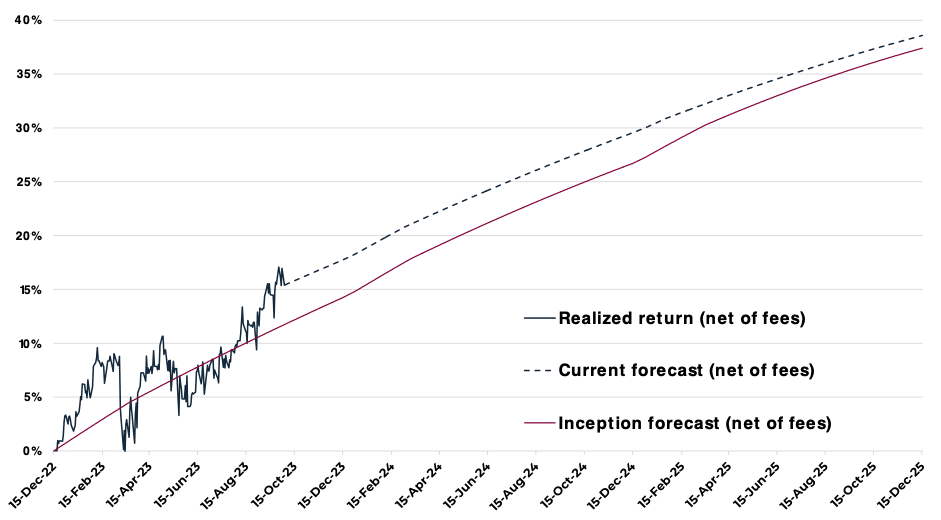

Stockholm (HedgeNordic) – Danish fixed-income boutique CABA Capital launched a fixed-income fund, CABA Flex, in December last year to harvest risk premiums in Scandinavian mortgage bond markets. Unlike other fixed-income funds in the Danish market, CABA Flex employs a buy-and-hold strategy within a three-year maturity structure, with an initial expected return of 37 percent over its three-year lifespan. Ten months into its existence, CABA Flex has already delivered a cumulative return of 15 percent, with almost 11 percent gained in the past four months alone, leaving an expected 20 percent potential return for the upcoming two years.

“The performance has been particularly strong in the past four months, driven by the spread tightening between the interest rates of Scandinavian mortgage bonds relative to government bonds,” explains Kristian Myrup Pedersen, Fixed Income Quant at CABA Capital. These spreads were significantly affected by the post-Covid adjustments in the Scandinavian bond markets during 2021 and 2022, leading CABA Capital to launch its three-year fund in mid-December 2022 to take advantage of historically elevated spreads in the market.

“During the past four months, the absence of disruptions has paved the way for a stable performance in mortgage spreads.”

“Since October last year, the trend has been for lower spreads, abrupted only by the US banking crisis in March and the negative stories surrounding the Swedish real estate company SBB in May,” elaborates Pedersen. He goes on to say, “During the past four months, the absence of disruptions has paved the way for a stable performance in mortgage spreads.”

CABA Flex has returned a cumulative 15 percent net of all fees through October 3, surpassing the expected 12 percent return and leaving the fund three percentage points ahead of the expected return path. The fund’s expected return over its life span now stands at 39 percent, compared to the initial estimate of 37 percent. “For investors entering the fund today, the expected accumulated return is 20 percent, corresponding to 9 percent on an annualized basis,” notes Pedersen.

Looking ahead, deviations from the expected return path will be influenced by interest rate spreads in the Scandinavian bond market, according to Pedersen. However, he emphasizes that this impact will diminish over time as the fund follows a buy-and-hold strategy and the underlying bonds get closer to maturity. “The risk will decline over time as the underlying bonds get closer and closer to maturity,” Pedersen elaborates. “The risk level has already declined by 25 percent since inception, and the risk level is expected to have declined by 70 percent when the fund reaches its final expiration date in December 2025.”