By Hans-Marius Lee Ludvigsen – DNB Asset Management: The Nordic market is often still unfamiliar territory for investors and this is even more true for Nordic small caps. However, the lack of knowledge does not make this sector unattractive. On the contrary, this year many analysts and managers are highlighting the small cap segment due to valuations.

In fact, now is a particularly good time to bet on small companies after we saw a very low return for small caps in 2022 and 2023. In Sweden, where the bulk of the market is located, the decline of small companies compared to large ones is particularly significant. Nordic small caps are currently trading at around 13 times of next year’s earnings per share, which represents a record discount to their higher-cap counterparts. At the same time, small Nordic companies are expected to continue to grow faster than large caps. This makes them particularly attractive for investors who want to add high-growth stocks to their portfolio.

The prices of small companies are now lower – this is the case in many regions – and we observe that they can protect their earnings just as well as large companies, as long as you get the stock selection right.

Fundamental data for the selection

There is a lot of data to support the idea of investing in small businesses. Historically, they have always done better in the long run. They grow faster and internally the workforce brings greater ownership. In merger and acquisition activity, they are usually acquired at a higher price.

The Nordic countries are very dependent on exports. If we were to move towards a global recession, there is of course a risk that the Nordic countries will follow this trend. But over time, there are always attractive fundamentals for small companies. And the current valuations further increase the chances of a good investment.

Attractive asset class in a strong region

Those who invest in Nordic small caps get the best of both worlds. The Nordic countries have historically performed well in the Nordic equity markets. They also have high GDP per capita, low government debt, stable political conditions and good governance. This is favorable for investors who value conservatism and sound governance systems.

At the same time, investors get the best of the small companies that have historically performed much better than large companies. Combining the two, the average return for the last 24 years is about 12 percent per year, which is exceptional.

Width and depth of the market surprising

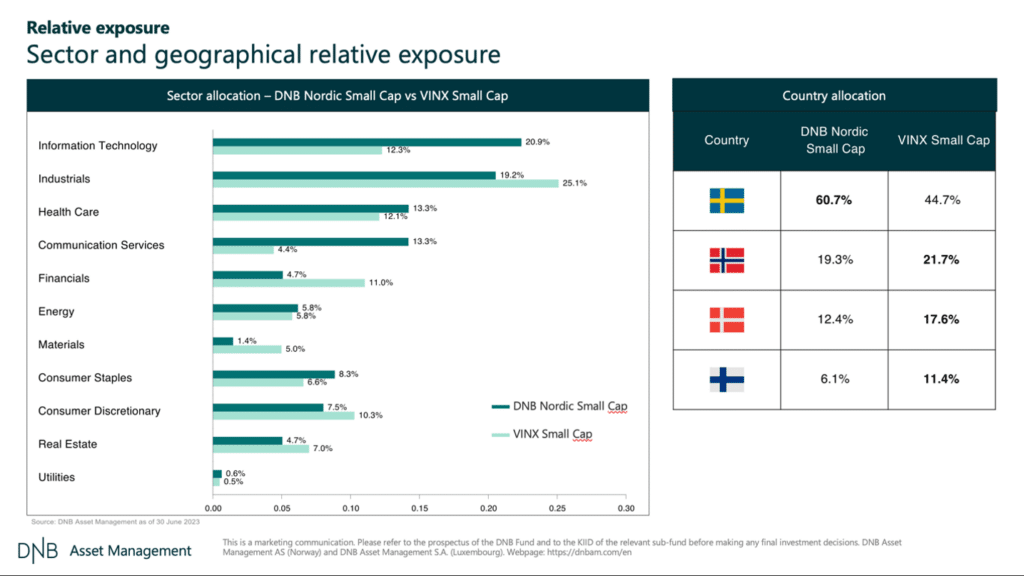

The portfolio may be interesting for investors looking for the highest returns. But it is equally interesting for investors looking for something special and new, a niche region and a niche asset class. Nordic small caps are also suitable to add to global index funds or other investments and to achieve some diversification effect due to the different industry composition in the region.

Most investors are surprised by the breadth as well as the depth of the market. We have more than 2000 companies to choose from. And of course their historical performance is attractive as well as the job stability that the Nordic countries offer. In fact, for most investors, this is a relatively new asset class that they still need to familiarize themselves with. We say it’s worth it!

This article was originally published here.