By Jesper Rangvid: Bond vigilantes have returned—this time in France. By 2034, France is expected to have the second-highest debt ratio in the EU. It already has EU’s highest spending on ageing, partly due to its low retirement age. Amid political uncertainty, bond vigilantes have taken notice, resulting in a significant milestone: France now faces higher borrowing costs than Spain, a country severely impacted by the European sovereign debt crisis in 2012. Although the effects are not yet dramatic, the developments serve as a cautionary signal for other nations with similarly unsustainable debt paths, including the United States.

“A bond vigilante is a bond trader who threatens to sell, or actually sells, a large amount of bonds to protest or signal distaste with policies of the issuer,” according to Investopedia (link).

While it is challenging to determine precisely how much a bond trader sells “to signal distaste with policies of the issuer,” we can gauge the collective stance of all bond traders by examining yield developments. Recently, something noteworthy—perhaps even concerning—has occurred with French yields.

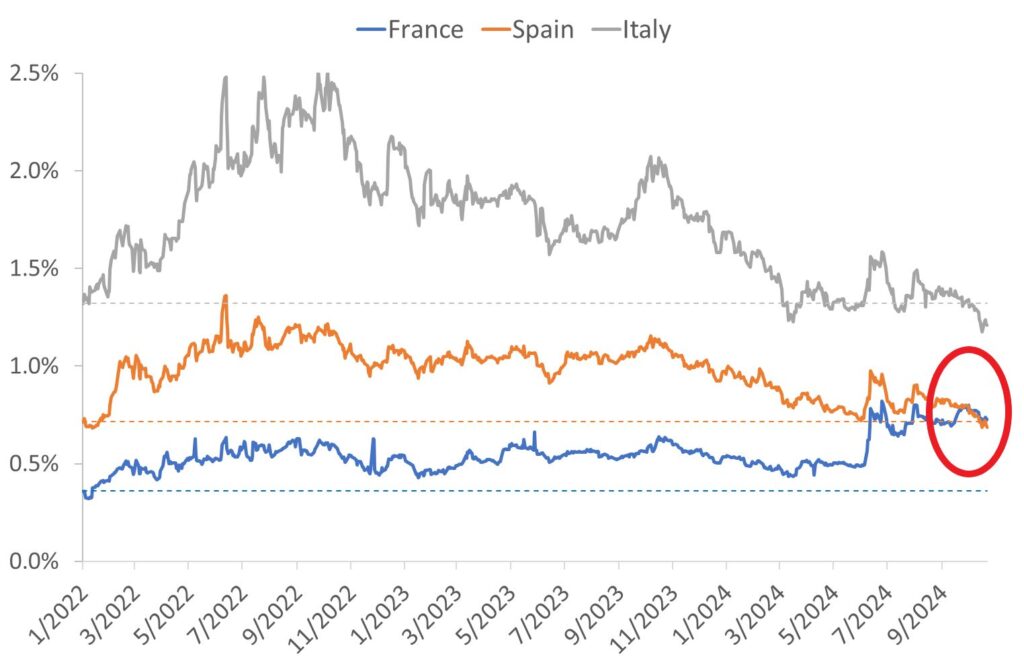

Figure 1 illustrates the yield on ten-year sovereign bonds from France, Italy, and Spain, each relative to the benchmark German ten-year yield, i.e., yield spreads. The figure presents daily yield spreads since early 2022, with dotted lines indicating the levels of yield spreads in 2022, allowing for an easy visualisation of changes over time.

As shown in the figure, while there have been fluctuations, the Italian yield spread is now below its 2022 level, and the Spanish yield spread is at its 2022 level. However, the French yield spread has risen significantly. Currently standing at 0.7 percentage points, it has doubled from 0.35 percentage points in early 2022.

The French yield spread now notably exceeds that of Spain, as shown by the circled final observations in Figure 1. This indicates that French taxpayers now face higher borrowing costs than their Spanish counterparts. Recall that Spain was one of the so-called PIGS-countries (Portugal, Italy, Greece, and Spain) during the 2012 European sovereign debt crisis. Now, France finds itself in a worse position than Spain, albeit by a small margin. This shift is significant and the reason behind this analysis.

