By Paul Jackson – Global Head of Asset Allocation Research at Invesco: It is time to forget central scenarios and think about improbable but possible outcomes. Markets finished 2023 positively, so our list of surprises errs to the negative (these hypothetical predictions are our views of what could happen even if they do not necessarily form part of our central scenario).

Aristotle said that “probable impossibilities are to be preferred to improbable possibilities”, meaning that we find it easier to believe in interesting impossibilities (B52s on the moon, say) than in unlikely possibilities. The aim of this document is to seek those unlikely possibilities — out-of-consensus ideas for 2024 that I believe have at least a 30% chance of occurring. The concept was unashamedly borrowed from erstwhile colleague Byron Wien, who sadly passed away during 2023.

I believe the biggest returns are earned (or the biggest losses avoided) by successfully taking out-of-consensus positions. A year ago, the mood was hesitant after a difficult 2022. Hence, my improbable but possible ideas were biased to the positive side (“US core CPI inflation falls below 4.0%”; “Ukrainian government debt outperforms” and “Pakistan stocks to outperform major indices” were ideas that worked). The mood is now more optimistic (after a bullish end to 2023), so my list expresses some caution – don’t look for internal consistency, as there is none.

1. The US experiences a short recession

Judging by recent performance in US equity and high yield markets, there seems little fear of recession. However, until the blowout 4.9% Q3 GDP growth (quarter-on-quarter, annualised), the US economy seemed to be decelerating (growth trending lower), which made sense given Fed tightening and the squeeze on real incomes. Further, the strong Q3 growth came from three main sources: government consumption (contributing 1.0 percentage point to GDP), inventories (1.3 ppts) and personal consumption (2.1 ppts). It is hard to imagine the government providing that level of support for long (our calculations suggest that gross government debt exceeds 120% of GDP and that government interest costs approached 16% of revenues in November 2023, a level not seen since 1997). As for inventories, their contribution tends to be fleeting, with strength in one quarter often turning to weakness in subsequent periods. Most worrying is the fact that consumer spending in Q3 was spurred by a sharp decline in savings (disposable income grew by 0.7% but savings fell by 17%). I doubt the consumer can repeat that trick over the coming quarters. Given possible delayed effects from Fed tightening, I think we might see two consecutive negative GDP quarters by the end of 2024 or an NBER defined recession.

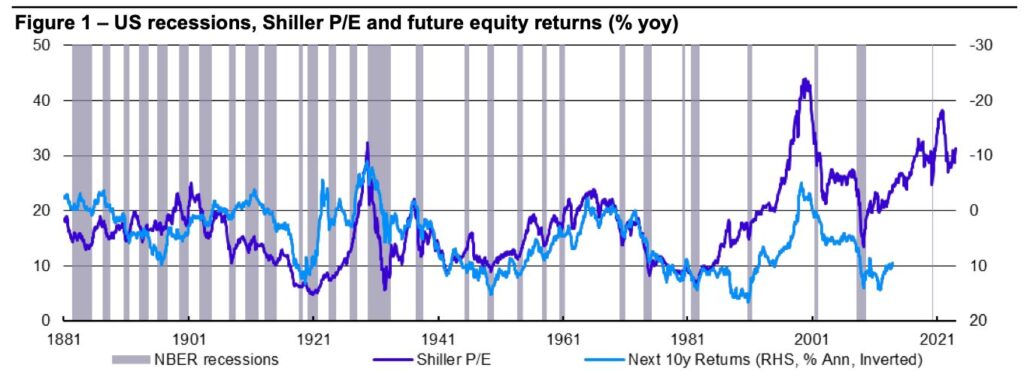

2. S&P 500 finishes the year lower than it started

Global equities finished 2023 on a strong note, with the S&P 500 gaining 24% during the year. Admittedly, that only took it back to where it was at the end of 2021 but I think the latter was overblown (the record close was 4797 on 3 January 2022). Figure 1 suggests the US market remains expensive (Shiller PE above 31, based on our estimates). Long term returns have tended to be poor from these valuations and I suspect the optimism implied by markets may go unrewarded (especially if there is recession or higher inflation).

