Traders expect markets, asset classes, investment styles, and securities to experience material trends and fluctuations over time. However, in an environment of information asymmetry, implementation challenges, and separating new information from mere noise, traders also know that they must do more to improve their results. As trading desks seek efficiencies, how will they meet the challenge of interacting with more flow, entering new markets, and integrating new asset classes? These changes introduce a wider range of potential outcomes and require changing investment implementation strategies continuously to account for new information as it becomes available.

Optimizing Multi-Asset Institutional Trading

To maintain a competitive advantage and keep pace with expanding scope, institutional trading desks often acquire new software that focuses on a narrow purpose or a single asset class. Over time, these incremental tools can make for a cluttered desktop, time-consuming data onboarding for analysis purposes, and greater implementation and maintenance expenses.

Given our 20+ years of Analytics experience helping asset managers enhance productivity, transparency, and performance, our award-winning1 approach favors an integrated solution. Stand-alone or integrated with our leading2 Triton execution management system (EMS) our purpose-built Analytics Portal framework is designed to support a trader’s objectives across the entire trade life-cycle. From pre-trade execution planning and execution to post-trade analysis, reporting and trade data APIs, Analytics Portal integrates and scales to meet clients’ needs.

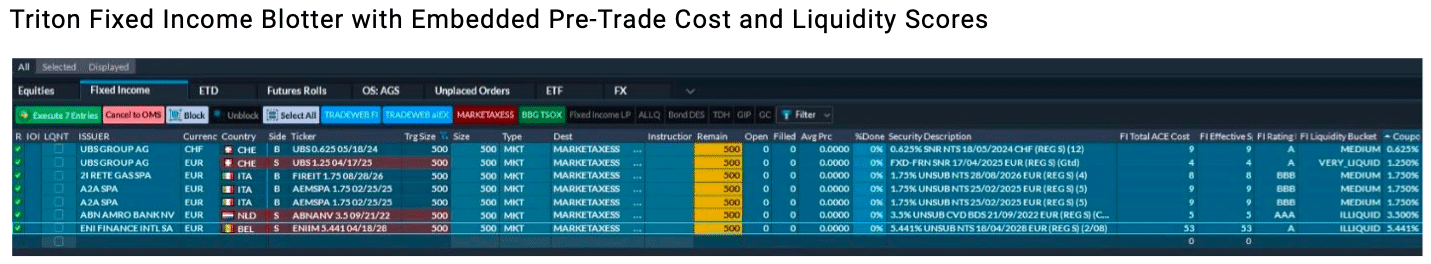

Triton is Virtu’s global, broker-neutral, multi-asset class EMS used by over 40%3 of leading asset managers. Triton integrates equities, FI, futures, FX, and more into a single intuitive interface and combines Virtu’s cutting-edge liquidity, execution, analytics, and workflow solutions.

Managing multiple asset classes within a single EMS requires asset class-specific data and a consistent approach to automate workflows, perform trades, capture data, and analyze the success of trading strategies. Automating specific types of flow enables to focus on the performance of higher-risk trades which means having tools that address multiple instruments is essential.

Understanding Trading Costs

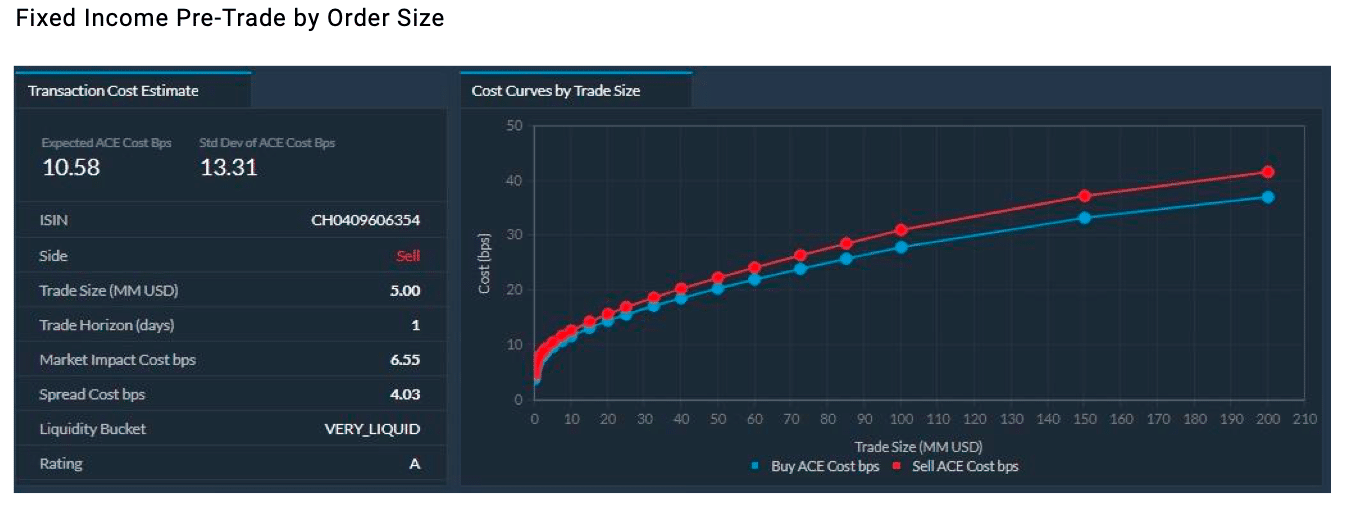

Virtu’s Agency Cost Estimator (ACE) model generates realistic cost estimates based on order-specific characteristics and the latest market data. ACE is calibrated using Virtu’s Global Peer database—in 2021, Virtu Analytics captured over US$16T4 notional of equities trade data—which serves to bring the model’s estimate in line with observed buy-side costs. Virtu built FI and FX ACE using the same principles and, while the model inputs and methodologies are tailored to each asset class, they each provide expected cost across an optimized trade schedule. Triton Valor workflows include integrated ACE for equity, FI and FX.

