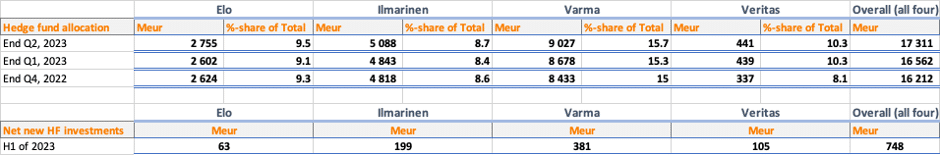

Stockholm (HedgeNordic) – Finland’s four pension insurance companies – Elo, Ilmarinen, Varma, and Veritas – increased their hedge fund allocations in the first half of 2023 following solid performance from the industry during the challenging market environment of 2022. The group’s combined allocation to hedge funds increased by 6.8 percent during the first half of the year from €16.2 billion to €17.3 billion. This reflects an asset-weighted return of 2.1 percent, along with an estimated net allocation of €750 million to hedge funds during the initial six months of 2023.

Varma, the second-largest of the four pension insurance companies in Finland’s private sector earnings-related pension system, maintains the highest allocation to hedge funds. Varma’s allocation to hedge funds increased from €8.4 billion to slightly over €9 billion at the mid-point of the year, accounting for 15.7 percent of its €57.4 billion investment portfolio. Varma made an estimated €380 million in net investments to hedge funds during the first half of the year. Varma’s hedge fund portfolio returned 2.3 percent in 2022 after enjoying a 15.3 percent return in 2021. Over the first six months of 2023, its hedge fund investments returned 2.4 percent.

Ilmarinen, the largest of the four with €58.2 billion in assets, saw its allocation to hedge funds rise from €4.8 billion to €5.1 billion during the first six months of the year. This pushed the percentage allocation from 8.6 percent at the end of 2022 to 8.7 percent mid-year. The increase partly reflects a 1.5 percent return and an estimated net investment into hedge funds of €200 million during the first half of the year. Ilmarinen’s hedge fund portfolio returned 8.2 percent last year.

Elo, the third-largest of the four pension insurance companies in Finland, increased its hedge fund allocation from 9.3 percent to 9.5 percent of the €29 billion portfolio at the end of June. Elo’s hedge fund portfolio increased by €131 million to €2.6 billion, partly reflecting a return of 2.6 percent during the six months of 2023 and net investments of around €63 million. Elo’s portfolio of hedge funds returned a similar 2.3 percent in 2022.

The hedge fund portfolio of Veritas, the smallest of the four pension insurers, also increased as a share of the overall portfolio after a solid 2022. Veritas had €441 million or 10.3 percent of its €4.3 billion portfolio allocated to hedge funds at the mid-point of the year, compared to €337 million or 8.1 percent at the end of 2022. After an impressive return of 12.3 percent in 2022, Veritas’ hedge fund portfolio edged down 0.3 percent over the first six months of 2023.