By Krzysztof Janiga, CFA, Senior Equity ETF Strategist at SPDR: As valuation levels in large caps became extreme, the market rally began to broaden with investors searching for opportunities across sectors and market cap segments. Small-cap companies may be well positioned to benefit from that broadening given inexpensive multiples, catch-up potential, cyclical sector composition and more domestic profiles in the deglobalizing world. While there are many commonalities among small caps, no two exposures are the same and, as such, each region is exposed to specific risks and opportunities.

US Small and Mid Caps: Dovish Signals and Long-term Resilience

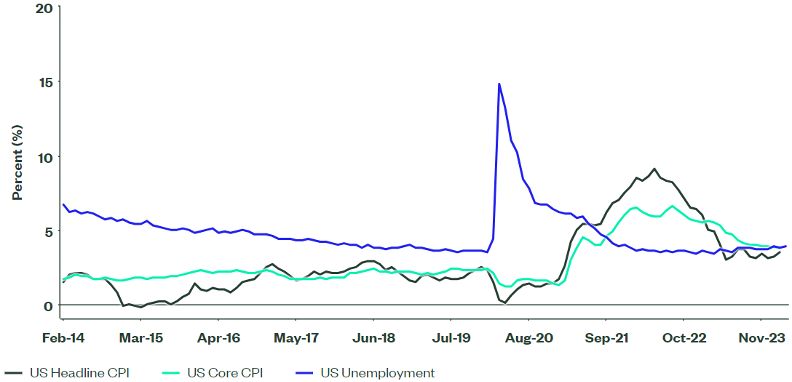

In this stage of the cycle, inflation prints will continue to dictate small-cap performance. US small caps sold off in April as the CPI overshoot led to increasingly hawkish bets and yield expansion. Since then, we observed a rebound driven by several dovish signals including: 1) the May Federal Reserve (Fed) meeting, which was less hawkish than feared; 2) softer-than-expected Q1 US GDP growth at 1.6% annualized rate and 3) wage growth moderating to 0.2%. While CPI overshoots remain a key risk for equity markets including small caps, recent data prints advocate for the possibility of a more dovish outcome than currently priced in by the markets.[1]

US GDP growth softened, but the Q1 print did not end the US exceptionalism story as growth continues to be much higher than in other parts of the developed world driven by consumption, which, thanks to labour markets, remained remarkably resilient against tight monetary policy. Economic expansion in the US has been chronically underappreciated, leading to continuous upgrades of GDP forecasts for 2023 and 2024.

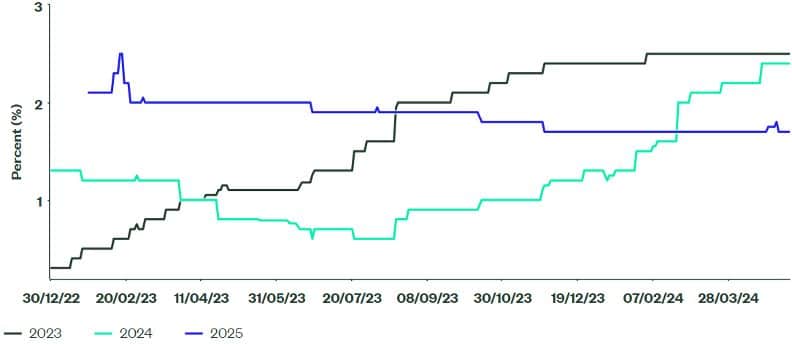

Figure 1: Bloomberg Consensus US GDP Growth Forecast Evolution

Moderating wage growth combined with the low unemployment is a goldilocks scenario for small caps. The 0.2% monthly growth in wages combined with productivity gains may allow the Fed to make a dovish turn in July or September, while remarkably low unemployment at 3.9% supports domestic consumption. In the long run, the labour market’s resilience is fundamental for more domestic and cyclical small and mid caps prospering.

