Stockholm (HedgeNordic) – Hedge funds are back on the agendas of family offices. According to a survey by BlackRock and London-based asset-raising business Juniper Place, “recent market turmoil and the expectations of sustained volatility in the medium term has re-invigorated hedge fund appeal” among family offices.

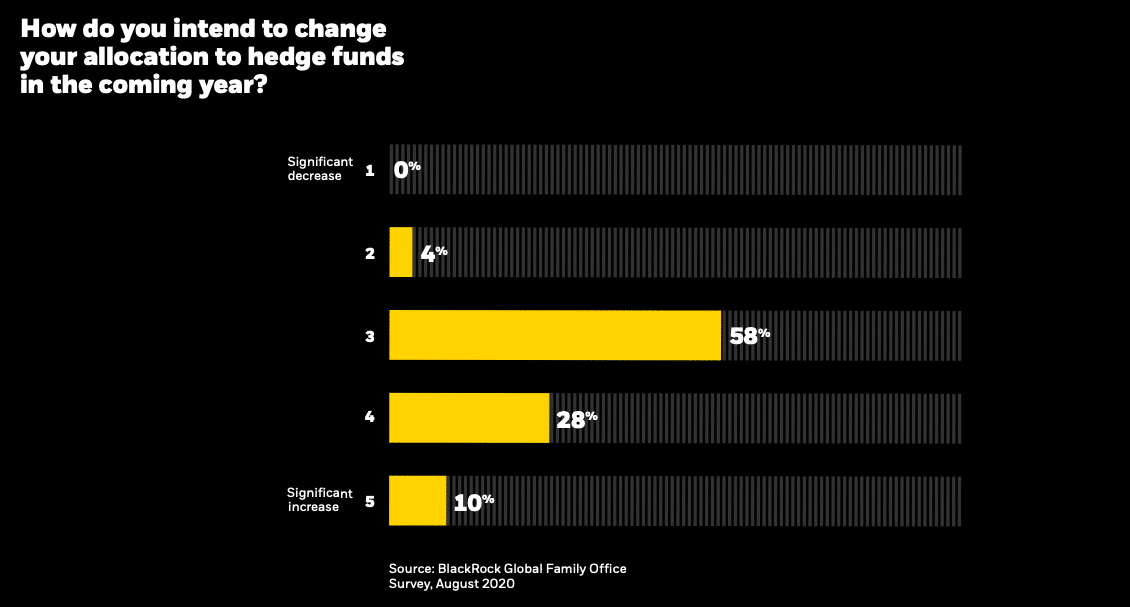

In a survey completed by 185 family offices globally, 38 percent of respondents intend to increase their exposure to hedge funds going forward, while the remaining respondents plan to maintain their exposure at the current level. “Strong indication of a reversal of the negative sentiment that we have observed in recent years,” writes the global family office survey report put together by BlackRock and Juniper Place.

In-depth interviews with several family offices revealed that “their interest in hedge funds has been driven by the desire for uncorrelated, enhanced risk-adjusted returns and a belief that a more volatile market could now be more conducive to strong performance.”

About 80 percent of family offices prefer equity long/short funds in the current environment, reflecting investors’ desire to mitigate exposure to equity beta. Global equity long/short funds gained an estimated 16.3 percent on average last year, as reflected by the Eurekahedge Long Short Equities Hedge Fund Index. Credit and distressed are two other popular hedge fund strategies among family offices in the current climate, selected by 47 percent and 41 percent of respondents, respectively.

According to the survey and interviews, some family offices are increasingly using hedge funds as diversifiers or substitutes for fixed income in their portfolios. “In our case it is a defensive component of our portfolio and as such is a conservative, low-volatility hedge fund programme,” explained the Head of a European Family Office that participated in the survey.

The survey conducted by BlackRock and Juniper Place also finds that “alternatives continue to be a key focus for clients seeking diversification and to potentially enhance returns.” On average, the surveyed family offices allocate about 35 percent of their portfolios to alternative asset classes. The survey highlighted that family offices are planning to increase their exposure to alternatives, with private equity and private debt being the most favored areas. About 55 percent of family offices said they planned to increase their exposure to private equity.