Examining Figure 1 more closely, we see a sharp rise in all yield spreads following 9 June 2024, the final day of the 2024 European Parliament elections. Yet French yields increased the most. From the Friday preceding the elections (7 June) to the following Friday (14 June), the French yield spread widened by 0.29 percentage points, compared to 0.22 points for Italy and 0.2 points for Spain.

The primary reason for this larger increase in French yields was President Macron’s announcement of a general election in France in response to the European Parliament election results, introducing further uncertainty to France’s political landscape. As Figure 1 indicates, the French yield spread has remained elevated since then, while the Italian and Spanish spreads have come down.

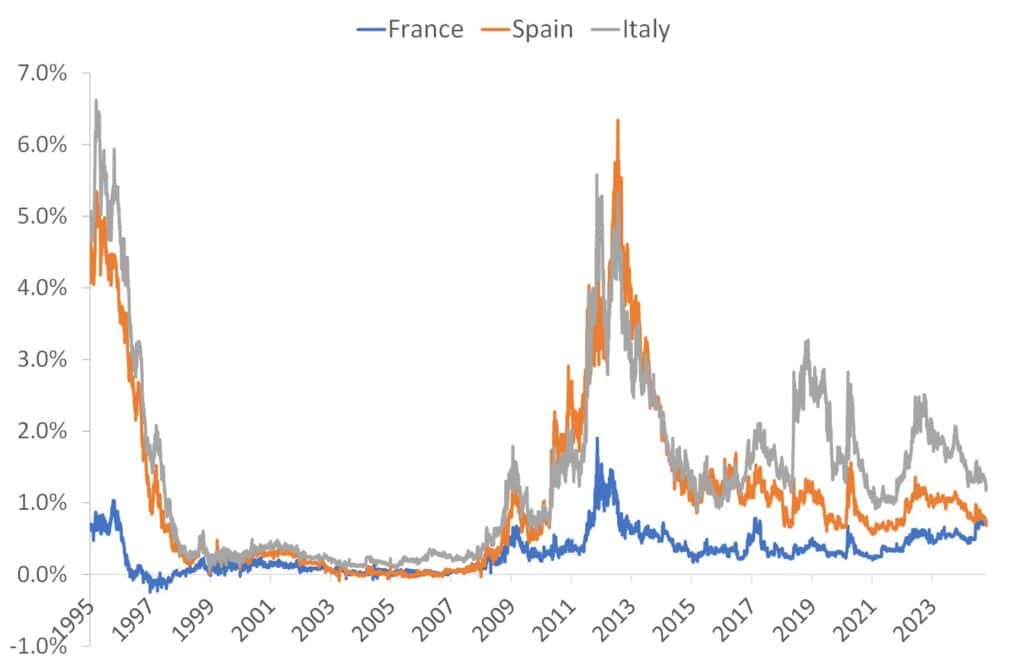

The figure begins in 2022—a practical choice, as a starting point is necessary. For additional context, Figure 2 illustrates yield spreads over the past three decades, during which French yields have consistently remained below those of Italy and Spain, except for the strange 1999–2008 period—until now.

Before the euro’s introduction in 1999, Italian and Spanish yields were considerably higher than French yields. Then came the unusual period between the euro’s launch and the financial crisis of 2008, when bond vigilantes seemed dormant, perhaps believing the euro had eliminated sovereign risk altogether. This complacency was shattered during the 2010–2012 sovereign debt crisis, which saw significant yield spread expansions. French yields rose as well, though far less than those of Italy and Spain. Up until now, French bonds were seen as safer than Italian and Spanish bonds. Today, this is no longer the case.

Why have French yields increased?

French yields have risen for two main reasons: a worrying public debt trajectory and uncertainty surrounding the political situation.

Regarding the political situation, political scientists are better placed to offer in-depth analyses. My point is simply that the political situation in June—whatever caused it—affected yields. The rise in French yields during recent weeks appears to stem similarly from political uncertainty surrounding the budget (link). Nor will I conduct a lengthy analysis of the French economy. Interested readers may refer to European Commission forecasts for France (link) or the comprehensive OECD report on the French economy (link). Instead, I will highlight a few key points.

