By Marco Lukesch and Harrison Darling – Emso Asset Management: Developed markets private credit is now a mature asset class and a mainstay of diversified portfolios. Private credit in emerging markets, by comparison, is still largely in its infancy. Global investors are beginning to enter the market but are mainly focused on direct lending to corporates. In our view, a direct lending-led strategy in emerging markets is suboptimal. We believe that it is important to take a different approach and instead focus on trying to mitigate what we believe is the biggest risk in emerging markets private credit investing: the unreliable Rule of Law.

Private Credit Landscape

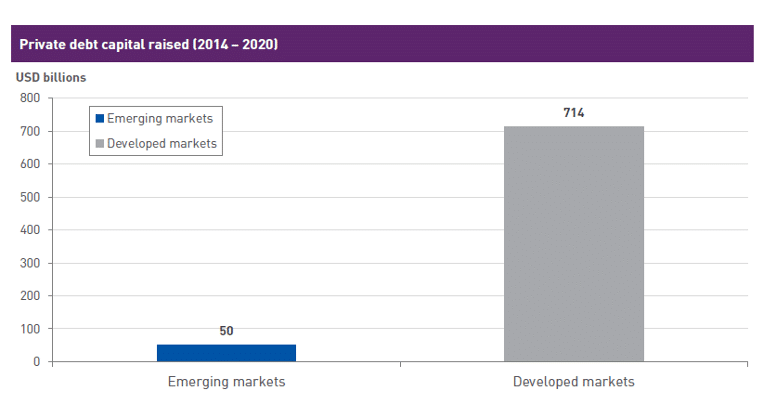

The appeal of private credit has increased in the current world of low (and negative) interest rates. Broadly speaking, private credit refers to lending outside of the traditional bank and bond markets. In North America and Western Europe, the strategy has grown exponentially over the past decade and has become a separate asset class within most institutional investors’ portfolios. From senior secured direct corporate lending to other esoteric strategies, private credit in developed markets is diverse and provides investors a range of investment options. In contrast, private credit in emerging markets is still in its infancy. Within emerging markets, there exists a structural opportunity because of the mismatch between the supply and demand of capital. This dislocation has created a funding gap for EM businesses of approximately USD 700 to 850 billion per annum¹. Figure 1 provides a helpful illustration of this dynamic.

Given the structural imbalance and attractive risk-return potential of EM private credit, we feel that global investors are starting to take notice. A majority, however, are focused on direct lending to corporates. While this strategy has proven successful in developed markets, where 82% of DM private credit is in the form of direct lending, in our opinion, a direct lending-led strategy in EM is currently suboptimal.

We believe that contract enforceability through local courts (‘Rule of Law’) is the biggest risk in EM private credit investing. To mitigate this risk, we feel it is important to focus on two investment strategies:

- Bankruptcy-remote, asset-backed structured lending: instead of being secured by collateral and relying on courts in the event of default, investors should seek to own the collateral directly and outright from day one;

- Contracted sovereign risk: investors should build programs that provide liquidity/financing to citizens/companies in exchange for direct and indirect sovereign credit obligations.

We believe that these two investment strategies provide the opportunity for private credit investors to access emerging markets while, at the same time, mitigating the Rule of Law risk, and additionally adding diversification across geography, asset class, and tenor.

Developed Markets Private Credit: Opportunity Set

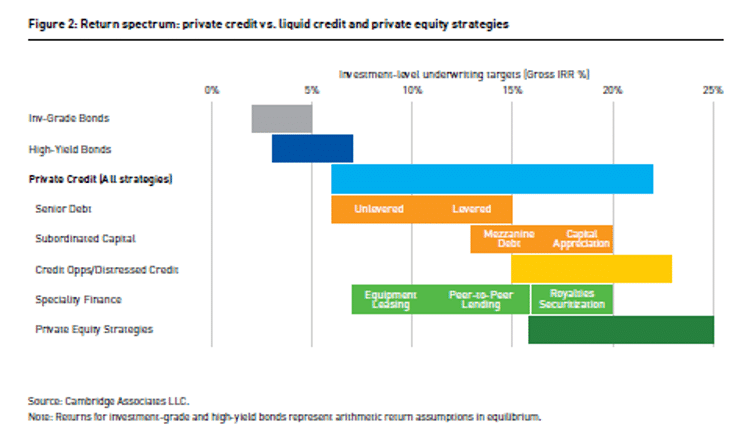

Institutional investors have historically been drawn to private credit due to the premium it can provide over tradeable fixed income as well as the portfolio diversification benefits. As evidenced below in Figure 2, the DM private credit opportunity set provides investors with many options and alternatives.

The DM Direct Lending Playbook: Portability to Emerging Markets?

The growth of DM private credit can be attributed to a well-established private markets ecosystem and, most crucially, highly functioning legal systems. Many emerging markets, however, do not provide these same comforts.

In developed markets, direct lenders will often mitigate the risk of loss by having the corporate borrower pledge its assets and equity as collateral. If the borrower defaults, the lender goes to the courts, enforces the pledge, converts the ownership, and sells the assets. In other words, the fundamental prerequisite to private credit investors recovering capital (in a reasonable amount of time) is a reliable and highly functioning Rule of Law. In North America and most of Europe, investors have confidence in the legal system and, as such, are focused on the recovery value of assets (i.e. sale price of assets) and enterprise value (i.e., sale price of company).

In many of the emerging markets, investors do not have a similar level of confidence in the Rule of Law. We, therefore, advocate employing an investment strategy which is focused on two specialty finance niches: bankruptcy-remote, asset-backed structured lending and contracted sovereign risk. These two niches are designed to minimize reliance on local courts and maximize the recovery of invested capital in downside scenarios.

Bankruptcy remote, asset-backed structured lending

In structured lending transactions, such as equipment leasing, the focus is on asset ownership and building scalable investment programs alongside local partners. To ensure control, in many cases, the goal is to create bankruptcy remote trusts in which we novate all assets or cashflows. In the event of a default, it is possible to directly sell the asset without the need to navigate local courts and deal with the borrower’s inherent home field advantage. Assets that underpin some of these transactions include equipment, real estate, receivables, and vehicles, among others.

Contracted sovereign risk – creating sovereign value

In many emerging markets, governments owe companies or citizens money, but are typically slow to pay. Examples span from subsidy payments due to local farmers to funds owed following court settled disputes. In example sovereign risk transactions, programs are typically built alongside local partners that purchase, service, and collect direct and indirect sovereign obligations. These programs provide liquidity to companies or citizens in exchange for short-term government risk. Given the inherent complexity and illiquidity, we believe that these types of transactions can capture a substantial premium to publicly traded sovereign equivalents.

Conclusion

In our view, private credit will continue to be a mainstay in institutional investment portfolios for the foreseeable future. As investors look for increased diversification, we believe that EM private credit will present opportunities for investors to increase and diversify their private credit portfolios. However, while it has historically been an uncrowded space, we believe that investors in EM private credit will need to keep downside protection at the forefront of their investment strategies by focusing on mitigating ‘Rule of Law’ risk.

Marco Lukesch, Head of Private Credit – Managing Director – Emso Asset Management

Marco started his career as a consultant focused on financial services at Oliver, Wyman & Co. He joined HBK Capital Management in 2005, where he was the co-head of EM. From 2013 onwards, he was co-head of EM at Pine River Capital Management, focusing on illiquid opportunities in CEEMEA and LatAm. He oversaw all aspects of investing: sourcing, structuring, trading, and management of illiquid positions. At Pine River, he was instrumental in creating a consumer-lending platform in Brazil, as well as tax-blocker subsidiaries. Marco joined Emso in 2017. Marco graduated magna cum laude from the University of Pennsylvania with a B.A. and a B.Sc., and was admitted to the Phi Beta Kappa Society. Marco is also a Chartered Financial Analyst.

Harrison Darling, Private Credit – Associate – Emso Asset Management

Harrison began his career as an equity research analyst in Sydney in both private and public markets. In 2015, he joined Glennon Capital where he covered Australian listed businesses. He joined Emso in 2016, rotating across various teams prior to joining the EM Private Credit team in 2020. Harrison holds a Bachelor of Business from the University of Technology Sydney and is also a Chartered Financial Analyst.

[1] According to IFC’s report on Micro, Small and Medium Enterprises published in 2017.

This article features in HedgeNordic’s “Private Markets” publication.