By Dan Rizzuto, CFA and Linus Nilsson, CFA: Our article offers a condensed version of a contemporary evaluation of alternative investments represented by CTAs, Risk Premia, and Hedge Funds we recently completed. Here we describe Risk Premia as passive/semi-passive investments in alternative strategies and we have contrasted these investments with the active management approach of CTAs and Hedge Funds. In particular, we note an interesting correlation drift, that may not line up with expected risk and performance characteristics.

Risk Premia was initially presented as a low-cost alternative for various actively managed alternative investment strategies including some used in CTAs and Hedge Funds. In this analysis “Hedge Funds” represent all managers in our universe that are not categorized as “CTAs” or “Risk Premia.”

Equities are the Leaders – For Now!

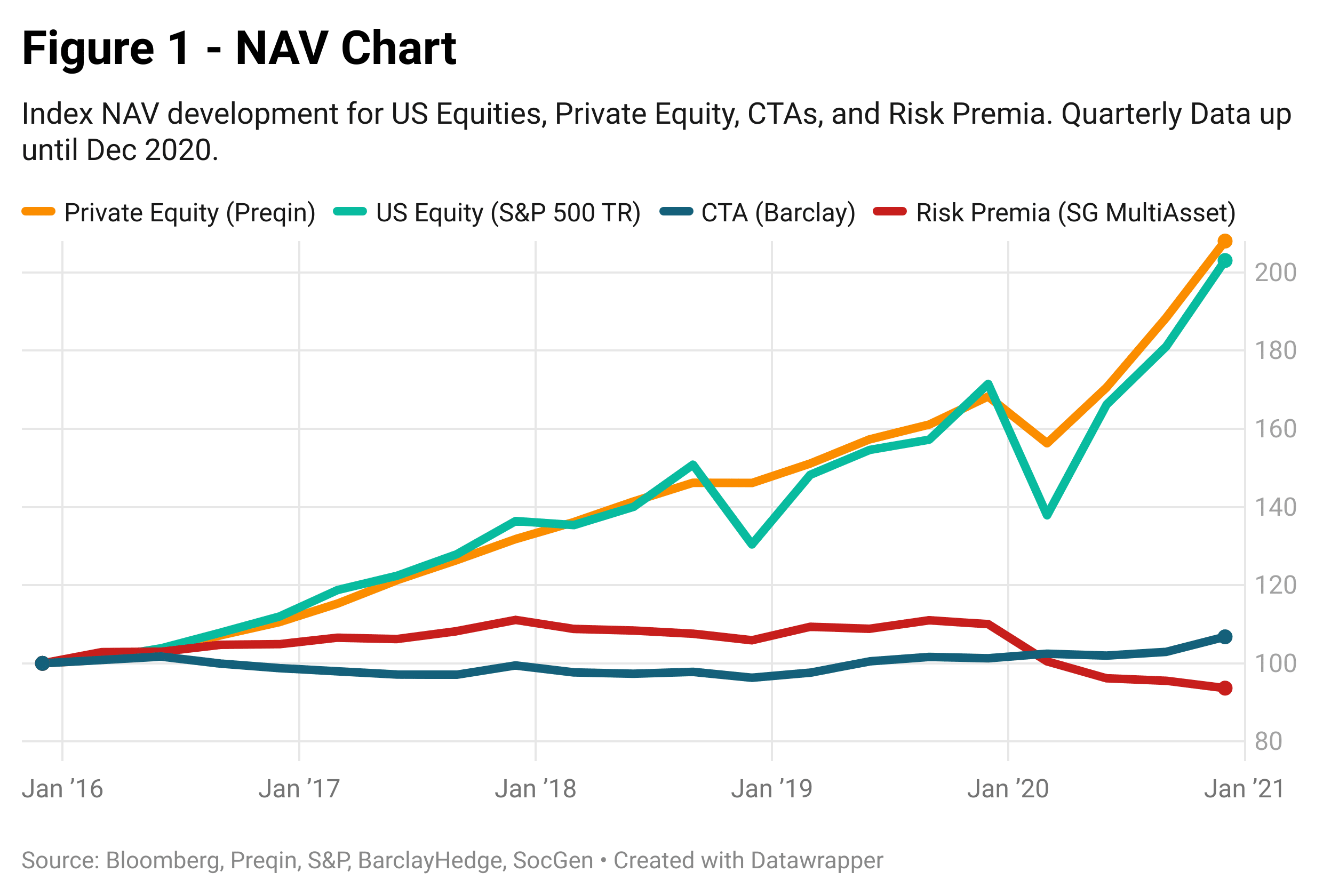

We thought it helpful to look at the recent returns of CTAs and Risk Premia alongside public equities and private equity as additional “alternatives.” It may be fair to expect that if accommodative monetary and fiscal activity continues or expands, these equity- centric investments could continue to dominate performance rankings.