Each year, the European Commission publishes its Debt Sustainability Monitor (link), which provides an overview of fiscal sustainability risks faced by EU Member States in the short, medium, and long term. The latest report (2023) categorises France’s medium-term fiscal sustainability risk as “high.” Only seven out of the 27 Member States face such a “high” risk, including France alongside Italy and Spain.

French debt is projected to grow significantly, reaching 130% of GDP by 2034 (up from 110% in 2023), leaving France the second-most indebted EU country in 2034. Only one country, Italy, is forecasted to have a larger debt ratio in 2034, at 164% of GDP.

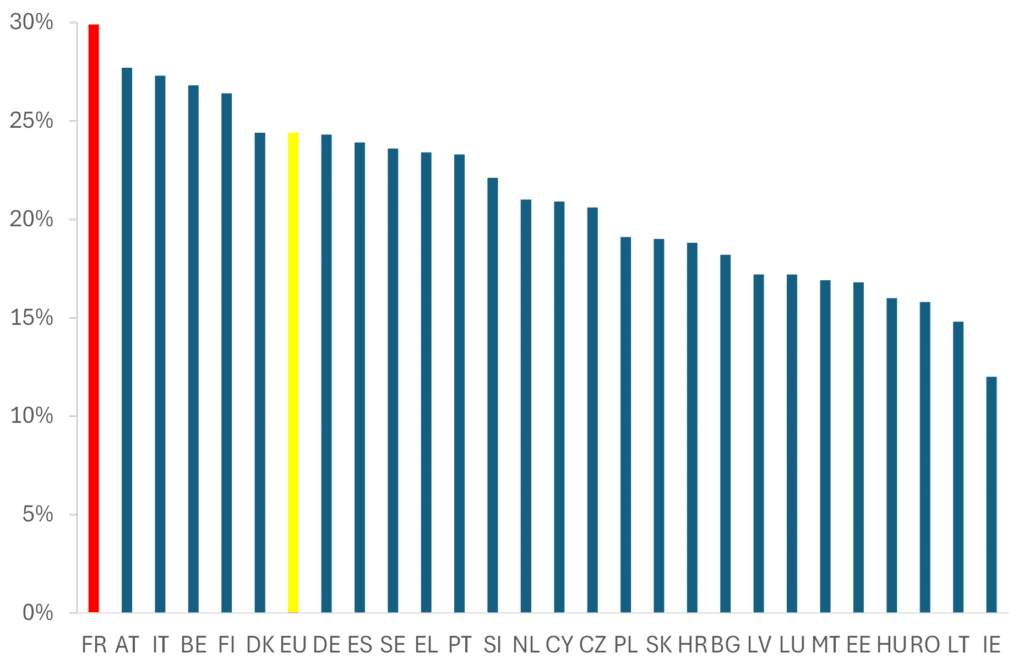

Public spending may stimulate future economic growth. If debt is rising due to government investments in areas like new technology that promise future economic benefits, high debt levels may be less concerning. However, if debt grows due to expenditures unlikely to spur future growth, bond vigilantes may take a stricter view. In this context, it is notable that France leads EU countries in spending on ageing-related costs, as shown in Figure 3.

Figure 3—drawing on data from the European Commission’s 2024 Ageing Report—illustrates that France allocated the highest share of GDP to ageing in the EU in 2022, at 29.9% (link).

While it is worth noting that France is one of only four countries expected by the European Commission to reduce its spending on ageing by 2070, it will remain among the highest spenders in 2070, surpassed only by Belgium and Austria. This implies that, for many decades to come, France will continue to dedicate a very substantial portion of its GDP to ageing costs.

