Stockholm (HedgeNordic) – One of the main attractions of hedge funds to institutional investors has been their ability to deliver uncorrelated absolute returns. A recent report indicates that institutional investors now want their hedge fund managers to “target double bottom-line benefits: do well financially by doing good socially and environmentally.”

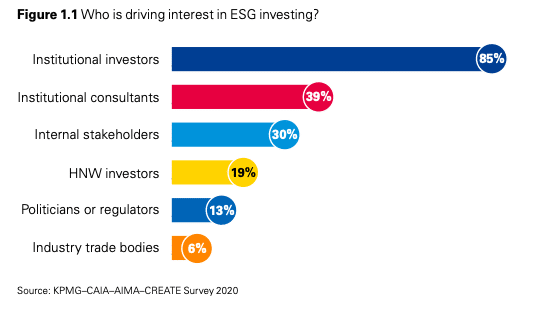

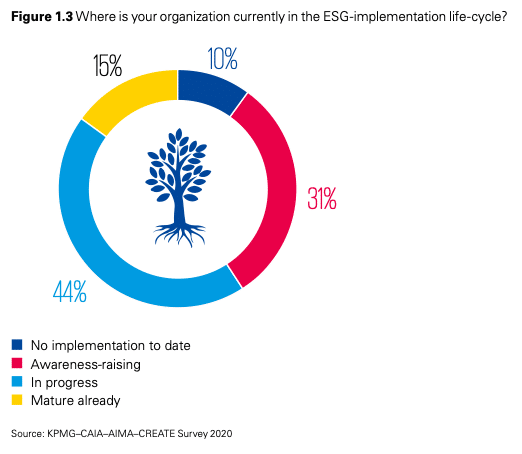

According to a survey of 135 institutional investors, hedge fund and long-only managers with combined assets of $6.25 trillion, 55 percent of institutional investors include environmental, social and governance (ESG) considerations as part of the due diligence process before allocating to a hedge fund manager. The report published by a collaboration of industry partners, including the Alternative Investment Management Association (AIMA), CAIA, CREATE-Research and KPMG, also highlights that 59 percent of hedge fund managers are either at the ‘mature’ or ‘in progress’ stage of implementing ESG through appropriate policies, committees, research and data. The advance is mainly driven by institutional investors.

“Recognising that purpose and profit are no longer mutually exclusive, a growing number of institutional investors expect hedge fund managers to incorporate environmental, social and governance (or ESG) factors into their investment activities,” writes Jack Inglis, the CEO of AIMA. “We are not yet able to pronounce unequivocally that ESG-compliant investments will lead to better returns,” acknowledges Inglis. “But every indication, from managers and investors alike, suggests that ESG integration is not just increasingly important, but for savvy managers, it can go hand-in-hand with generating alpha.”

In the process of incorporating ESG factors into their activities, three approaches have been used by at least three in every ten surveyed hedge fund managers. The first avenue is ESG integration (52 percent), which involves identifying material ESG factors and incorporating them into the investment process. The second avenue is negative screening (50 percent), which involves the exclusion of stocks that sit uncomfortably with the personal values of investors. The third avenue is shareholder engagement (31 percent).

According to the survey results, the scale of adoption of ESG considerations remains hampered by the lack of good quality data for managers to assess ESG risk factors. “A number of factors have conspired against progress thus far,” writes the report, which adds that “far and away, the most important one is the lack of quality and consistent data on ESG factors, as cited by 63 percent of our hedge fund respondents.” Another factor that hampers the progress is the confusion over industry terminology.

The complete report can be found here.

Image by ejaugsburg from Pixabay