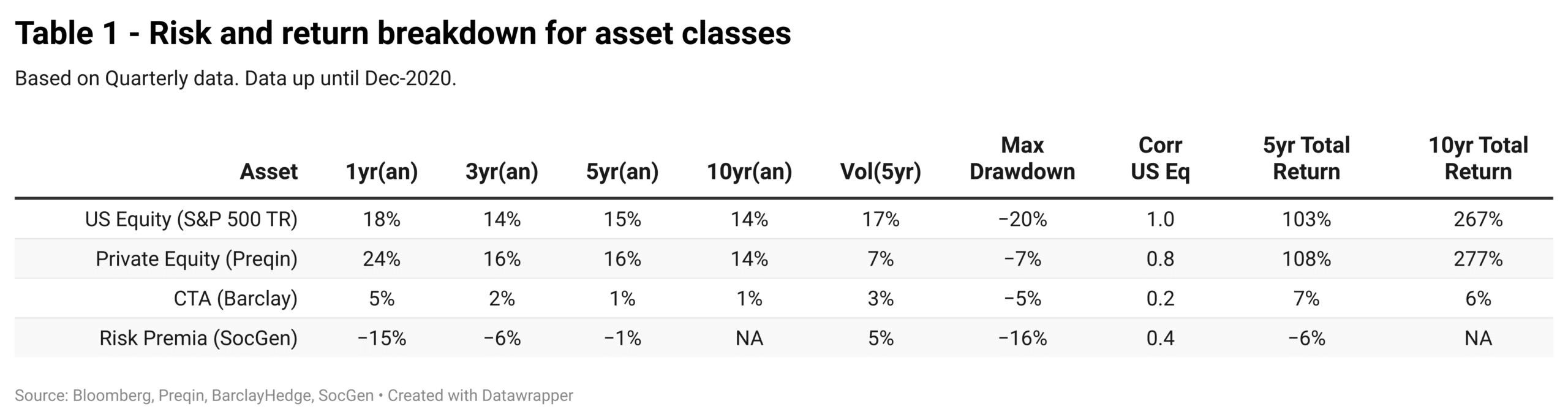

Figure 1 and Table 1 demonstrate the particularly favorable environment for absolute returns in equity investments.

The equity out-performance does bring a concern of a reversion to long-term averages. If such a reversion is in store, our analysis of alternative investments here seems all the more pertinent and timely.

Table 1 includes a comparison of return and volatility represented by quarterly returns and risk up to December 2020 in order to align with the quarterly data available for Private Equity (Preqin). A less granular mark-to-market frequency projects important metrics in a unique light. For example, the more muted magnitude of volatility and drawdowns for CTAs on a quarterly basis may surprise some, particularly relative to the other investments listed here.

The Curious Progression of Risk Premia Correlations

Since the advent of alternative beta studies, one of the most researched factors has been time series momentum. This price trend following factor is generally recognized as a primary trading signal for CTAs. This strategy is mostly responsible for the uncorrelated profile of trend following CTAs.