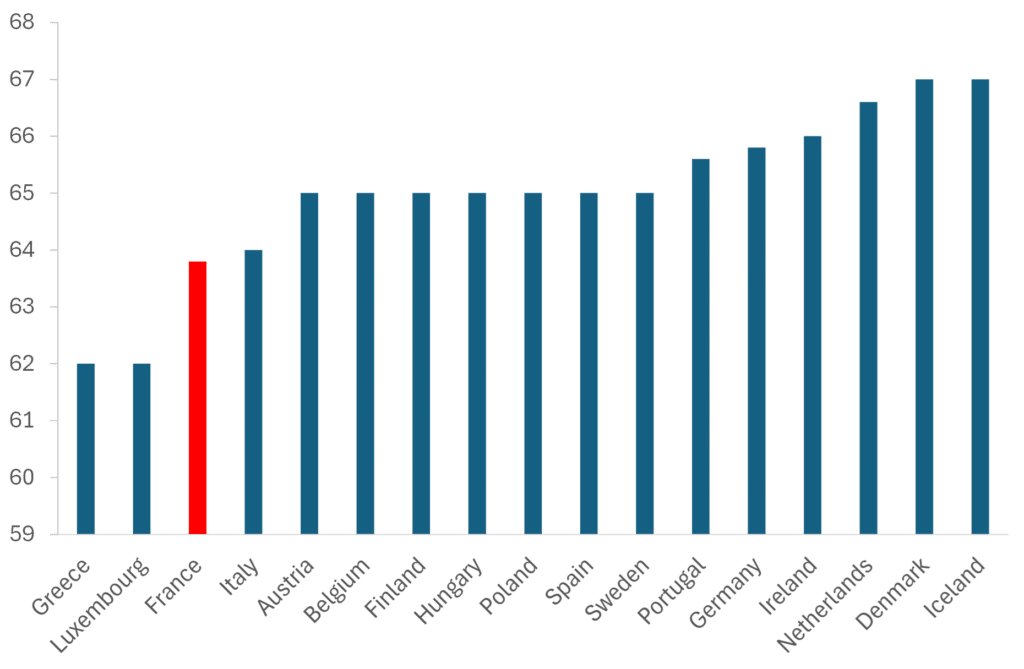

One key factor behind France’s high expenditure on ageing is its comparatively low statutory retirement age, as shown in Figure 4.

Currently, the normal retirement age in France is 63.8. It is lower in Greece (and we all know the problems that created in Greece in 2010-2012) and Luxembourg (that can afford it), but otherwise the French retirement age is unusually low relative to other European countries.

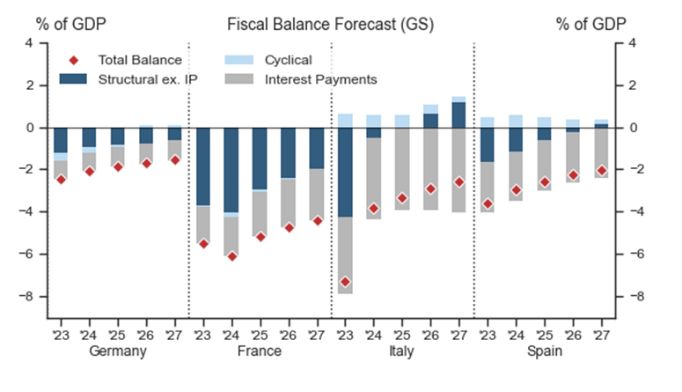

Such low retirement ages and large ageing costs contribute to large structural deficits. I came across an analysis from Goldman Sachs that examines the underlying drivers of fiscal balances in Germany, France, Italy, and Spain (with thanks to Edward Conard for highlighting the analysis; if you are not already on Conard’s distribution list, you can sign up to receive his insightful Macro Roundupshere: link). It is in Figure 5.

The key point here is that France will have the largest structural deficit over the years to come among the countries examined here. While Germany, Italy, and Spain are projected to approach structurally balanced budgets by 2027, France is expected to maintain a considerable structural deficit of around 2% of GDP.

It is likely due to developments and outlooks such as these, coupled with an uncertain political situation, that French yields have risen relative to German yields, while yield spreads in Italy and Spain have stayed the same or fallen.

Conclusion

It appears that bond vigilantes are alert again, this time focusing on France. Although the rate increases in France are not yet dramatic, it is notable that French taxpayers now face higher borrowing costs than Spanish taxpayers. The fact that bond vigilantes may wake up one day serves as an important lesson for countries with unsustainable public debt trajectories, including the UK, US, and many others.

This post originally appeared on Rangvid’s Blog: https://blog.rangvid.com/2024/10/27/cest-la-vie-bond-vigilantes-are-back/