Figure 2: US Inflation and Unemployment

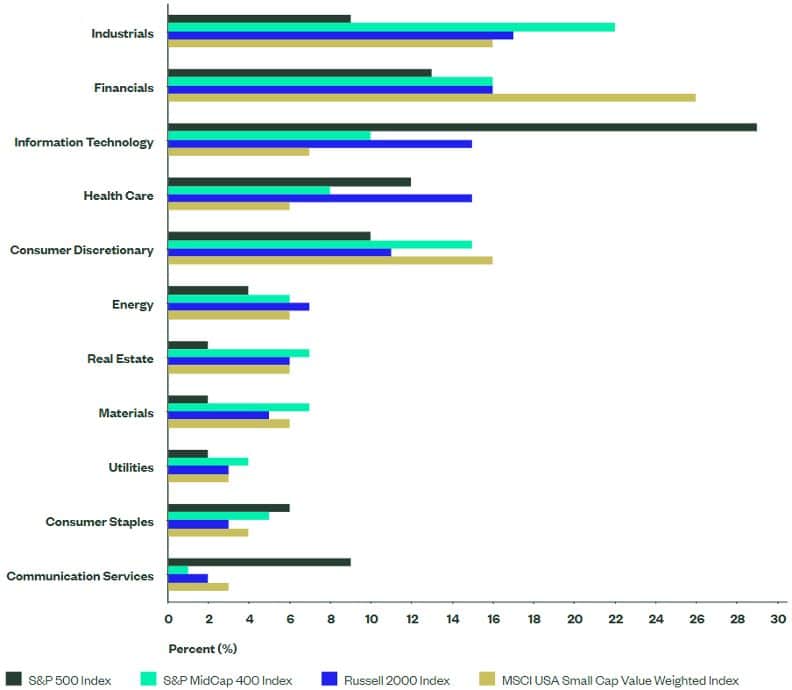

Small- and mid-cap indices generate between 76% and 79% of their revenue within the US, while the corresponding number for the S&P 500® Index is 59%[2]. This makes the Russell 2000, MSCI USA Value Weighted and S&P MidCap 400 indices more direct tools to access US exceptionalism. But each strategy has a unique profile:

- The S&P MidCap 400 Index overweights more traditional companies — Industrials is the largest sector — which is appealing in the context of rebounding ISM readings. Longer term, public spending in the form of the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, the Inflation Reduction Act, and broad reshoring efforts are likely to benefit more domestic and industrial-heavy mid and small caps.

- The Russell 2000 Index overweights biotech and software companies, which often are in the earlier stage of development. This means the index has, in our view, a higher risk-return profile.

- The MSCI USA Small Cap Value Weighted Index is skewed towards financials, which represent more than a quarter of the index.

The common characteristics of the three indices is a cyclical and less tech-heavy sector split, which may be a tailwind if the hard landing is avoided and broadening of market rally continues.

Figure 3: US Small and Large-cap Index Sector Breakdown

How to Access US Small and Mid Caps

SPDR® S&P® 400 U.S. Mid Cap UCITS ETF (Acc)

SPDR® Russell 2000 U.S. Small Cap UCITS ETF (Acc)

SPDR® MSCI USA Small Cap Value Weighted UCITS ETF

European Small Caps: Upcoming Cuts and Improved Growth Create Opportunities

The backdrop for European small caps has notably improved on an absolute and relative basis over the course of 2024. Inflation in Europe is moderating more convincingly than in the US, making June rate cuts a base-case scenario in the Eurozone and in the UK. The Riksbank and the SNB have already begun the easing process providing a tailwind to risky assets. Easing in Sweden is of particular importance given structurally short debt maturity schedule.

