Stockholm (HedgeNordic) – The Nordic Hedge Award will distinguish outstanding hedge fund managers from and active in the Nordic region on April 9, 2025, in Stockholm. Unlike many industry awards, the Nordic Hedge Award goes beyond pure performance-based evaluation. While nominees are selected using quantitative criteria, the winners are determined with input from a professional jury board of institutional investors. HedgeNordic is pleased to announce the jury board for the 2024 Nordic Hedge Award.

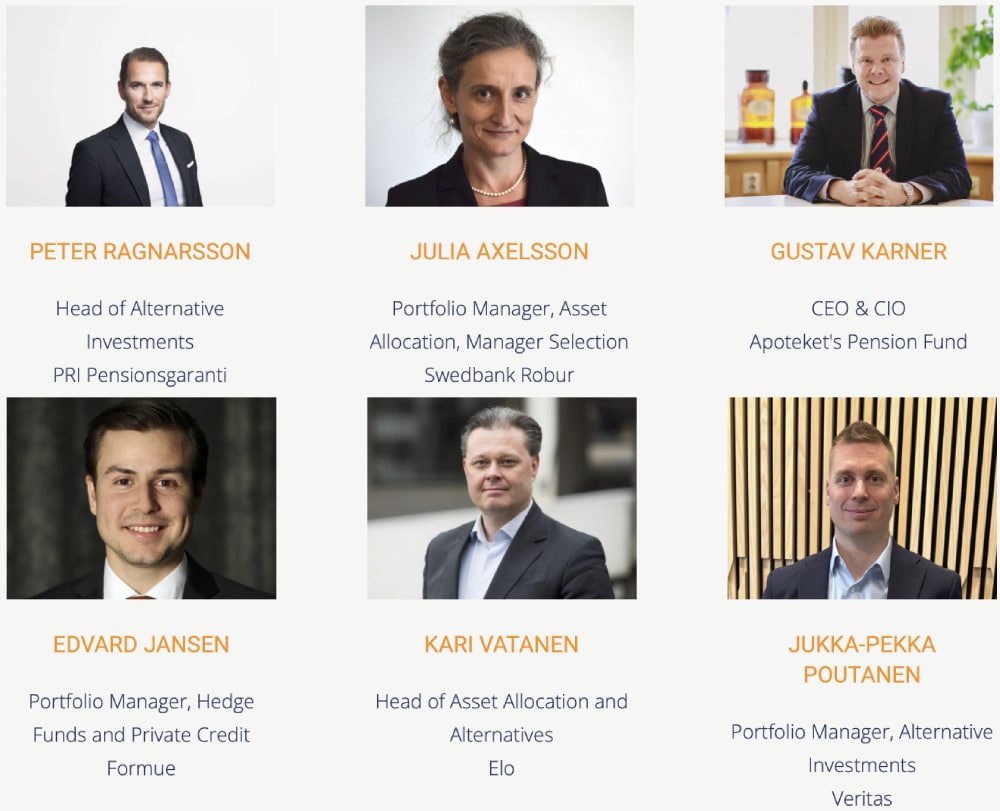

HedgeNordic is honored to have the support of Peter Ragnarsson, Head of Alternative Investments at PRI Pensionsgaranti; Julia Axelsson, Portfolio Manager of Asset Allocation and Manager Selection at Swedbank Robur; Gustav Karner, CEO and CIO at Apoteket’s Pension Fund; Edvard Jansen, Portfolio Manager of Hedge Funds and Private Credit at Formue; Kari Vatanen, Head of Allocation and Alternatives at Elo; and Jukka-Pekka Poutanen, Portfolio Manager of Alternative investments at Veritas Pension Insurance.

This jury of industry professionals from the Nordic region will evaluate the nominated funds at the 2024 Nordic Hedge Award considering both quantitative and qualitative criteria. The final results and winning funds are determined by combining the jury’s qualitative evaluations with the quantitative score calculated using a model co-developed with the Swedish House of Finance at the Stockholm School of Economics. The winners will be awarded at the event in Stockholm on April 9, 2025.

View the nominees for the 2024 Nordic Hedge Award: 2024 Nominations.

To learn more about present and past jury boards to the Nordic Hedge Award and the role of jury members, please visit: Jury Board to the Nordic Hedge Award.

The Nordic Hedge Award is supported by these fine entities: