HedgeNordic is running an In-Depth series throughout the month of September that explores the world of commodities. This series examines both the benefits and challenges of investing in commodity markets, showcasing different approaches to capitalize on opportunities in this space. This series sheds light on the strategies, trends, and market developments shaping the commodities landscape today.

Nordic Hedge IndexNHX

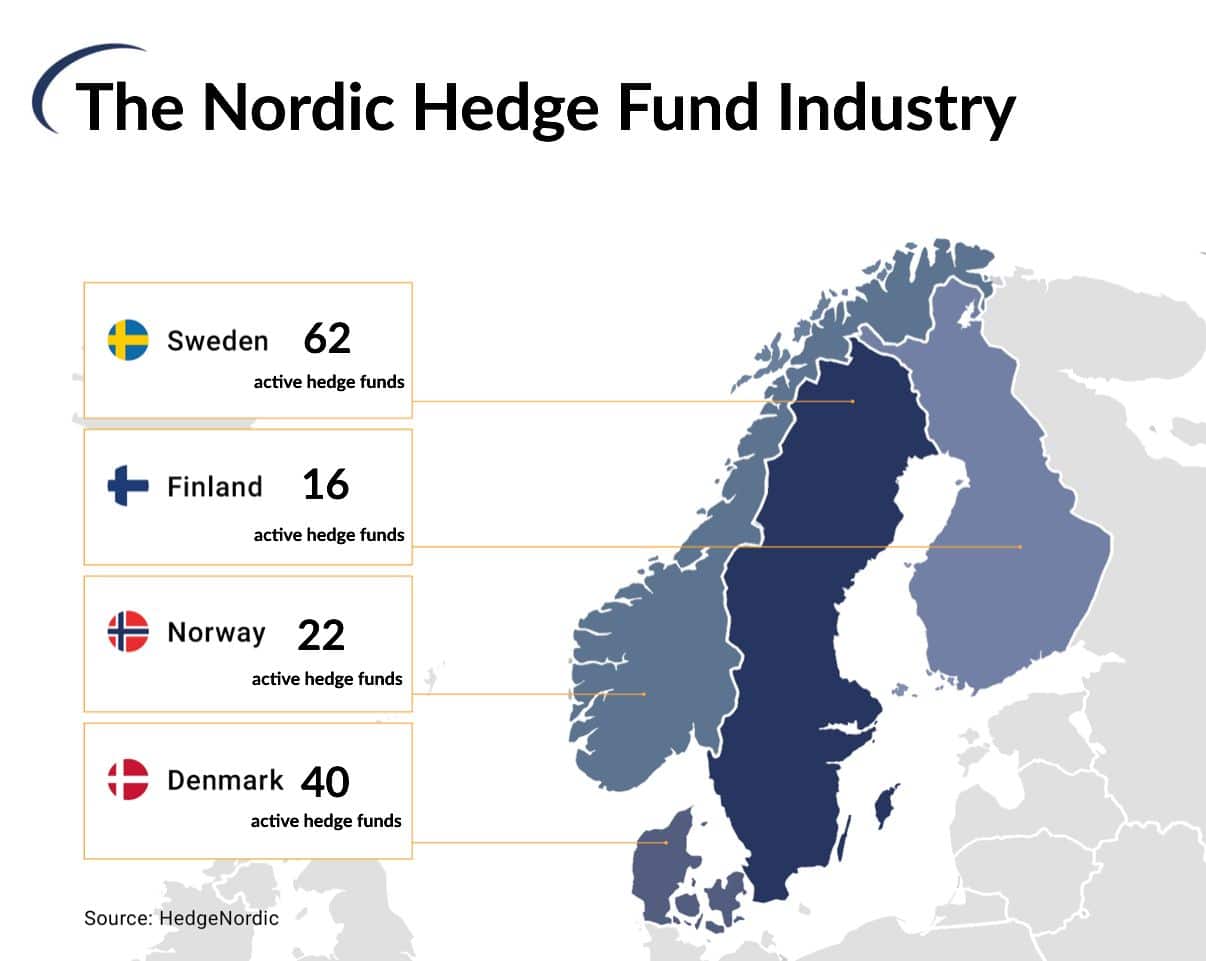

Your Single Access Point to the Nordic Hedge Fund Universe