While disinflation is a most welcome but ongoing theme, the improvement to the investment backdrop which we didn’t observe earlier comes from better-than-expected economic activity. Germany avoided recession in Q1 and GDP growth in France at +0.2% and Spain at +0.7% in the first quarter exceeded estimates. In the UK, recession ended with GDP jumping by 0.6% quarter-on-quarter — the strongest growth since the end of lockdown. On balance, the economic activity is likely to remain much more muted than in the US. However, with rate cuts on the horizon, improvements to the economic outlook and lack of recession are becoming significant tailwinds to European small caps in our view.

Small caps in Europe are trading at inexpensive multiples compared not only to large caps but also to their own history. The forward price-to-earnings (P/E) at 13.0x is in the second-lowest decile for the last 10 years. Over that period, on average, the MSCI Europe Small Cap Index traded at a 9% higher P/E multiple than the MSCI Europe Index. It currently trades at a 7% discount — one of the lowest levels in 10 years. These levels may provide an interesting entry point as rate cuts are at hand while the European economies are holding up better than expected.

Figure 4: Price-to-earnings 1y Forward

The MSCI Europe Small Cap and MSCI Europe Small Cap Value Weighted indices generate respectively 66% and 69% of their revenue within Europe, making them more domestic exposures compared to the MSCI Europe Index at 42%[3]. From a regional standpoint, small-cap indices overweight the UK and Sweden while the most significant underweights are France and Switzerland.

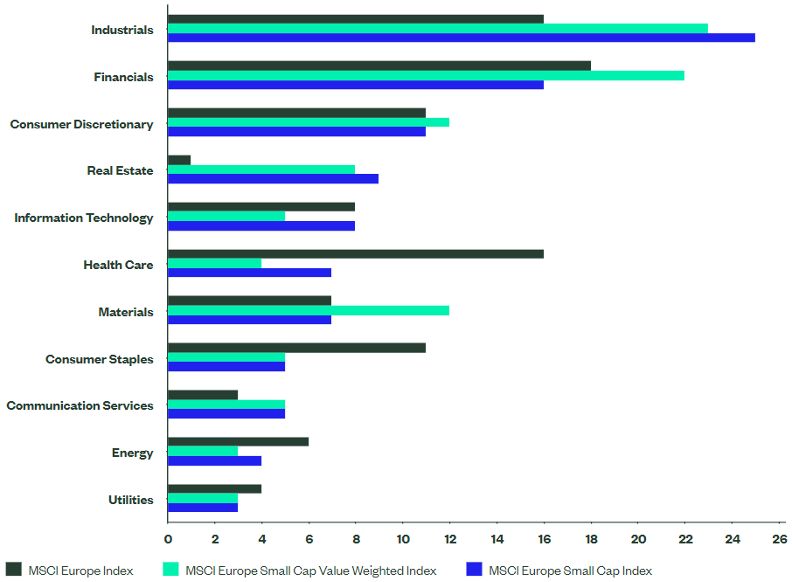

Perhaps the most important distinction lies in the sector composition, with Industrials representing nearly a quarter of small-cap exposures. The sector is supported by long-term tailwinds including green transition, energy security, and reshoring. Another important overweight is Real Estate, a battered sector which may enjoy a rebound as the battle against inflation in Europe is being won and central banks across the continent are clearly more keen to cut interest. The underweight towards Health Care and Consumer Staples makes European small caps a more risk-on exposure from the sector standpoint.