3. USDJPY falls below 125

Having peaked at around 152 in November 2023 (a 33 year high), USDJPY has since fallen to around 141 (as of 29 December 2023). This rebound in the yen (fall in USDJPY) has been aided by speculation that the BOJ will soon be raising rates (I am amazed it hasn’t done so already) and, of course, that the Fed is about to start easing. With real GDP growth of 1.5% in the year to 2023 Q3 (not bad given the demographics) and CPI inflation of 2.8% in November (3.8% if fresh food & energy are excluded), I find it hard to understand why the BOJ continues to operate such a loose policy (policy rate of -0.1% and continued purchases of some assets). Supposing the BOJ does start to normalise, and that most other major central banks start to ease, I expect the yen to strengthen substantially. A 10% strengthening of the yen in 2024 would take USDJPY below 125 and I think that is easily achievable (the yen would then still look historically cheap in real terms).

4. Democrats win at least two of three major races

US elections take place on 5 November 2024. As well as the race for the White House, all seats in the House of Representatives are up for re-election, along with 34 (out of 100) Senate seats. Opinion polls make uncomfortable reading for Democrats. Analyses conducted by 270toWin suggest that Donald Trump is likely to return to the White House, that Republicans are likely to retain the House, while regaining the Senate (see 270towin.com). A Republican clean sweep could enable a radical second Trump presidential term, perhaps provoking domestic and international shock waves. However, all of the races appear tight and I suspect Democrats will perform better than currently expected: Fed rate cuts may improve the national mood; Republicans have underperformed opinion poll indications in recent elections/referenda (as women rebel) and there is always the possibility that Donald Trump’s legal travails finally erode his popularity. I doubt the Republicans will make a clean sweep and suspect the Democrats may come out on top in at least two of those three races.

5. ANC loses sole control of South Africa

Since the first universal suffrage elections in 1994, South Africa’s African National Congress (ANC) has been the governing party. Starting with Nelson Mandela’s victory, the ANC’s share of vote had never fallen below 62%…until Cyril Ramaphosa’s victory in 2019 (57.5%). Even worse, the ANC’s share of vote fell below 50% (to 46%) in nationwide local elections in 2021. Recent opinion polls suggest its share of vote will be 40%-50% in the 2024 general election (between mid-May and Mid-August). The electoral system is one of proportional representation but there are some changes this time (including accommodation of independent candidates), which may complicate the outcome. Judging by opinion polls, the ANC will be the largest party in parliament but I can think of three possibilities if it has less than 50% of the seats: first, a coalition with the Economic Freedom Fighters (Marxist- Leninist black nationalist party); second, a broader coalition including both the ANC and the centrist Democratic Alliance (official opposition) and, third, the ANC enters into opposition (to a government formed by the Multi-Party Charter group of parties, led by the DA). Either, way, it looks as though South Africa is heading for coalition government, which may bring volatility.