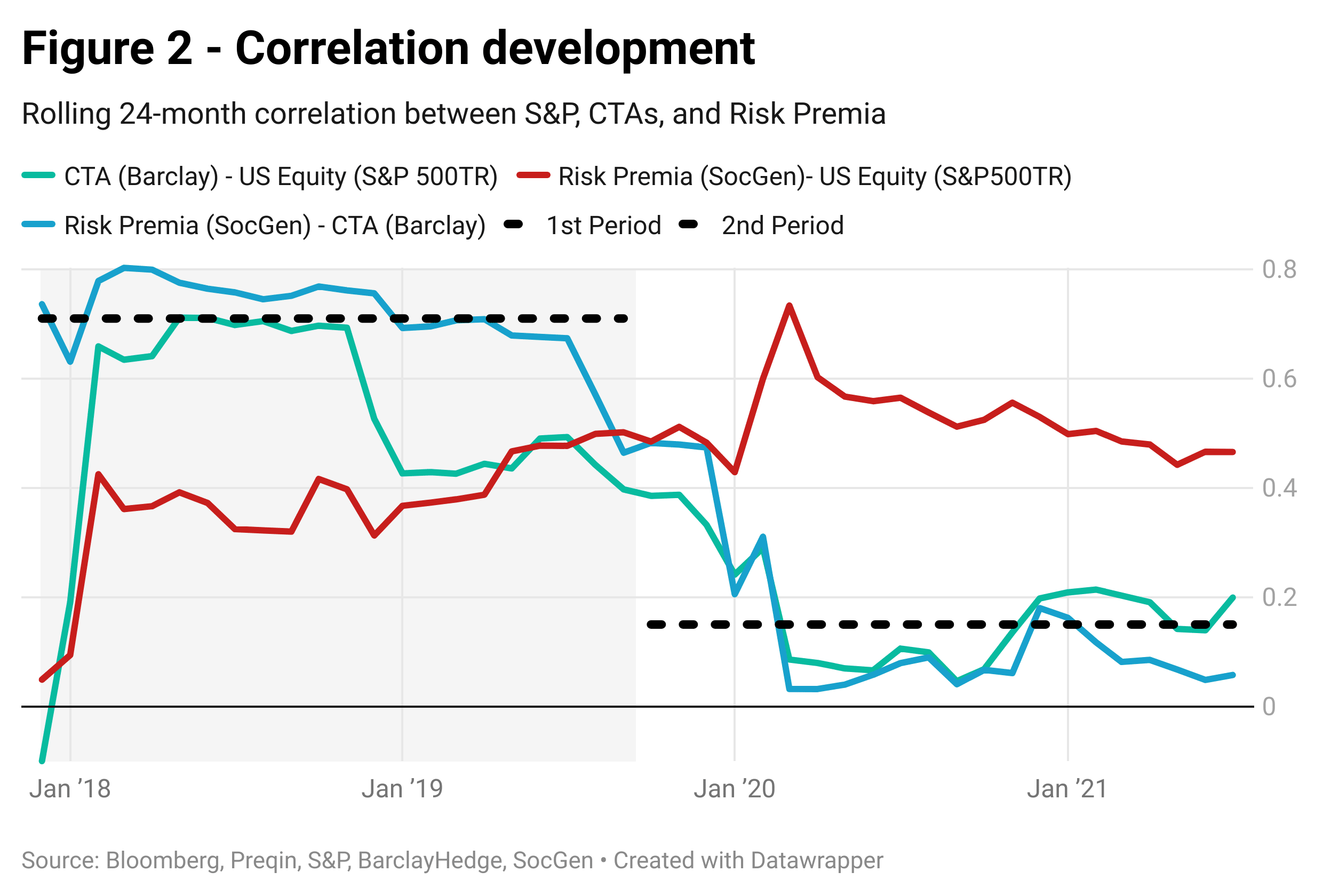

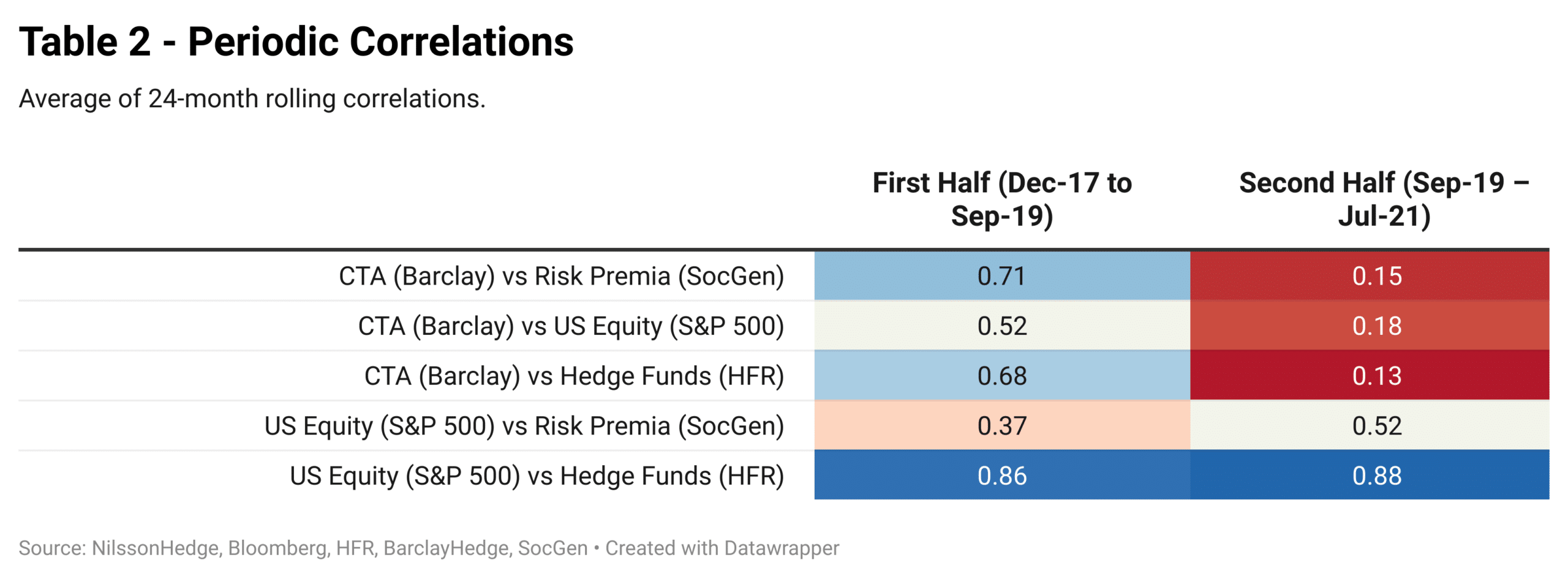

As illustrated in Figure 2 most Risk Premia strategies launched early on implicitly showed a substantial allocation to trend following signals. CTA and Risk Premia correlations were high, and Risk Premia correlation to equities comparatively lower (Table 2, “First Half”).

As the universe of Risk Premia grew and matured, their performance profile gradually shifted in favor of a higher correlation to equity risk factors (“Second Half” in Table 2) More recently, Risk Premia strategies have approximately a 0.5-0.7 correlation with the US Equity Markets while CTAs have realized a much lower correlation of 0.1-0.2.

