By Bentley Atteberry, CEO, CIO, Director of Metals – Myst Capital: The world is in the early stages of one of the largest economic shifts in industrialized times. The shift from burning fossil fuels to create energy to alternative, lower-emitting sources, presents a challenge and opportunity not seen since the industrialization of the global economy during the 19th and 20th centuries.

This new industrial revolution paradoxically requires more energy to produce more materials that are essential to the transition to cleaner and more efficient energy sources.

Electricity is classified as a secondary energy source, meaning that the production of electricity counts as energy consumption. In fact, about 20.4% of global energy consumption is from electricity. This is up 3% from 2010 due to an increase in the production of renewable electricity and the increasing demand from transport sectors for electricity over combustion. While electricity has traditionally relied on combustion fuels as a generation source, renewable sources are growing, and technologies have matured.

The most common renewable sources are in the form of hydro, photovoltaic solar (PV), and wind. Hydro dams have been around for decades but are somewhat constrained due to their potential unintended impacts and there are a limited number of flowing water sources that can be dammed.

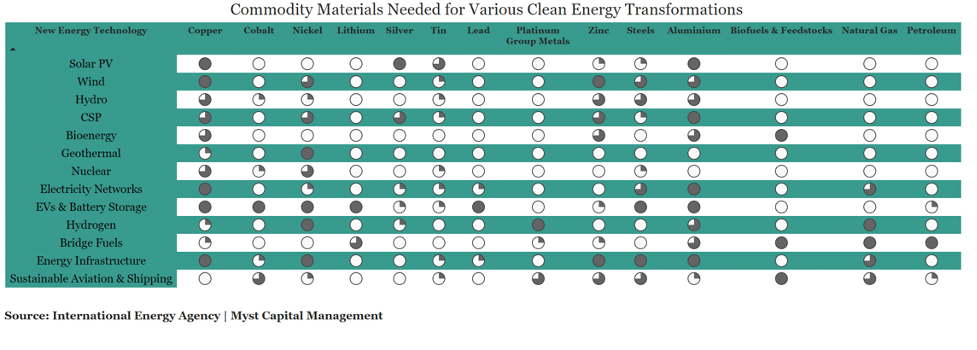

The focus of growth in electricity generation from renewable sources has come from wind farms (onshore and offshore) and PV. Those two sources require vast amounts of industrial metals. A majority of photovoltaic cells use silicon wafer as a building block. They are then fastened, protected, and supported with materials made from metals including aluminium, stainless steel, zinc, nickel, cadmium and other minor minerals. The solar cells are connected with a copper ribbon that is coated with a tin solder. The electricity the modules create is then transported using copper and/or aluminium wires.

Wind turbines are even more metal intensive. The permanent magnet generator in the wind turbines require four of the rare earths, neodymium, praseodymium, dysprosium, and terbium, but from a mass standpoint, a majority of the metal needed in turbines is Steel, Zinc, Aluminium, and Copper. Offshore wind farms continue to grow in popularity due to the more consistent wind conditions in the ocean and the immense space needed for them. With that said, offshore wind requires the most metal per MW of electricity produced. Some of the foundations are now requiring around 1,000 tonnes of steel rebar each while the isolated nature of the offshore wind means that miles of underwater cabling increase the amount of copper used from around 4.3 tonnes per MW to over 9.5 tonnes per MW. This brings up the issue of connecting the renewable sources to the grid.

Hooking up renewable sources to the electrical grid ultimately requires more transmission lines. The grid is set up differently in various countries depending on the source of electricity and proximity to the demand centers. Power plants using combustible fuel sources could be located close to demand centers. Renewable generation sources are dependent upon the geography and typically are not located near demand centers due to the mass amounts of space they take up. This means they rarely line up with the current grid infrastructure. Ultimately, that will require new transmission lines which typically are made up of aluminium (transmission wires), zinc and steel (the towers), and copper (in the transformers or whenever wires go underground or underwater). Location to demand sources is just one of two major challenges with these renewables. They are not constant generators and peak supply typically does not match peak demand. This means that electricity they generate must be stored somewhere to use during periods to fill the gaps.

Energy storage systems (ESS) are vital to the energy transition. A majority of these systems coming online are in the form of Battery Energy Storage Systems (BESS). While mass amounts of battery innovation is targeting this area, lithium ion packs are the current favourite. Technologies such as sodium ion batteries or vanadium redox flow are in early-stage adoption phases. This demand source will contribute significantly to metals involved in all types of energy storage systems such as Lithium, Tin, Aluminium, Nickel, Cobalt, Graphite, Vanadium, Lead, and others. Due to the extreme quantities needed, substitution due to prices and material shortages will arise. With that said, there have already been some transitions back to Lead Acid Batteries (LAB) for storage systems. The benefit of LABs is their performance under a partial state of charge (PSOC) and relative price. This has brought them back as useful during the transition.

