By Levi Morin – SS&C Eze, a unit of SS&C Technologies: I don’t think it’s an overstatement to say that the market environment over the past 3.5 years might be the most unprecedented we’ve seen this century. (And yes, I know The Great Recession happened.)

The world shut down, supply chains dried up, we cut interest rates and bought a lot of treasury and mortgage bonds, stocks went to an all-time high, and inflation to a level not seen since before I was born.

Inflation was ‘transitory’ until it wasn’t. The Fed raised rates by 525 basis points in less than a year and a half, stocks cooled off, a couple of banks collapsed, and now we find ourselves here – still with more questions than answers.

Now, I’m not here to offer my take on where the markets or interest rates are going next. My guess is as good as yours. A year ago, I thought that we would have either entered a recession by now or declared a successful ‘soft landing.’ I was wrong on both accounts.

What I am here to say is that if the last 3.5 years have taught us anything, it’s the importance of being nimble with your investment strategy. Having a system in place allowing your firm to execute on tactical and strategic asset allocation decisions with speed and accuracy is no longer a nice to have; it’s a requirement.

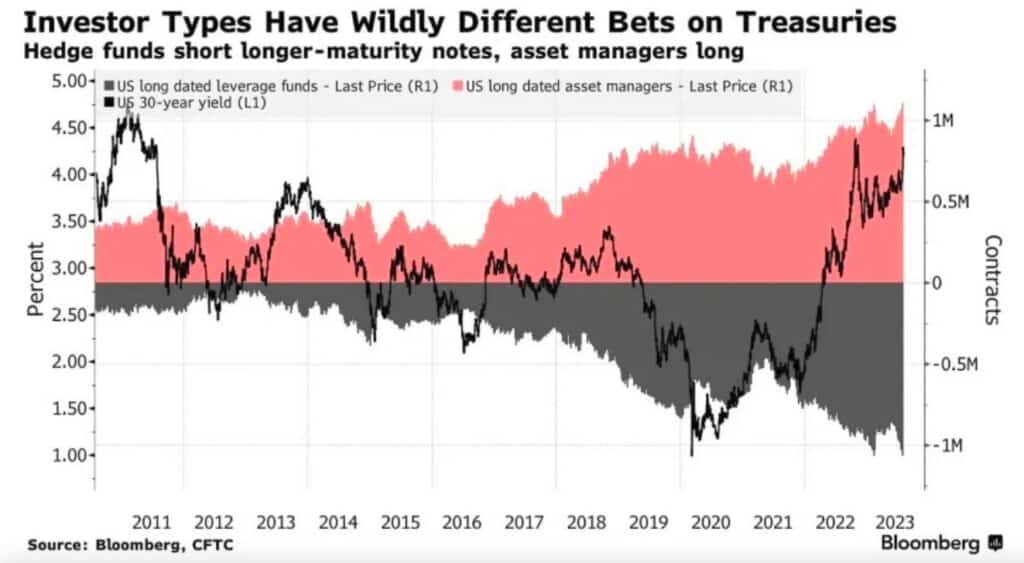

With the risk-free rate sitting at ~5.25%, managers who may have been traditionally equity-focused are looking to allocate a portion of their strategy to various fixed-income products. Now more than ever, managers are making active bets on where rates are headed. Just look at the graph below. Recent history shows we’ve never seen more dispersed views on interest rates.

Regardless of investment strategy today, asset allocation tomorrow could be vastly different as investors react to new information. Unfortunately, the front, middle, and back office requirements of onboarding and executing a new strategy or asset class can be manual and detract from time spent generating investment ideas.

In speaking with investment managers about bond workflows, I’ll sometimes hear something like this: “We figure out the amount we want to trade based on calculations we have set up in Excel. Once we know what we want to trade, we’ll call up our dealers and execute over the phone or on chat. When trade details have been confirmed, we’ll swivel over to system X to book it, then export and email an Excel file to the necessary counterparties for clearing.”

In terms of efficiency – it’s not great.

And that was a simple cash bond example. Forget about the added steps and data points needed to trade derivatives, like an interest rate or credit default swap.

You get where I’m going with this. The more time spent on workflows like the one above, the higher the chance of error and the less time spent generating alpha. Having the right solution in place helps consolidate and streamline these workflows.

Here’s what such a solution should offer:

- Real-time Views of Critical Data: Front office users need real-time analytics and risk metrics that allow them to view current exposures and what-if impacts of the trades they’re proposing. This allows them to enact changes as simple as targeting or changing by a percent of NAV or proposing changes to target a specific risk metric like duration, DV01, or yield.

- Dynamic Compliance Functionality: Simultaneously, they’ll need to ensure that their portfolios remain within the bounds of compliance and risk, regardless of any changes made throughout the trade lifecycle. Compliance rules and requirements typically need to address everything from regulatory requirements to specific investor mandates, as well as risk and exposure thresholds.

- Efficient Execution with Electronic Connectivity: When it comes to execution, firms are typically executing wherever they can source the best liquidity, whether that be over the phone or using a variety of RFQ providers. Electronic connectivity directly to these platforms allows users to easily execute orders and have all trades flow automatically to a single system. This helps eliminate any manual data entry or booking trades separately across different platforms.

- Reliable Allocation & Settlement Processes: Flexible allocation logic runs throughout the trade lifecycle and helps ensure blocks are correctly and fairly allocated across accounts based on firm requirements. Post-trade, the correct settlement information and net monies are seamlessly calculated, and allocations are then packaged up and securely sent to the necessary systems and third parties for settlement.

Everything I’ve just described is the bread and butter of a good OMS. Whether it’s using treasury futures or interest rate swaps as a duration overlay, CDX to introduce a hedge to credit risk, or simply trying to capture additional yield with bonds or loans, having the right system in place can significantly reduce error, save time spent on manual workflows, and enhance your firm’s agility.

This article was first published here.