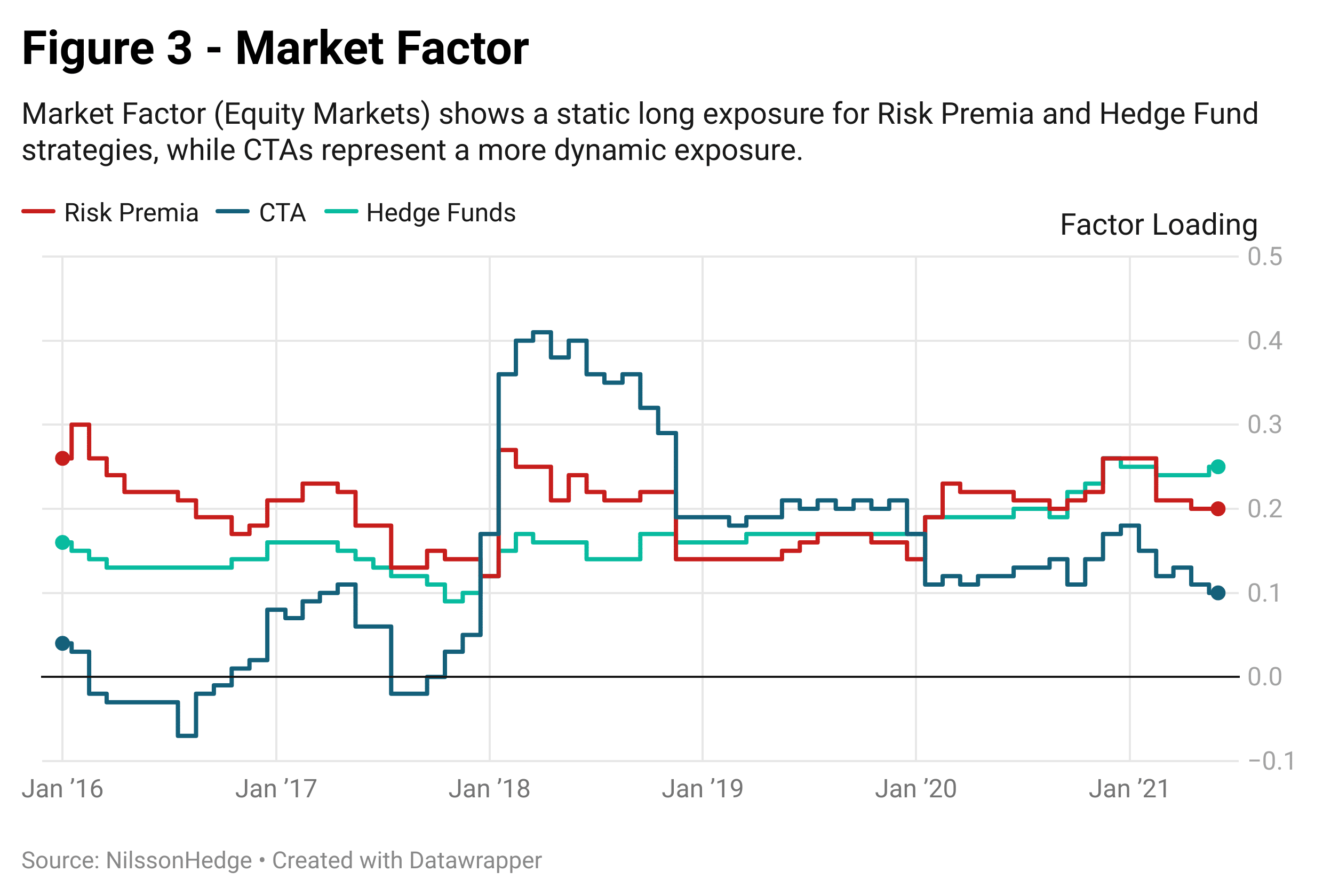

To further understand the change in exposure profiles, we perform a multiple regression with the Fama French Five Factor Model and cross-sectional momentum (FF5). Isolating the behavior of the Market Exposure factor leads us to observe (Figure 3) that Risk Premia strategies have a larger similarity with Hedge Funds than they do with CTAs, especially since 2019.

This is consistent with the observation that both Risk Premia and Hedge Funds may have structurally increased their sensitivity to equity beta. CTA exposure to equities has remained dynamic, largely as expected.

A continued lack of Risk Premia performance in combination with higher correlation to equity markets may for many investors result in another negative performance “surprise”, akin to the equity drawdown we observed early on during the Covid-crisis.

We wonder here if such a downward shock can really be considered unexpected by this point as history is replete with similar events and today’s measures project a willing tolerance (again!) for considerable equity beta.

Risk Premia and Long Equity Have Negative Skew

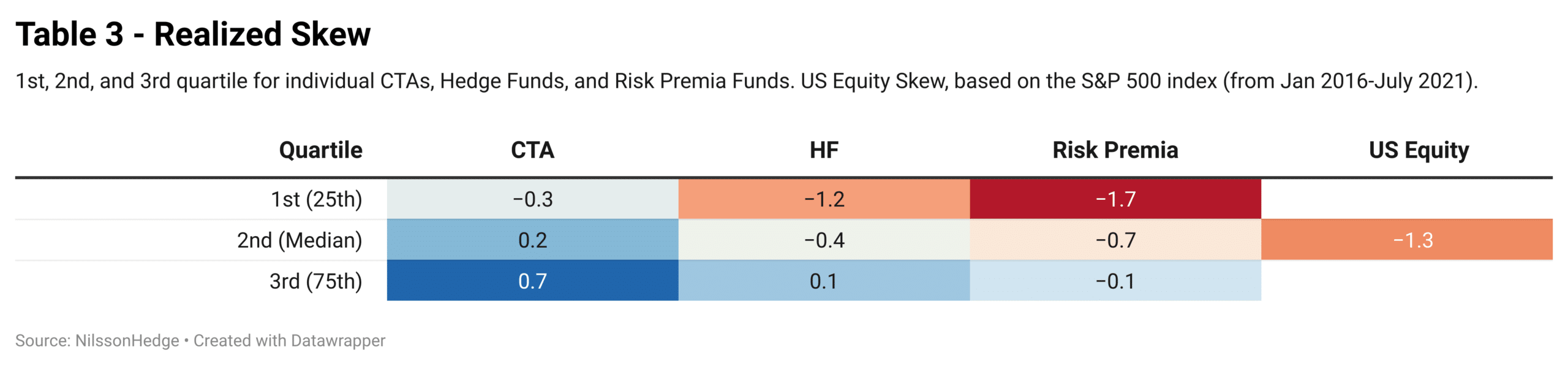

In Table 3, the results for CTAs (positive skew) and Hedge funds (negative skew) are in-line with prior research and general perception. For Risk Premia strategies, most are realizing negative skew.

We observe that Risk Premia strategies have a skew structurally closer to Hedge Funds and equity markets than to CTAs.

