By Rebecca Chesworth, Senior Equity Strategist at SPDR: Investors agonised over managing a complex or delayed US election result, but the Republican’s unexpectedly swift and clear election win has delivered immediate Trump Trade opportunities to some equity sectors – and potential headwinds to others.

The clean sweep Scenario 1 we explored in our pre-election analysis (Figure 1) now looks very likely.

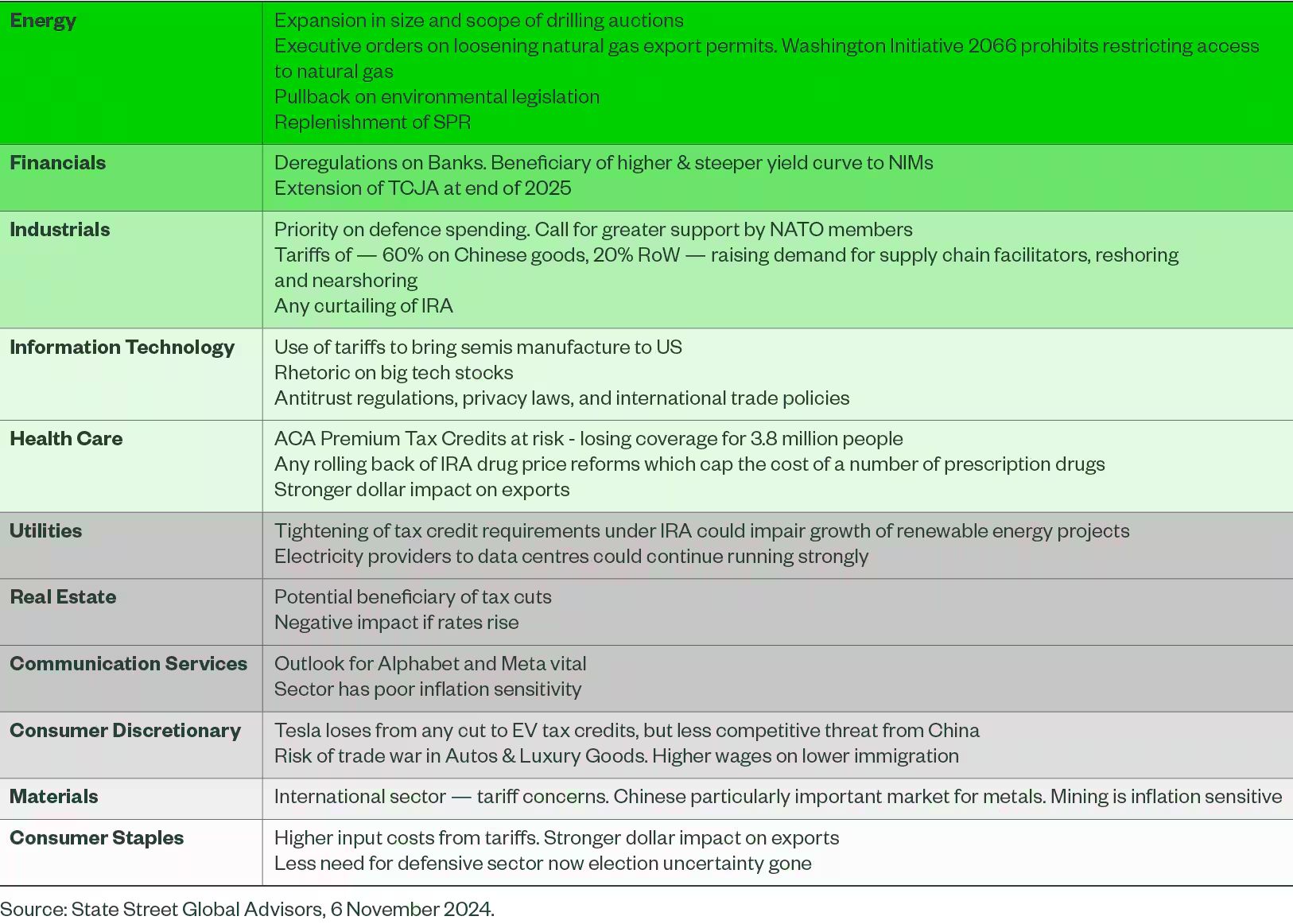

Figure 1: Impact of Election Outcomes on US Equity Sectors

With the election result now known, these are our thoughts on the eleven US sectors, ordered by potential impact.

