Stockholm (HedgeNordic) – Nordic hedge funds advanced 0.3 percent on average in June (95 percent reported) to end the first half of 2021 up 4.3 percent, pulling off the best first-half performance since 2009. Last month’s market environment was not very fruitful for many Nordic CTAs, with the group incurring an average decline of 1.4 percent for the month.

The remaining four strategy categories within the Nordic Hedge Index enjoyed gains last month. Fixed-income and multi-strategy hedge funds were up a similar 0.6 percent last month, with fixed-income vehicles ending the first half of 2021 up 1.6 percent and multi-strategy vehicles up almost 4.0 percent. Equity hedge funds, this year’s strongest-performing strategy group in the Nordic Hedge Index, advanced 0.4 percent on average in June to end the first six months of 2021 up 6.8 percent. Funds of hedge funds rose 4.0 percent through the halfway point of 2021 after gaining 0.3 percent in June.

At a country level, the Finnish hedge fund industry gained the most in June, with its 14 members advancing 1.7 percent on average. Finnish funds within the Nordic Hedge Index ended the first half of 2021 up 7.7 percent. Danish hedge funds, meanwhile, gained 1.2 percent last month to take the group’s first half-year performance to 4.3 percent. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry, were down 0.3 percent on average last month to trim their 2021 advance to 3.0 percent. Norwegian funds edged down 0.1 percent in June to end the first half of this year up 6.5 percent.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index widened month-over-month as last month’s top performers did better than the prior month’s best performers. In June, the top 20 percent of Nordic hedge funds gained 3.8 percent on average, while the bottom 20 percent lost 2.8 percent. In May, the top 20 percent were up 2.4 percent on average and the bottom 20 percent were down 2.9 percent. About 60 percent of all members of the Nordic Hedge Index with reported June figures posted gains for the month.

Top Performers in June

HCP Focus Fund, a long-only equity hedge fund under the umbrella of Helsinki Capital Partners, was last month’s best-performing member of the Nordic Hedge Index. The fund gained 15.6 percent last month to take its performance for the first half of 2021 into positive territory at 14.3 percent.Energy transition-focused Proxy Renewable Long/Short Energy gained 9.0 percent in June to bring its 2021 performance into positive territory, too, at 4.5 percent.

Stockholm-based long/short equity fund Gladiator Fond gained 8.5 percent last month to cut the year-to-date decline to 18.8 percent. Multi-strategy Visio Allocator Fund, meanwhile, gained 5.5 percent in June to end the first half of 2021 up 15.2 percent. Healthcare-focused, long-biased long/short equity fund Rhenman Healthcare Equity L/S advanced 5.0 percent last month, ending the first six months of the year in positive territory at 11.6 percent.

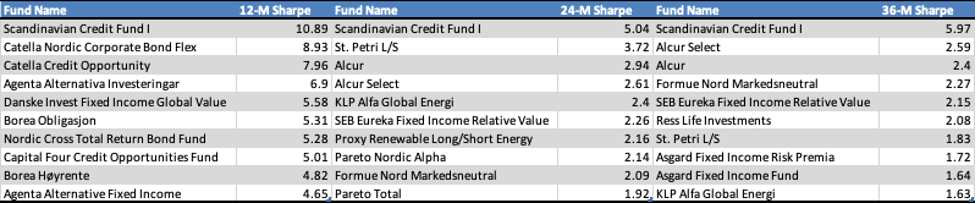

Highest Sharpe Ratios

Given the heterogeneous nature of hedge fund strategies, absolute performance numbers do not always reflect how successful hedge funds are. Risk-adjusted measures such as the Sharpe ratio are a good starting point in the process of identifying the best-performing hedge funds. The three tables below display the Nordic hedge funds with the highest Sharpe ratios over the past 12 months, past 24 months, and 36 months.

The Month in Review for June 2021 can be downloaded below:

Photo by Glen Carrie on Unsplash