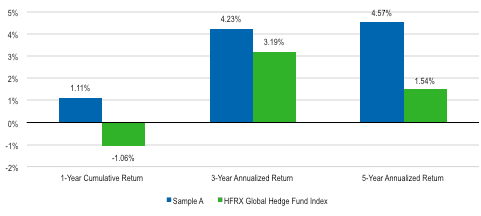

In the following chart, various historical performance metrics of liquid alternatives are compared to those of traditional hedge funds. Liquid alternatives are represented by a sample peer group of multi-strategy, multi-manager liquid alternative mutual funds while HFRX Global Hedge Fund Index represents the hedge fund space. As the data illustrates, liquid alternatives outperformed traditional hedge funds over the historical one-, three- and five-year periods, by margins of 217, 104 and 303 basis points, respectively.

The sample size in the previous analysis is small and the time period somewhat limited. Over longer horizons, we may expect results to vary, with quite a bit of return dispersion between the proxies included in the sample. Nonetheless, if there were a consistent drag on the performance of liquid alternatives associated with any sort of illiquidity premium, we would have expected to see some small degree of evidence in the data sampled. In fact, the opposite can be observed.

Comparing Historical Returns of Liquid Alternatives and Traditional Hedge Funds

As at 30 June 2015

This discussion also raises the question of the extent to which traditional hedge fund models actually utilize their ability to invest in illiquid holdings, a capacity which underlies the theoretical advantage of the illiquidity premium.

Through K2s analysis, while some strategies by their nature may lend themselves toward less liquid holdings than others — distressed debt for example— the majority of hedge fund managers that reviewed trade in highly liquid securities most of the time. This analysis suggests that the illiquidity premium may be limited in practice, due to the investment practices of traditional hedge funds that observed.

Sceptics often question the pedigree of the managers that agree to act as sub-advisors for liquid alternative mutual funds, suggesting managers have no real incentive to do so if they are successful in the private space. “We believe this is inaccurate.” Saunders is convinced.

“Information from Morningstar Inc. supports this assessment, showing that such established hedge funds as Wellington Management, AQR Capital Management, Coe Capital Management, Chilton Investment Company, Loomis Sayles, Jennison Associates, Chatham Asset Management, Graham Capital Management and York Registered Holdings all participate in liquid alternative fund structures. Sub-advising managers may be attracted to liquid alternative mutual funds because of a desire to diversify their investor base and to obtain a stream of inflows from the retail market.”

Furthermore, the breadth of hedge fund managers sub-advising liquid alternative funds is well positioned for growth. “In our experience, the majority of hedge fund managers have only recently started to realize that they have the potential to construct portfolios under public fund rules that provide essentially similar exposures using different means (futures, options) to achieve the economic leverage like their private vehicles—that is to say they can be managed in substantially the same manner as their existing products.”, Saunders explains

Another common perception of liquid alternative funds is that their trading strategies are restricted relative to those of private hedge funds, for example by their means of being able to use leverage. Saunders feels this criticism is overstated as the interpretation is not accurate and liquid alternative funds may use limited leverage through various vehicles.

“Critics have charged that liquid alternative funds have weaker returns due to their inability to invest in illiquid holdings, may not provide exposure to quality hedge fund managers, and exhibit lower performance potential due to restrictions on leverage. We have examined each one of these concerns, and found them to be overstated or even untrue.” Saunders concludes.

“In our opinion, liquid alternative mutual funds have the potential to provide significant value for investors, whether on their own or as part of a portfolio with traditional assets. There remain differences between liquid alternatives and traditional hedge fund strategies, and while it is important to continue to monitor and study these differences over time, it is equally important to distinguish fact from mere perception, and to not let common assumptions about liquid alternatives override their potential benefits.”