Stockholm (HedgeNordic) – Whereas global hedge funds dipped negative in September and brought to an end a five-month string of positive returns, Nordic hedge funds enjoyed their sixth consecutive month of positive returns. Nordic hedge funds, as reflected by the Nordic Hedge Index, edged up 0.3 percent in September (92 percent reported), bringing the industry’s year-to-date performance further into positive territory at 2.7 percent.

Month in Review – September 2020

Three of the five strategy categories in the Nordic Hedge Index enjoyed gains for the month of September. Equity hedge funds, which enjoyed their best summer on record, led the gains last month with an average return of 1.3 percent. Following a six-month string of positive returns, Nordic equity hedge funds are now up 6.4 percent for the year. Fixed-income hedge funds and funds of hedge funds were up 0.2 percent and 0.3 percent last month, respectively. Multi-strategy hedge funds edged down 0.2 percent last month, while CTAs incurred losses for a second consecutive month. Last month’s decline of 1.8 percent brought the year-to-date performance for CTAs into negative territory at 1.2 percent.

At a country level, the Norwegian hedge fund industry gained the most last month with an average advance of 1.3 percent. Norwegian hedge funds are up 3.2 percent for the first three quarters of 2020. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry with 77 listed funds, gained 0.5 percent last month to bring the group’s year-to-date advance to 2.4 percent. Danish hedge funds, meanwhile, edged up 0.3 percent in September, whereas Finnish hedge funds were down 1.4 percent on average. Finnish funds still remain the best-performing group among their neighbours with an average year-to-date gain of 3.7 percent.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index remained unchanged month-over-month. In September, the top 20 percent of Nordic hedge funds advanced 3.5 percent on average, while the bottom 20 percent lost 2.7 percent on average. In August, the top 20 percent were up 5.3 percent on average and the bottom 20 percent lost 0.9 percent on average. About 60 percent of the members of the Nordic Hedge Index with reported September figures posted gains last month.

Top Performers

Equity hedge funds dominated last month’s list of top performers in the Nordic Hedge Index. Adrigo Hedge, a long/short equity fund focused on larger and more liquid companies in the Nordics that was merged into the younger Adrigo Small & Midcap L/S on October 1, was last month’s best-performing member of the Nordic Hedge Index with a gain of 9.3 percent. Adrigo Small & Midcap L/S, meanwhile, advanced 6.5 percent last month to take its year-to-date performance to 20.1 percent.

Activist investor Accendo gained 5.3 percent in September, which brought its performance for the first three quarters of 2020 to 51.1 percent. Accendo is the second best-performing member of the Nordic Hedge Index this year, trailing only thematic-focused long/short equity fund St. Petri L/S. Norron Select gained 5.1 percent last month and 12 percent in the first nine months of 2020. Oslo-based long/short fundamental equity fund CARN Long Short rounded out the top five list of best performers with a monthly gain of 4.6 percent, which brought its 2020 performance to 28.5 percent.

Biggest Positive Surprises

Hedge funds exhibit different risk-return profiles and hence experience different levels of volatility in their returns. With a gain of 9.3 percent for September, Adrigo Hedge experienced the biggest surprise last month relative to its historical level of volatility. Last month’s gain was 4.8 standard deviations above zero. Trend-following commodity fund Calculo Evolution Fund, meanwhile, gained 4.1 percent in September, which is 2.5 standard deviations above zero.

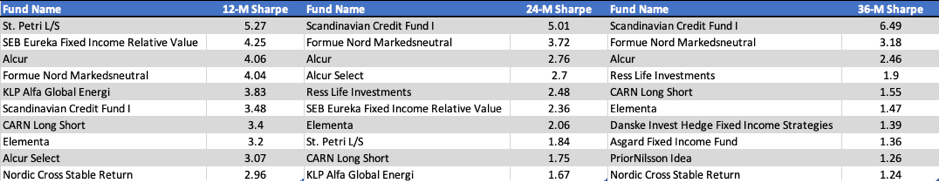

Highest Sharpe Ratios

Given the heterogeneous nature of hedge fund strategies, absolute performance numbers do not always reflect how successful hedge funds are. Risk-adjusted measures such as the Sharpe ratio are a good starting point in the process of identifying the best-performing hedge funds. The three tables below display the Nordic hedge funds with the highest Sharpe ratios over the past 12 months, past 24 months and 36 months.

The Month in Review for September can be downloaded below:

Photo by Elena Mozhvilo on Unsplash