Multi-Asset Trade Automation

High-touch trading often requires a higher degree of traders’ attention to manage the trade. Properly tuned algo wheels and auto-routing products are useful tools that enable traders to focus on larger, more complex orders. These solutions are now being adapted and applied to ETF, FI and FX execution.

Triton enables traders to create rules to control which orders are routed automatically and to which destinations. The auto-routing rules can be simple (e.g., based on size) or complex and can even consider current market conditions. Each rule begins with determining which orders should be routed (based on size, asset class, custom fix tag, region/ country), and layered rules can help determine where the order should be routed, including a primary and secondary backup. For all asset classes, exception monitoring and outlier alerting provide crucial feedback that allows traders to course correct when something is not performing as expected.

Post-Trade Analytics

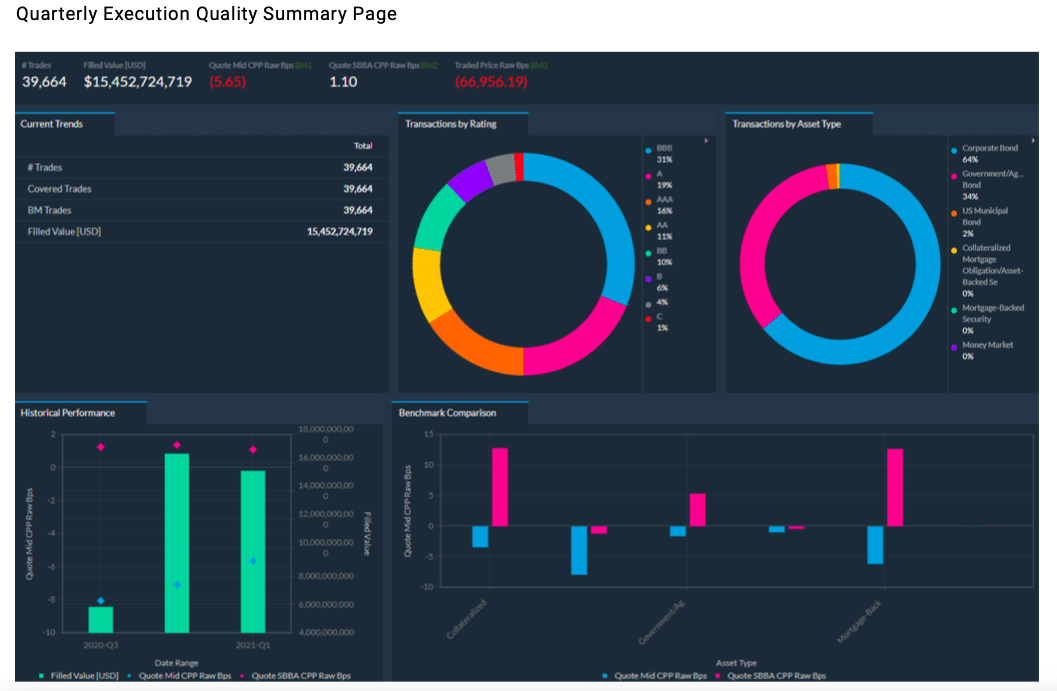

Virtu’s multi-asset post-trade capabilities are used to analyze the performance of any trade regardless of execution channel or asset class. Located in North America, Europe, and APAC, Virtu’s Analytics team specializes in helping organizations recap recent trading, summarize activity and identify/understand outlier patterns. Most importantly, our team works with clients to identify actionable information to affect their trading outcomes. Our consultative approach helps clients target high-cost areas and understand the main drivers of cost (participation rates, time of day, and more).

Virtu’s Analytics Portal and customizable trade data APIs can be used to deliver insight to meet our clients’ needs, including account-specific reporting, execution quality committees, and board meetings.

Today’s fiduciary responsibilities should include consideration of how multiple outcomes can be achieved in a broad range of possible market experiences. The requirement to continually seek better ways of achieving client outcomes is why a consistent “multi-asset class” mindset and toolset should be adopted.

It’s always the right time to elevate your multi-asset execution. Contact Virtu Analytics to start the conversation.

1) Top-ranked for trade reporting and analytics by AITE Group’s 2020 Impact Innovation Awards in Capital Markets.

2) #1Overall Outperformer (2021), #1 Best Platform Adaptability (2021), #1 Overall Outperformer (2020), #1 Best Customer Support (2020) The TRADE’s 2021 and 2020 Execution Management Survey of Buy-Side Users.

3) Ranking of top 400 global asset managers by IPE, 2020.

4) FY ending December 31, 2021.