Figure 5: Sector Composition

How to Access European Small Caps

SPDR® MSCI Europe Small Cap UCITS ETF

SPDR® MSCI Europe Small Cap Value Weighted UCITS ETF

Global Developed Small Caps: Diversified Exposure With Undemanding Valuations

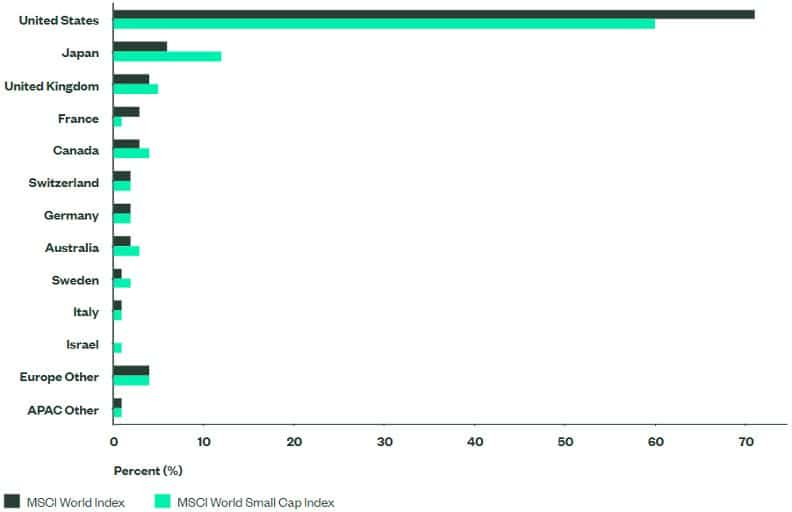

The MSCI World Small Cap Index combines US small caps (representing 60% of the exposure) and European small caps (accounting for 18%). This helps to balance risks and opportunities associated with each region. The third-highest weight is Japan, representing 12% of the index — double its weight in the MSCI World Index. While the weakening Yen drove equity performance over the last two years, in 2024, “Shunto” negotiations led to strong wage growth, which is a tailwind for more domestic small caps. And the Tokyo Stock Exchange reforms are expected to increase efficiency among listed companies.

Figure 6: Country Composition

As CPI levels across the world gradually moderate and the outlook improves beyond the United States, the opportunity for a catch-up trade opens up. Valuations remain inexpensive, both on an absolute basis and in relation to the MSCI World Index. Finally, when it comes to potential broadening of performance, the MSCI World Small Cap Index is less concentrated than the MSCI World Index where the weight of the top 10 constituents is 1.9% versus 21.5%, respectively[4].

Figure 7: Price-to-earnings 1y Forward

How to Access Global Developed Small Caps

SPDR® MSCI World Small Cap UCITS ETF

Emerging Markets Small Caps: More Direct Access to Economic Growth

Emerging market (EM) economies continue to outpace the developed world. Yet EM equity returns have been poor, dragged down by Chinese stocks that face numerous challenges, including the reemergence of technology crackdown, geopolitical tensions, and slower-than-expected economic activity. And while Chinese equities rebounded over the course of the year, geopolitical and regulatory risks remain in place.

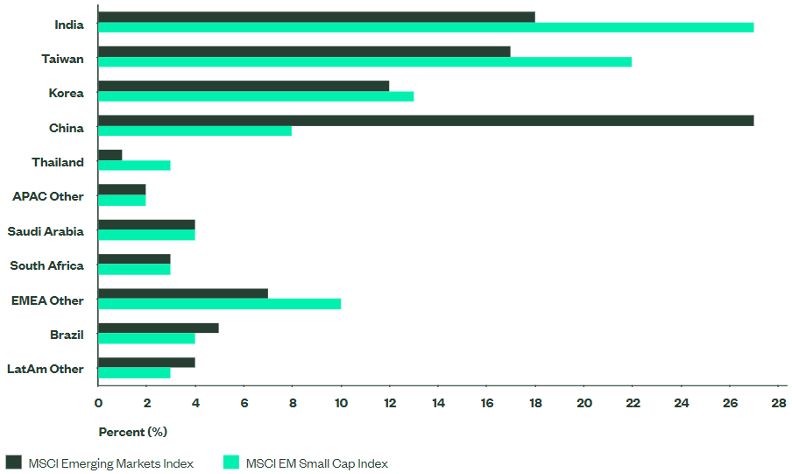

The MSCI EM Small Cap Index offers a simple solution to those risks and headwinds by heavily underweighting China, which accounts for only 8% (versus 27% for the MSCI EM Index — see Figure 8). Instead, India, which is the fastest growing major economy, represents 27%. Rapid growth and the need for diversification in supply chains make India an attractive place for foreign capital, which is expected to flow into the country over the medium term in various forms. The second-most important overweight is Taiwan at 22% of the index. While geopolitical risks need to be monitored, Taiwan remains an indispensable part of the semiconductor supply chain. The third-highest overweight is South Korea, a powerhouse in technology offering access to a wealth of high-quality companies.