Fossil Fuels Won’t Be Completely Phased Out

Much like Lead acid batteries, fossil fuels will undergo a transition instead of a full phase out. As noted in the beginning, only 20% of consumed energy is in the form of electricity. While a transition towards a greater share of electricity is underway, combustible energy is still needed to help power, create, and manufacture all the materials and equipment needed in the energy transition. This is where the paradox lies. More materials are needed to produce clean energy but those materials require emitting fuel energy sources to produce.

Technological innovation is ongoing in those industries for lower emitting production processes, however those changes will not happen in a short period of time. Steel production for example accounts for between 7-11% of global CO2 emissions (depending on the source). Carbon Capture, Utilization, and Storage solutions (CCUS) are being put in place to capture carbon at the industrial source. Of course, these systems require more metal such as nickel and steel. Using lower emitting combustion fuel sources is becoming a more common bridge solution.

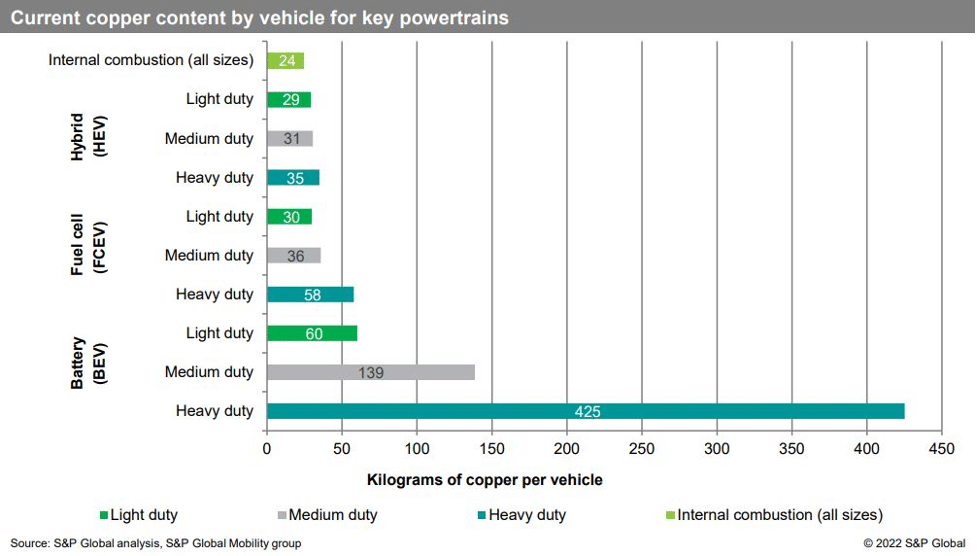

The heavy-duty vehicle industry, including trucks, ships, trains, and planes, is where most of these alternative fuel sources are being applied to. Biofuels, either in the form of renewable diesel, ethanol or sustainable aviation fuels are all very low emitting fuel sources derived from agriculture crops such as sugar, soybeans, and corn. These are becoming more common in land-based shipping as battery electric trucks are not very efficient, economical, and use mass amounts of materials. The maritime shipping industry is potentially the most in-limbo as no clear front-runner has emerged for renewable fuel. Currently over 95% of ships use petroleum products to power them and make up around 5% of annual oil demand. Alternatives such as ammonia and hydrogen are being pushed forward as the potential top solutions in this space given their clean emissions. For example, Hydrogen production through electrolysis emits oxygen. With that said, the current most common and economical way to produce ammonia and hydrogen is by using natural gas. Natural gas burns cleaner than other fossil fuels and has been growing in popularity as a bridge fuel.

Lastly, the transition from internal combustion for the passenger vehicle is well underway. The move to battery powered electric vehicles results also means more electronics, chips, and sensors which means more demand for metals such as Tin, Lithium, Copper, aluminium, nickel, cobalt, graphite, and manganese.

The transition generating energy from high carbon emitting sources to renewable energy sources is about much more than electric vehicles. The entire supply chain process from extracting the upstream materials, to the electricity powering the computers involved in the engineering processes, to the transportation of inputs and outputs is at the foundation of the largest transformational industrial revolution in history.

Sources:

1. Enerdata. World Energy and Climate Statistics – Yearbook 2023. Share of electricity in total final energy consumption (enerdata.net)