Copenhagen – (Jesper Rangvid): Central banks argue that they are not profit-seeking institutions and cannot go bankrupt, suggesting that their financial performance does not matter. This contrasts with recent events. ECB reported a profit of exactly zero (0) euros for 2022. Bundesbank basically did the same. This is in line with new research showing that central banks prefer to avoid negative results. And why? Because they fear for their independence. A recent discussion about Bundesbank illustrates this. If the Bundesbank had recognised its (unrealised) loss of 140 billion euros, this discussion would have been even more heated.

After first looking at the Fed’s large unrealised losses (link) and then at its realised losses (link), today I end my little odyssey on central bank finances with an analysis of euro area central banks. We start with a look at the ECB, then turn to the largest national central bank in the euro area, the Bundesbank, and finally discuss what it all means.

ECB’s results for 2022

Funnily enough, the European Central Bank’s (ECB) expenditure in 2022 was exactly – that is, literally exactly, to the last decimal place – equal to its income. Or, to be more precise, ECB reported a profit of exactly 0 euros for 2022.

To understand this, we need to talk a little about the fascinating features of central bank accounting.

Like the Fed, ECB bought enormous amounts of bonds after the 2008 global financial crisis and during the pandemic. At the end of 2022, ECB’s assets were worth €700 billion, of which the largest part (€457 billion) was its bond portfolio. The bonds were bought when interest rates were very low. Since summer 2022, ECB has raised the monetary policy interest rate from -0.5% to 3.5%. As a result, market yields have risen, and the value of the ECB’s bond holdings has fallen.

The ECB shows these assets in its balance sheet at amortised cost. In the notes to the balance sheet, ECB states that the market value of the securities is €398 billion. This means that ECB has unrealised losses of €457 billion – €398 billion = €59 billion on its securities purchased under the various asset purchase programmes.

ECB’s capital is €8.8 billion. If ECB reported its securities at market value, ECB would be insolvent; the loss of €59 billion would more than deplete its capital. However, as ECB does not recognize these losses, it carries on as if everything is fine.

Thus, let us instead turn to ECB’s realized losses and gains.

ECB had positive net interest income of €900 million in 2022 and fees (mainly supervisory fees collected by ECB from the banks it supervises) of €600 million. The ECB also has “own funds”. These comprise “the ECB’s financial resources, namely paid-up capital and amounts set aside in the general reserve fund and in the provision for financial risks.” Fluctuations in the market value of own funds are reported in the income statement. ECB lost €1,840 million here in 2022, because the bonds held in its own funds lost value as interests rose in 2022.

So ECB’s accounts work like this: At the end of 2022, ECB has €59 billion in losses in its monetary policy bond portfolio. However, these losses are not shown in the income statement of ECB because these bonds are reported at Hold-to-Maturity values. The losses from the ECB’s own funds of EUR 1,840 million, on the other hand, are shown in income statement. Confusing? Yes, but that is the way it is. Clear reasons for these different accounting treatments of losses in ECB’s different bond portfolios? No.

How come ECB ends up showing a profit of zero? The income of ECB (net interest income, fees, etc.) is not enough to cover the costs (write-down of own funds, staff costs etc.). ECB, however, apparently does not want to show a loss. That is why ECB releases part of its provisions for financial risks. 1,627 million euros are being released. This covers exactly the net losses. The financial result is then zero euros. More details can be found here (link).

Provisions are buffers built up over time. When ECB has made profits in the past, part of them has been saved as a buffer, which ECB now draws on.

These buffers amounted to €6,566 million at the end of 2022. What happens if the ECB continues to make losses and its buffers are eventually used up? Then the national central banks of the euro area could make up for the losses. Or, as ECB writes (link), “the loss could be booked to the ECB’s annual account and offset against future income”, i.e. the ECB could issue IOYs. This is similar to the IOYs (Deferred assets) that the Fed is now issuing to the US Treasury, as I described in my previous post (link).

ECB vs. the Eurosystem

Most of the assets purchased under the various Eurosystem asset purchase programmes were purchased by the national central banks, i.e. the Deutsche Bundesbank, the Banque de France, the Banco de Italia, and so on. To examine these, we need to move from the balance sheet of the ECB itself to the consolidated balance sheet of the Eurosystem. The consolidated balance sheet includes the balance sheets of the national central banks of the Eurosystem and the ECB.

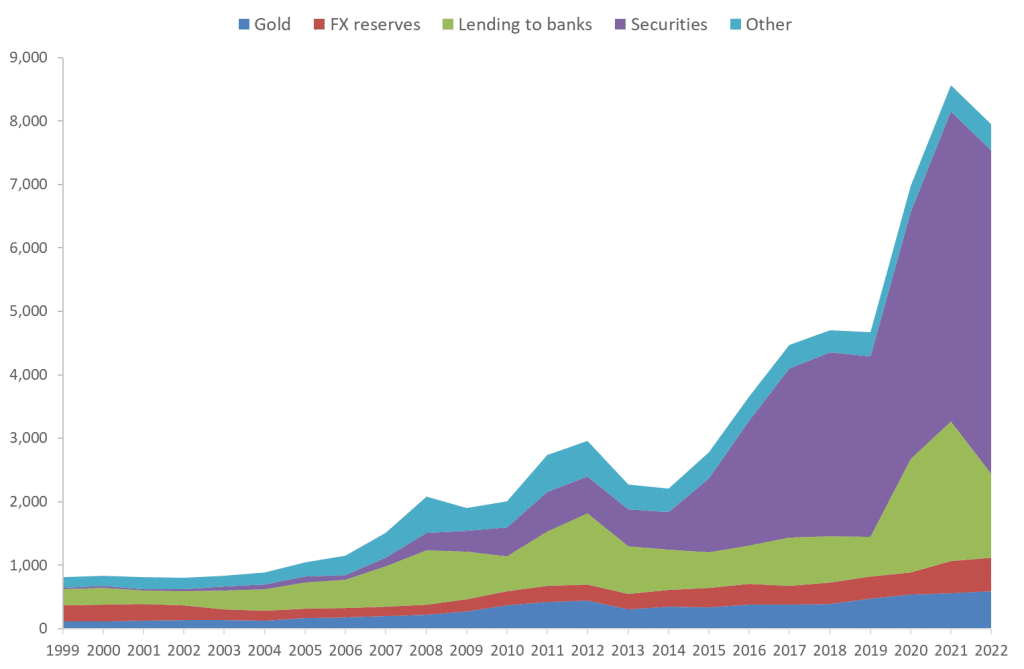

Figure 1 shows the expansion of the Eurosystem’s consolidated balance sheet. The figure shows that securities purchases, i.e. Quantitative Easing, account for the main part of the balance sheet expansion. In 1999, euro area central banks held almost no securities on their balance sheets; securities accounted for 3% of assets. In 2022, euro area central banks held securities worth more than €5,000 billion, and securities represented more than 60% of total assets.

Data source: Webpage of the ECB.

The securities are reported at amortised cost (Hold-to-Maturity value). While ECB, as mentioned above, reports the market value of its monetary policy securities holdings in the notes to the balance sheet, the market value of all securities held in the Eurosystem is not reported. This is regrettable. It would have been transparent to report these market values, as most asset purchases were made by the national central banks (NCBs) of the euro area. Therefore, the NCBs will also bear the bulk of the losses. Since ECB does not report the market value of the securities held by the NCBs, it becomes somewhat cumbersome to determine the total losses in the Eurosystem, as one has to examine the balance sheets of all national central banks. We do not want to do that here. Instead, I will focus on the largest NCB, the German central bank, the Bundesbank.