Alpha is at a Premium

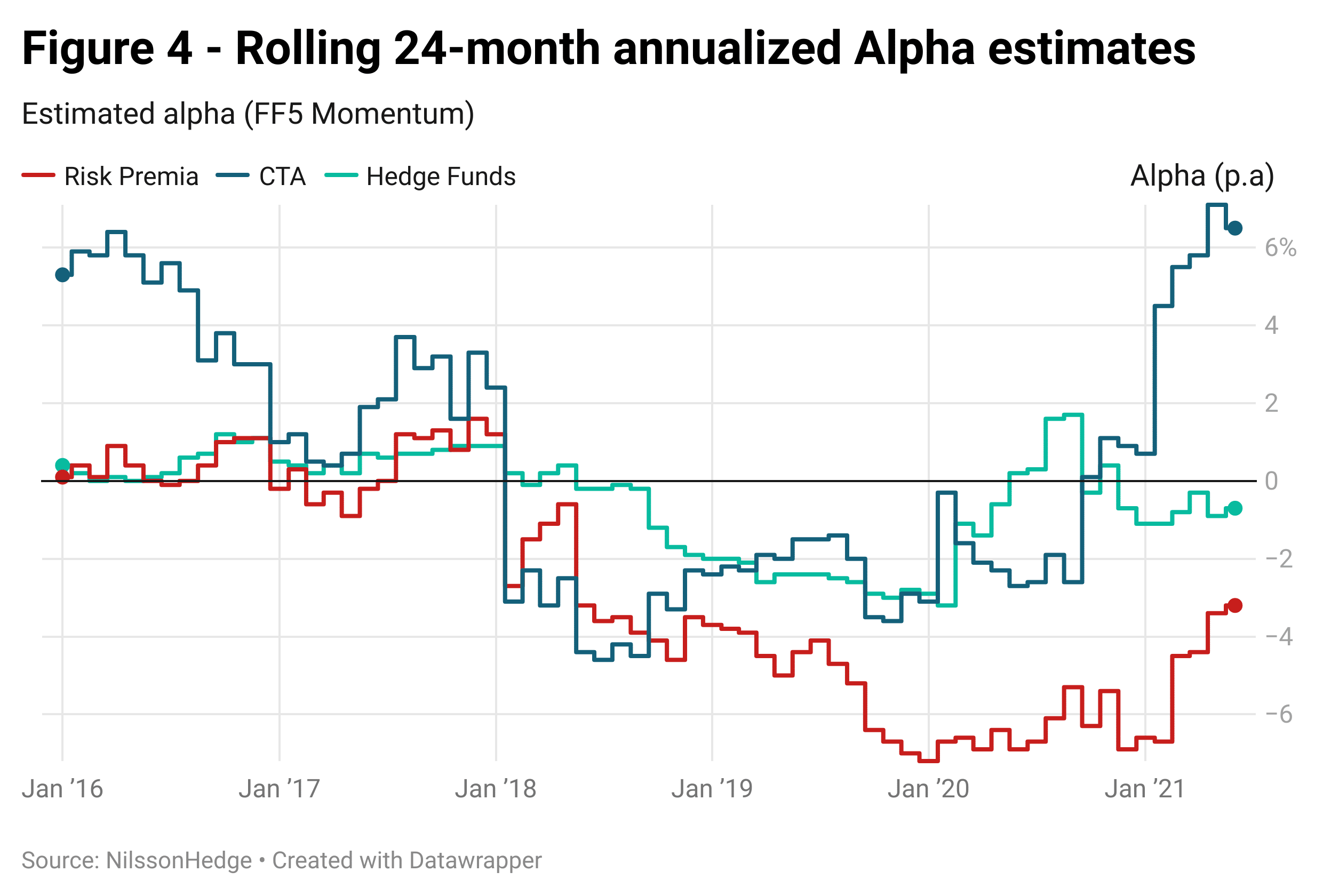

While there are multiple ways to define Alpha, below we define Alpha as the residual returns adjusted for the FF5 regression.

Risk Premia strategies delivered negative Alpha beyond what would be expected net of costs. Hedge Funds and CTAs have recovered, and on average, delivered marginally positive Alpha over the period. We’ve seen a recent recovery for Risk Premia in 2021, in terms of absolute return.

Re-Evaluate Your Alternative Investments with a Critical Eye Towards Equity Beta

When we evaluate CTAs, Risk Premia and Hedge Funds, comparing their specific return and correlation profiles, some curious, perhaps surprising observations arise.

We observe an evolutionary track of Risk Premia where investment profiles have changed, possibly without intention, but from some perspectives considerably. We note that as the dynamics of investment allocation are challenging enough, a key tenet of successful allocating is an investment’s adherence to expected attributes.

If we do return to environment where asset allocation decisions are more akin to those required prior to the period of unprecedented monetary and fiscal stimulus, a more thorough and continuous evaluation of alternative investments, in particular Risk Premia, may be needed.

Indeed, should a reversion back to traditional market dynamics be severe, resulting in another dramatic equity downturn, it is important now to properly evaluate the expectations of your CTAs, Risk Premia, and Hedge Funds in the context of equity market stress, sustained negative equity performance, and increased volatility across markets globally.

BIO:

Dan Rizzuto is the Head of Capital Introductions and Advisory at Marex. Dan has been a committed advocate of the alternative asset management industry for over twenty-five years. He has held senior management, business development, analytic, and operational roles in both the asset management and banking industries throughout his career at companies including Société Générale, Graham Capital Management, DKR Capital, and Bear, Stearns. Dan is a CFA Charterholder.

Linus Nilsson founded NilssonHedge, a public hedge fund database, as an initiative to bring transparency to the hedge fund universe. The database uses an innovative way of aggregating public performance data and offers access to hedge fund returns. Linus is a CFA Charterholder. Access the database at www.nilssonhedge.com.

This article featured in HedgeNordic’s “Quant Strategies” publication.