Figure 2: US sectors ranked by potential benefits/harms of coming Republican Administration

The Federal Reserve Clears the Air

Energy is a winner from Day One. The president and vice president repeatedly vowed on the campaign trail to increase domestic fossil fuel production — reiterating a past Republican campaign slogan “drill, baby, drill”. Amongst early impacts, we expect expansion in the size and scope of drilling auctions. Other considerations include:

- Oil trade groups drew up ready-to-sign executive orders for President Trump on loosening natural gas export permit early in the campaign. Texas and Pennsylvania, both Republican-won, are the largest producers.

- A likely majority “yes” vote on the Washington Initiative 2066 would prohibit state and local governments from restricting access to natural gas.

- A potential pullback on environmental legislation, with looser regulations, would imply lower compliance costs.

- The rate of replenishment of the Strategic Petroleum Reserve

As an important domestic source of revenue, we expect little direct impact from tariffs.

- A higher inflation outlook – this sector has the biggest inflation sensitivity often outperforming as the US 5-year breakeven rate rises

Financials is another immediate beneficiary of the result, as Trump pledged large-scale demolition of government regulations starting on Day One. The biggest impact would likely on banks, where deregulation would boost profitability.

- The Tax Cuts and Jobs Act will likely be extended at the end of 2025. We could expect a rollover of expiring tax cuts, with possibly additional tax cuts as mentioned by Trump (including a reduction of corporate tax rate to 20%)

- Net interest margins, which calculate the money that banks earn in interest on loans compared with the amount paid on deposits, could benefit as the result of a higher, steeper yield curve.

Industrials faces a broadly positive impact across their diverse set of industries.

- Defence stocks are likely beneficiaries as Republican administrations often prioritise defence spending. Trump has specifically called out the need for greater support by NATO members, suggesting defence spending higher than the 2% of GDP agreed by the organisation earlier this year.

- The president-elect loves tariffs and has threatened to levy 60% on goods and services imported from China and 10% or 20% for imports rest of the world. This is not promising on a global basis from a growth or inflation angle. Amongst corporates’ response could be even more need to reshore and nearshore production activities, thus raising demand for supply chain facilitators.

- Industrials stocks have been big beneficiaries of Biden’s Inflation Reduction Act (IRA). The new administration could curtail some spending, indeed Republican lawmakers have committed to repealing the law. However, given the importance of the fiscal stimulus to many states, we don’t expect much disruption to companies involved in construction, engineering, and infrastructure development.

Information Technology: sentiment is very positive following the election result; especially given the high-profile support from tech billionaires during the campaign. However, we have several concerns and believe the impact will be more mixed.

- Trump’s sharp focus on China and preference for leveraging tariffs over existing 2022 Chips Act to bring advanced chipmaking to US could stifle the supply of chips at a crucial time of technological development. Big manufacturers including TSMC are demanding government investment to help build chip plants built in US.

- Trump and Vance have a history of attacking big tech stocks such as Meta (in Communication Services). Rhetoric on the US-China relationship will be key for Apple, which still sees a significant proportion of its component supply from China.

- Antitrust regulations, privacy laws, and international trade policies are all up in the air.

Health Care didn’t feature much in the campaign, but Republicans generally advocate for market-oriented solutions, opposed government intervention in the sector. Two issues to watch are:

- Any change to the Affordable Care Act (ACA). We do not expect a full repeal of the legislation given its broad popularity, but ACA Premium Tax Credits (which were increased during COVID and extended under Democrats through end of 2025) are at risk. This could remove coverage for 3.8 million people, would be negative for managed care names, and would put hospitals at greater risk on uncompensated care.

- A response on the IRA drug price reforms, which cap the cost of a number of prescription drugs. These may not be rolled back because of cost to public finances, but also will not be extended, which is taken as a positive by large pharma.

Utilities faces no direct impact from tariffs as they are a highly domestic industry. Under a Republican Sweep, we could see a partial repeal or tightening of tax credit requirements under IRA which could impair growth of renewable energy projects. However, many of solar power operations are in Republican states which affords some protection.

Real Estate and Communication Services also appear mixed. The former is a potential beneficiary of tax cuts but would be vulnerable to rate rises. The latter has poor inflation sensitivity.

Some Consumer Discretionary stocks in autos and luxury goods are at risk of a trade war in response to tariff, whilst housebuilders are potentially weak as there had been hopes of tax credits from Harris and interested rates could remain higher for longer. Tesla has responded strongly since election day despite loses from any cut to EV tax credits, a rise best explained as the Musk factor!

Materials is international in nature, and therefore exposed to tariff concerns. China is particularly important market for metals. However, mining is inflation sensitive.

Consumer Staples for us is the key loser. Investors should be wary of an impact on margins of higher input costs from tariffs. The sector is also a poor performer if inflation or the US dollar is higher.

Investors in any sector should recognise that this Trump Trade is unlikely to be a reboot of the post 2016 election Trade, which was fuelled by much more accommodating central banks, and low inflation, and resulted in a 15-month equity rally. And the devil will be in the detail of Trump’s tariff policy, which has in the past have had unintended consequences for US companies.

