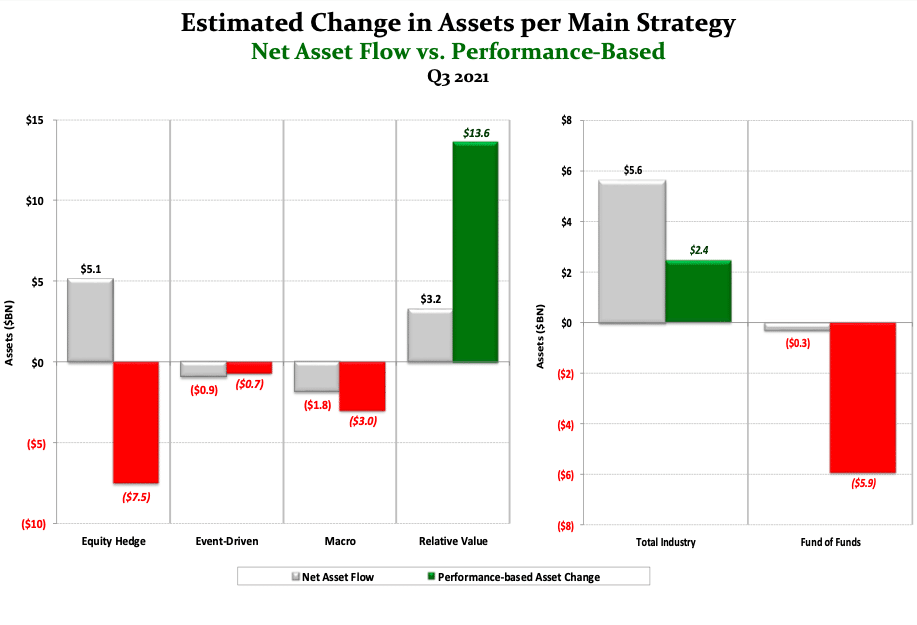

Stockholm (HedgeNordic) – Hedge funds attracted $5.6 billion of net investor inflows in the third quarter, marking the fifth consecutive quarter of net inflows for the industry, according to Hedge Fund Research. Following marginal performance-based asset gains of $2.4 billion during the quarter, total hedge fund capital rose narrowly to an estimated $3.97 trillion at the end of September, representing an increase of about $370 billion from the start of the year.

“Total global hedge fund capital nudged higher in 3Q21 narrowly eclipsing the prior quarter record and inching towards the $4 trillion milestone as commodity prices surged, interest rates increased, equity market volatility increased, and inflationary pressures continued to build,” comments Kenneth J. Heinz, President of HFR.

“Total global hedge fund capital nudged higher in 3Q21 narrowly eclipsing the prior quarter record and inching towards the $4 trillion milestone.”

Total hedge fund industry capital increased by more than $1 trillion over the trailing six quarters since falling below $3 trillion in the first quarter of 2020, according to Hedge Fund Research. The $5.6 billion in net inflows for the third quarter brought the net inflows over the past four quarters to an estimated $40 billion. Performance-based asset gains amounted to only $2.4 billion for the third quarter, compared to $145.9 billion for the second quarter. The HFRI Fund Weighted Composite Index edged down 0.3 percent in the third quarter, following the strongest first half of a calendar year since 1991.

Credit- and interest rate-sensitive fixed income-based relative value arbitrage strategies enjoyed the largest increase in assets during the third quarter, with assets growing by $16.8 billion due to contributions from both investor inflows and performance-based asset gains. Total capital invested in relative value arbitrage increased to $1.03 trillion, including an estimated $3.2 billion of net asset inflows for the three months ending September. “Interest rate-sensitive Relative Value Arbitrage strategies led both performance and inflows for the quarter, while managers and investors alike focused portfolios on interest rate exposures, as the U.S. Federal Reserve signaled a decrease in bond purchases in coming months leading to an expectation of higher interest rates into 2022,” says Heinz.

“Looking to the year ahead, managers and investors have increased their respective focus on portfolio credit and interest rate sensitivity, tactical commodity exposures and equity market exposures, with implied optionality and flexibility to adjust to a fluid macroeconomic environment and market conditions,” says Kenneth J. Heinz. “Funds effectively positioned to navigate these multi-asset trends are likely to lead industry performance and growth into the new year.”