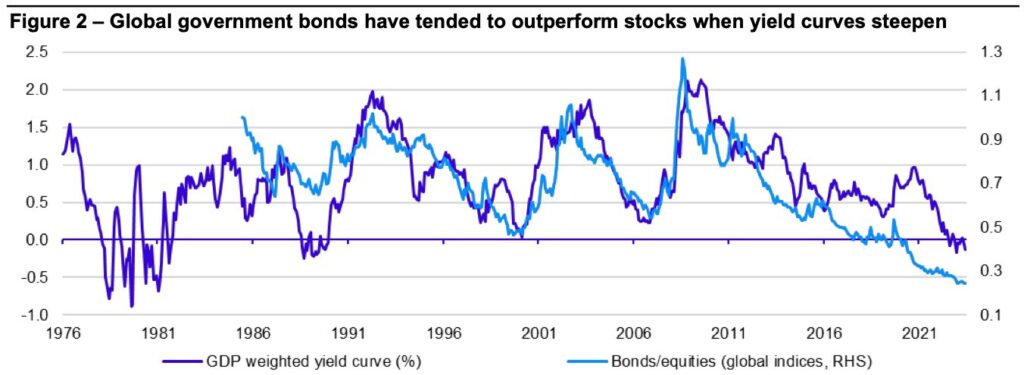

6. Global government bonds outperform equities

As shown by Figure 2, global government bonds have underperformed equities since the global financial crisis (GFC). That is hardly surprising given the low bond yields on offer for most of that period. Now that bond yields have risen, I believe the long period of extreme government bond underperformance is over. Further, Figure 2 suggests that government bonds have tended to outperform equities when yield curves steepen, which is what I predict for 2024 as central banks cut policy rates. Hence, I expect government bonds (ICE BofA Global Government Bond Index) to outperform equities (MSCI World Index) during 2024, which would be the first time since 2018 (and prior to that, 2011). I suspect that recession would help the cause.

Source: ICE BofA, MSCI, LSEG Datastream and Invesco Global Market Strategy Office

7. Geopolitics push Brent/gold above $100/$2350

A lacklustre global economy may explain why supply restrictions by OPEC+ and the Israel/Hamas conflict have had a limited effect on energy prices. However, with problems mounting in the Middle East (including the risk of Iranian involvement and problems in the Red Sea), the ongoing conflict between Russia and Ukraine and a US election cycle that could destabilise global geopolitics, I think it possible that the price of Brent goes above $100 in 2024 (up nearly 30% from 29 December 2023, based on the first month future price). Gold has gained more than $200 since the Hamas attack on Israel and I think it could go above $2350, especially with a repeat of the 2016 “Trump premium” (which I reckon added more than $200 to the price).

8. Colombian stocks to outperform major indices

In my search for exotic stock market opportunities, I usually look for the holy grail of a dividend yield that exceeds the price/earnings ratio. Last year, I chose Pakistan, which despite strong index gains remains in that valuation category. Other examples include Bahrain, Czechia, Kenya and Romania but I have chosen to go for Colombia this year. After a 7% index decline in 2023, the current MSCI COLCAP price/earnings ratio is 6.1x and the dividend yield is 11.2% (changing to 6.4x and 7.7%, respectively, based on consensus 2024 forecasts, according to Bloomberg, as of 4 January 2024). Usually, whenever valuation metrics are at such levels it signifies either that a big opportunity has presented itself or that something is about to go very wrong. The consensus estimates suggest that both earnings and dividends are expected to fall but still leaving dividend yield higher than PE. Also, the usual macro metrics (inflation and government/international balances) do not signal impending disaster and the Peso strengthened during 2023. As usual with these sorts of picks, the market is small, with a market capitalisation below $20bn.

9. Chinese stocks to outperform the US

Deploying the stopped clock principle, I am sticking with one of the ideas from last year that failed miserably: that Chinese stocks will outperform major indices. However, the underperformance reported in Figure 4 only enhances the valuation argument. China’s cyclically adjusted PE ratio was 13.1 at end- 2023 compared to 35.7 in the US, 42.2 in India and its own historical average of 25.3 (see Figure 3). Further, I think China’s economic performance has been better than many give it credit for: at 4.9% in 2023 Q3, its year-on year GDP growth was much better than the 2.9% seen in the US. With a central bank that has been easing over recent years, I suspect China’s economy will continue to outperform the US. I also think that China’s policy making approach has now become more predictable, which may not be the case in the US if there is a change at the White House.

10. France wins Euro 2024

UEFA’s Euro 2024 tournament will be played in Germany in June and July, with the final in Berlin on Sunday 14 July. Bookmakers seem to favour England, though that may be biased by the location of their businesses (see oddschecker.com). Predictions are made harder by the fact that three of the 24 competing nations are yet to be decided (by a process of playoffs) and that four “round of 16” competitors will be the best performing third placed teams from the group stage. Looking at the potential pathways through the competition, I suspect (unpatriotically) that England will be eliminated in the semi-finals by France, who I think will then register a Bastille Day victory against Spain.