Trump Trade: ETFs to consider

SPDR® MSCI Europe Energy UCITS ETF

SPDR® S&P® U.S. Energy Select Sector UCITS ETF (Acc)

SPDR® MSCI World Energy UCITS ETF

SPDR® MSCI Europe Financials UCITS ETF

SPDR® S&P® U.S. Financials Select Sector UCITS ETF (Acc)

SPDR® MSCI World Financials UCITS ETF

SPDR® MSCI Europe Industrials UCITS ETF

SPDR® S&P® U.S. Industrials Select Sector UCITS ETF (Acc)

Disclosure

Marketing Communication

For institutional / professional investors use only.

Information Classification: General Access

Important Risk Information

For Investors in Finland:

The offering of funds by the Companies has been notified to the Financial Supervision Authority in accordance with Section 127 of the Act on Common Funds (29.1.1999/48) and by virtue of confirmation from the Financial Supervision Authority the Companies may publicly distribute their Shares in Finland. Certain information and documents that the Companies must publish in Ireland pursuant to applicable Irish law are translated into Finnish and are available for Finnish investors by contacting State Street Custodial Services (Ireland) Limited, 78 Sir John Rogerson’s Quay, Dublin 2, Ireland.

For Investors in Norway:

The offering of SPDR ETFs by the Companies has been notified to the Financial Supervisory Authority of Norway (Finanstilsynet) in accordance with applicable Norwegian Securities Funds legislation. By virtue of a confirmation letter from the Financial Supervisory Authority dated 28 March 2013 (16 October 2013 for umbrella II) the Companies may market and sell their shares in Norway.

Diversification does not ensure a profit or guarantee against loss.

Past performance is not a reliable indicator of future performance.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable.

All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

The stocks mentioned are not necessarily holdings invested in by [SSGA or third party fund manager]. References to specific company stocks should not be construed as recommendations or investment advice. The statements and opinions are subject to change at any time, based on market and other conditions.

The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other rofessional advisor.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

This communication is directed at professional clients (this includes eligible counterparties as defined by the appropriate EU regulator) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Equity securities may fluctuate in value in response to the activities of individual companies and general market and economic conditions.

Investments in mid-sized companies may involve greater risks than those in larger, better-known companies, but may be less volatile than investments in smaller companies.

Investments in emerging or developing markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that aregenerally less diverse and mature and to political systems which have less stability than those of more developed countries.

Investing in foreign domiciled securities may involve risk of capital loss from unfavourable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Concentrated investments in a particular sector or industry tend to be more volatile than the overall market and increases risk that events negatively affecting such sectors or industries could reduce returns, potentially causing the value of the Fund’s shares to decrease.

The Fund/share class may use financial derivatives instruments for currency hedging and to manage the portfolio efficiently. The Fund may purchase securities that are not denominated in the share class currency. Hedging should mitigate the impact of exchange rate fluctuations however hedges are sometimes subject to imperfect matching which could generate losses.

The views expressed in this material are the views of SPDR EMEA Strategy and Research through 4 November 2024[MA1] and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This document has been issued by State Street Global Advisors Europe Limited (“SSGAEL”), regulated by the Central Bank of Ireland. Registered office address 78 Sir John Rogerson’s Quay, Dublin 2. Registered number 49934. T: +353 (0)1 776 3000. Fax: +353 (0)1 776 3300. Web: www.ssga.com.

SPDR ETFs is the exchange traded funds (“ETF”) platform of State Street Global Advisors and is comprised of funds that have been authorised by Central Bank of Ireland as open-ended UCITS nvestment companies.

SSGA SPDR ETFs Europe I & SPDR ETFs Europe II plc issue SPDR ETFs, and is an open-ended investment company with variable capital having segregated liability between its sub-funds. The Company is organized as an Undertaking for Collective Investments in Transferable Securities (UCITS) under the laws of Ireland and authorized as a UCITS by the Central Bank of Ireland.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Please refer to the Fund’s latest Key Information Document (KID)/Key Investor Information Document (KIID) and Prospectus before making any final investment decision. The latest English version of the prospectus and the KID/KIID can be found at www.ssga.com. A summary of investor rights can be found here: https://www.ssga.com/library-content/products/fund-docs/summary-of-investor-rights/ssga-spdr-investors-rights-summary.pdf

Note that the Management Company may decide to terminate the arrangements made for marketing and proceed with de-notification in compliance with Article 93a of Directive 2009/65/EC

7366521.1.1.EMEA.INST

Exp. Date: 31/12/2024© 2024 State Street Corporation – All Rights Reserved.