Stockholm (HedgeNordic) – QQM Equity Hedge employs a systematic strategy that takes long positions in companies surpassing profit and turnover expectations, while taking short positions in companies that fall short of these expectations. The second-quarter reporting season offered a rare anomaly where companies meeting or surpassing expectations saw their share prices perform poorly after earnings announcements. Consequently, July proved to be a difficult month for QQM Equity Hedge, resulting in a loss of 5.2 percent.

“The losses were not concentrated in any single stock, but rather the month’s result reflects a greater number of incorrect decisions far exceeding the number of right ones on both the long and short side,” QQM’s portfolio manager, Jonas Sandefelt, reflects on the performance in July. Throughout the month, QQM Equity Hedge maintained about 230 positions on the long and 260 on the short side. Among these, 85 stocks contributed two basis points or more, with 26 stocks contributing five basis points or more. In contrast, 153 stocks detracted two basis points or more, and 72 were negative by five basis points or more. “While no individual stock stands out, the accumulation of many small losses and few winners collectively led to the month’s outcome.”

“While no individual stock stands out, the accumulation of many small losses and few winners collectively led to the month’s outcome.”

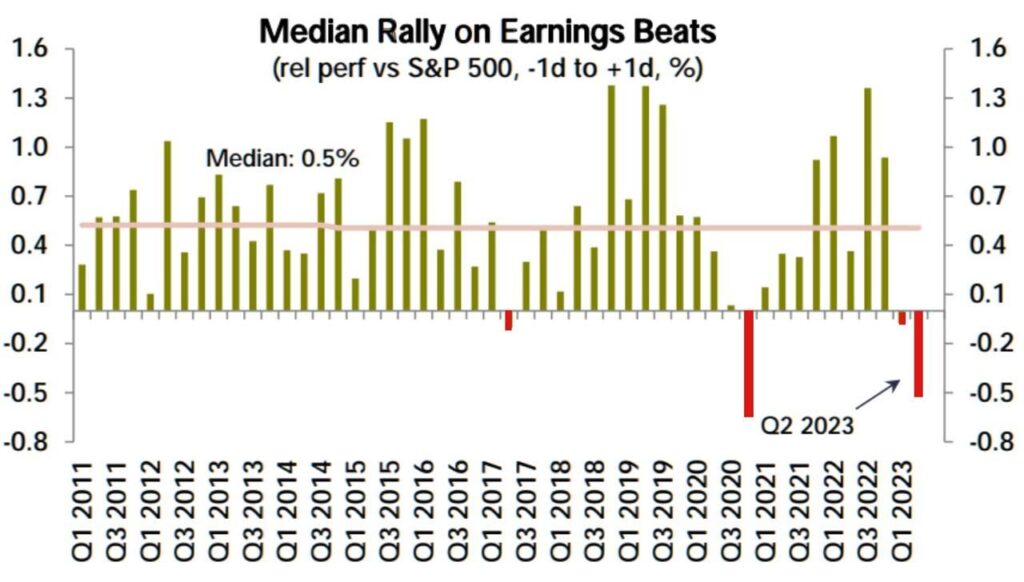

Before the quarterly report announcements due in July, QQM Equity Hedge held long positions in banks and capital goods, while shorting media and pharmaceuticals. These positions were based on QQM’s systematic models designed to identify and capture momentum in fundamentals. “The sectors in which we had long positions had many companies that demonstrated robust profits and turnover increases earlier in the year,” explains Sandefelt. Conversely, the short positions were taken in sectors exhibiting opposite trends. “What happened during the second-quarter reporting season was that many companies that submitted good reports and even exceeded expectations saw their share prices go down.”

“…many companies that submitted good reports and even exceeded expectations saw their share prices go down.”

One such example is the Danish company ISS, which experienced a 5.1 percent decrease in its share price during the month despite the company raising its profit projections. ISS reported quarterly revenue of DKK 19.93 billion versus the consensus estimate of DKK 19.37 billion, as well as raised its full-year growth guidance from the previous 4-6 percent range to 6-8 percent. “The analysts have written up their profit expectations for the company for 2024, yet the share price has not followed suit.”

This instance exemplifies the broader trend where the positions held by QQM Equity Hedge had unfavorable price reactions compared to the implications indicated by its systematic models. As of the end of July, QQM Equity Hedge recorded a year-to-date decline of 7.1 percent, after edging down 0.3 percent in 2022 and booking an advance of 11.6 percent in 2021.

Jonas Sandefeldt has been managing QQM Equity Hedge since July 2010 alongside Ola Björkmo by employing a purely systematic strategy to build a well-diversified market-neutral portfolio that aims to capture fundamental momentum in listed European companies. Sandefeldt currently manages QQM Equity Hedge alone after Björkmo resigned from his role as CEO and portfolio manager after selling his 28 percent equity stake in QQM back in March.