Figure 8: Country Composition

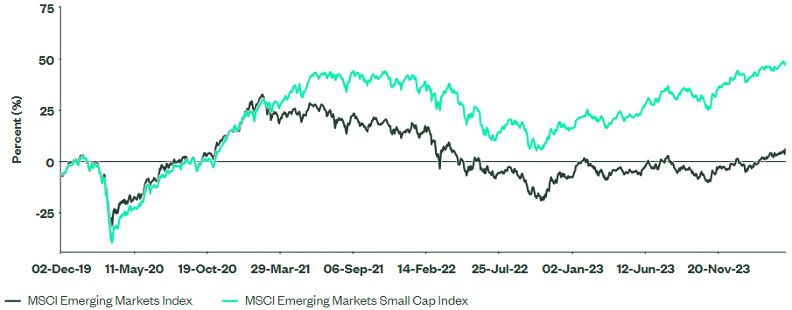

The country breakdown has been the key driver of the MSCI EM Small Caps Index outperforming the MSCI EM Index in recent years, and we expect it to remain a tailwind until there is sustainable improvement in the geopolitical and regulatory landscape of China.

Moreover, EM small caps also generate a larger share of their revenue domestically, allowing for more direct benefit from relatively robust EM economies. The MSCI EM Small Cap Index is well diversified with the top 10 companies representing only 3% (versus 25% in the MSCI EM Index)[5]. Moreover, state-owned companies, which may be less efficient, account for only 8%; the corresponding number for the MSCI Emerging Market Index is 23%[6].

Figure 9: Performance Since the End of 2019

How to Access Emerging Market Small Caps

SPDR® MSCI Emerging Markets Small Cap UCITS ETF

Footnote

[1] Bloomberg Finance L.P., as of 30 April 2024.

[2] FactSet, as of 31 March 2024.

[3] FactSet, as of 30 April 2024.

[4] MSCI, as of 29 March 2024.

[5] MSCI, as of 30 April 2024.

[6] MSCI, as of 31 October 2023.

Disclosure

Marketing Communication

Information Classification: General Access

For Professional Clients/Qualified Investors Use Only.

For qualified investors according to Article 10(3) and (3ter) of the Swiss Collective Investment Schemes Act (“CISA”) and its implementing ordinance, at the exclusion of qualified investors with an opting-out pursuant to Art. 5(1) of the Swiss Federal Law on Financial Services (“FinSA”) and without any portfolio management or advisory relationship with a financial intermediary pursuant to Article 10(3ter) CISA (“Excluded Qualified Investors”) only.

For Investors in Finland The offering of funds by the Companies has been notified to the Financial Supervision Authority in accordance with Section 127 of the Act on Common Funds (29.1.1999/48) and by virtue of confirmation from the Financial Supervision Authority the Companies may publicly distribute their Shares in Finland. Certain information and documents that the Companies must publish in Ireland pursuant to applicable Irish law are translated into Finnish and are available for Finnish investors by contacting State Street Custodial Services (Ireland) Limited, 78 Sir John Rogerson’s Quay, Dublin 2, Ireland.

Ireland Entity State Street Global Advisors Europe Limited is regulated by the Central Bank of Ireland. Registered office address 78 Sir John Rogerson’s Quay, Dublin 2. Registered Number: 49934. T: +353 (0)1 776 3000. F: +353 (0)1 776 3300.

Accordingly, the Securities shall only be sold in Israel to an investor of the type listed in the First Schedule to the Israeli Securities Law, 1978, which has confirmed in writing that it falls within one of the categories listed therein (accompanied by external confirmation where this is required under ISA guidelines), that it is aware of the implications of being considered such an investor and consents thereto, and further that the Securities are being purchased for its own account and not for the purpose of re-sale or distribution.

This sales brochure may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent.

Nothing in this sales brochure should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licenced investment advisor prior to making any investment. State Street is not licenced under the Investment Advice Law, nor does it carry the insurance as required of a licencee thereunder.

This sales brochure does not constitute an offer to sell or solicitation of an offer to buy any securities other than the Securities offered hereby, nor does it constitute an offer to sell to or solicitation of an offer to buy from any person or persons in any state or other jurisdiction in which such offer or solicitation would be unlawful, or in which the person making such offer or solicitation is not qualified to do so, or to a person or persons to whom it is unlawful to make such offer or solicitation.

For Investors in Norway The offering of SPDR ETFs by the Companies has been notified to the Financial Supervisory Authority of Norway (Finanstilsynet) in accordance with applicable Norwegian Securities Funds legislation. By virtue of a confirmation letter from the Financial Supervisory Authority dated 28 March 2013 (16 October 2013 for umbrella II) the Companies may market and sell their shares in Norway.

Issuer Entity

This document has been issued by State Street Global Advisors Europe Limited (“SSGAEL”), regulated by the Central Bank of Ireland. Registered office address 78 Sir John Rogerson’s Quay, Dublin 2. Registered number 49934. T: +353 (0)1 776 3000. F: +353 (0)1 776 3300. Web: ssga.com.

ETFs trade like stocks, are subject to investment risk and will fluctuate in market value. The investment return and principal value of an investment will fluctuate in value, so that when shares are sold or redeemed, they may be worth more or less than when they were purchased. Although shares may be bought or sold on an exchange through any brokerage account, shares are not individually redeemable from the fund. Investors may acquire shares and tender them for redemption through the fund in large aggregations known as “creation units.” Please see the fund’s prospectus for more details.

SPDR ETFs is the exchange traded funds (“ETF”) platform of State Street Global Advisors and is comprised of funds that have been authorised by Central Bank of Ireland as open-ended UCITS investment companies.

SSGA SPDR ETFs Europe I & SPDR ETFs Europe II plc issue SPDR ETFs, and is an open-ended investment company with variable capital having segregated liability between its sub-funds. The Company is organized as an Undertaking for Collective Investments in Transferable Securities (UCITS) under the laws of Ireland and authorized as a UCITS by the Central Bank of Ireland.

Investing involves risk including the risk of loss of principal.

Diversification does not ensure a profit or guarantee against loss.

Past performance is not a reliable indicator of future performance.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional advisor.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Investing in foreign domiciled securities may involve risk of capital loss from unfavourable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Companies with large market capitalizations go in and out of favor based on market and economic conditions. Larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the value of the security may not rise as much as companies with smaller market capitalizations.

Investments in small-sized companies may involve greater risks than in those of larger, better known companies.

The views expressed in this material are the views of SPDR EMEA Strategy and Research through 16 May 2024 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

Please refer to the Fund’s latest Key Information Document (KID)/Key Investor Information Document (KIID) and Prospectus before making any final investment decision. The latest English version of the prospectus and the KID/KIID can be found at ssga.com. A summary of investor rights can be found here: https://www.ssga.com/library-content/products/ fund-docs/summary-of-investor-rights/ ssga-spdr-investors-rights-summary.pdf.

Note that the Management Company may decide to terminate the arrangements made for marketing and proceed with de-notification in compliance with Article 93a of Directive 2009/65/EC.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the appropriate EU regulator or Swiss Regulator) who are deemed both knowledgeable and experienced in matters relating to investments.

The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

2015149.272.1.EMEA.INST

Exp. Date: 31/05/2025

© 2024 State Street Corporation.

All Rights Reserved.